Soybeans are among the most important agricultural commodities, serving as a critical source of protein and oil. With increasing global demand driven by food, feed, and biofuel industries, soybean production has become a cornerstone of many economies. This report highlights the top soybean producers in the world, their contributions, and their roles in the global agricultural market.

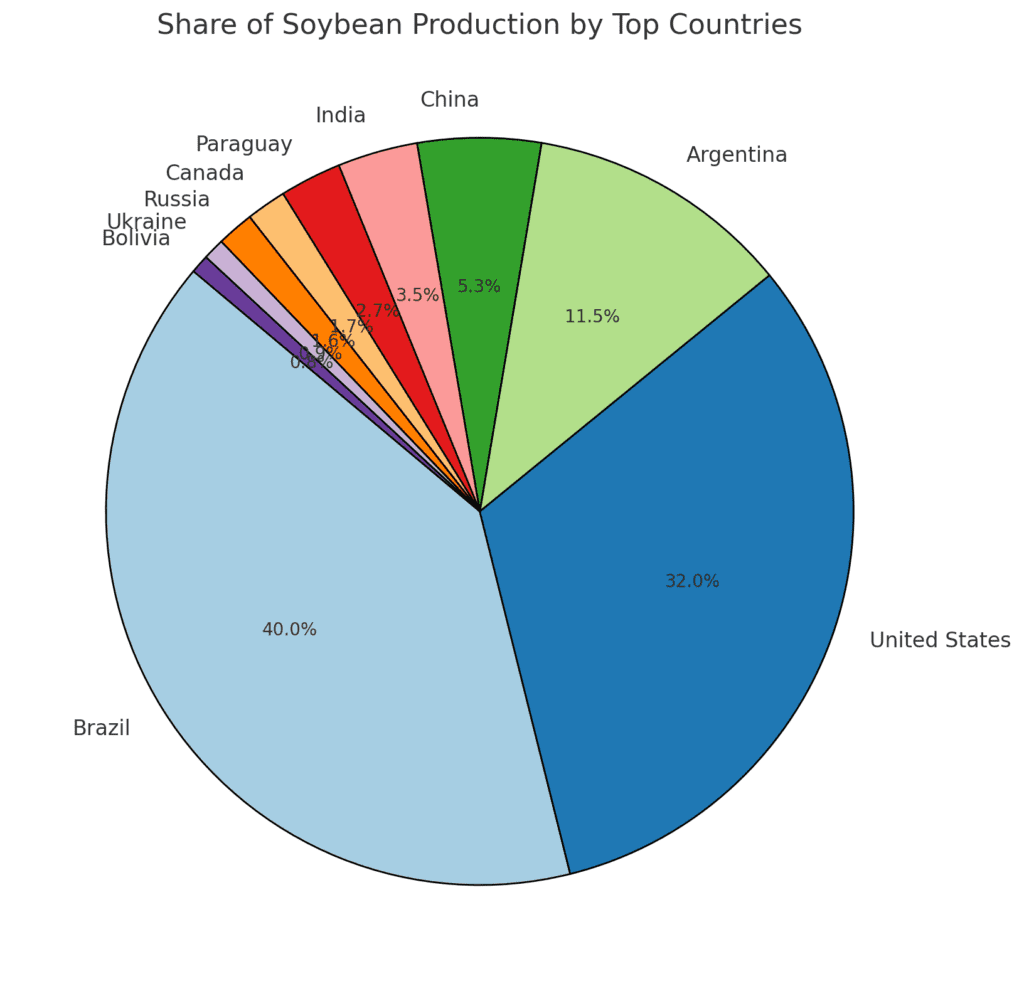

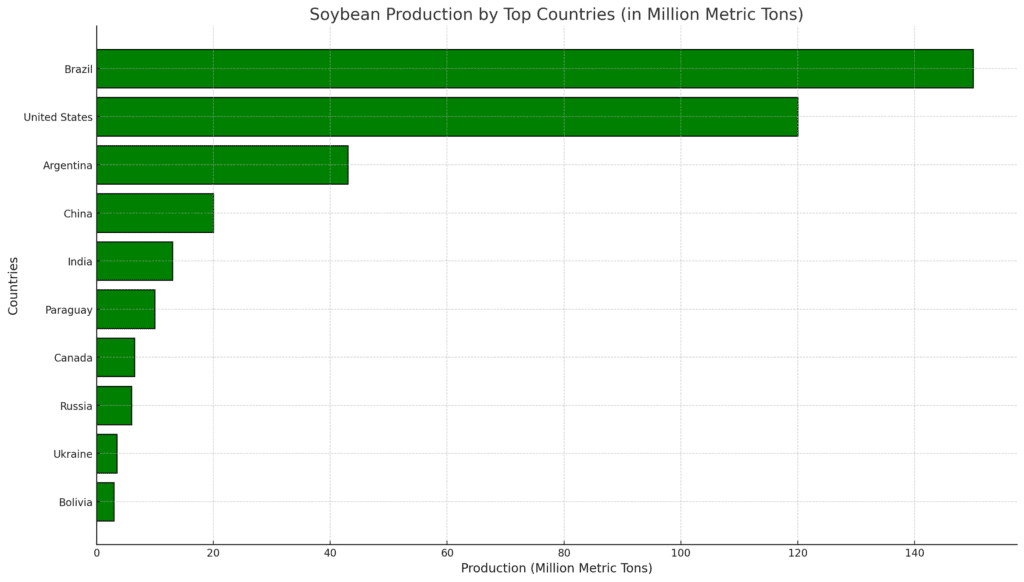

1. Brazil

- Annual Production: Approximately 150 million metric tons (2023).

- Global Share: Over 35% of global production.

- Key Regions: Mato Grosso, Paraná, and Rio Grande do Sul.

- Highlights:

- Brazil is the world’s largest soybean producer, thanks to its vast arable land and favorable climate.

- Advanced farming technologies and robust export infrastructure make Brazil a leader in soybean exports, with China as its primary market.

2. United States

- Annual Production: Approximately 120 million metric tons.

- Global Share: Around 30% of global production.

- Key Regions: Midwest states such as Iowa, Illinois, and Minnesota.

- Highlights:

- The U.S. has a highly mechanized soybean farming sector with strong government support.

- Soybeans are a major export commodity, with significant volumes shipped to China and other Asian markets.

3. Argentina

- Annual Production: Approximately 43 million metric tons.

- Global Share: Around 10% of global production.

- Key Regions: Buenos Aires, Córdoba, and Santa Fe.

- Highlights:

- Argentina is a major exporter of soybean meal and oil, crucial for animal feed and biofuel industries.

- The country’s soybean sector is highly dependent on exports, with Europe and Asia as key markets.

4. China

- Annual Production: Approximately 20 million metric tons.

- Global Share: Around 5% of global production.

- Key Regions: Heilongjiang, Inner Mongolia, and Jilin.

- Highlights:

- Despite being a major producer, China is the world’s largest soybean importer, sourcing primarily from Brazil and the U.S.

- Soybeans in China are used for food products like tofu and soybean oil, as well as animal feed.

5. India

- Annual Production: Approximately 13 million metric tons.

- Global Share: Around 3% of global production.

- Key Regions: Madhya Pradesh, Maharashtra, and Rajasthan.

- Highlights:

- India’s soybean production supports its domestic oil and animal feed industries.

- The country has limited exports due to high domestic demand.

6. Paraguay

- Annual Production: Approximately 10 million metric tons.

- Global Share: Around 2% of global production.

- Key Regions: Alto Paraná, Itapúa, and Canindeyú.

- Highlights:

- Paraguay’s economy is heavily reliant on soybean exports, particularly to European and Asian markets.

- The country focuses on sustainable farming practices to maintain productivity.

7. Canada

- Annual Production: Approximately 6.5 million metric tons.

- Global Share: Around 1.5% of global production.

- Key Regions: Ontario, Quebec, and Manitoba.

- Highlights:

- Canada’s soybean industry is export-driven, supplying high-quality soybeans to Europe and Asia.

- Advanced agricultural technology ensures high yields despite shorter growing seasons.

8. Russia

- Annual Production: Approximately 6 million metric tons.

- Global Share: Around 1.5% of global production.

- Key Regions: Amur Region, Belgorod Region, and Krasnodar Territory.

- Highlights:

- Russia’s soybean production is growing, driven by demand from its domestic livestock industry.

- The government is investing in expanding farmland and improving infrastructure.

9. Ukraine

- Annual Production: Approximately 3.5 million metric tons.

- Global Share: Around 1% of global production.

- Key Regions: Kirovohrad, Vinnytsia, and Poltava.

- Highlights:

- Ukraine’s soybean industry is export-oriented, with Europe as its primary market.

- Ongoing geopolitical issues pose challenges to production and trade.

10. Bolivia

- Annual Production: Approximately 3 million metric tons.

- Global Share: Less than 1% of global production.

- Key Regions: Santa Cruz.

- Highlights:

- Bolivia’s soybean sector is export-driven, contributing significantly to its economy.

- The country focuses on maintaining sustainable practices while meeting global demand.

Factors Driving Global Soybean Production

- Rising Global Demand: Soybeans are in high demand for animal feed, biofuels, and plant-based protein.

- Technological Advancements: Precision agriculture and genetically modified seeds boost productivity.

- Favorable Trade Policies: Countries with strong export infrastructure benefit from growing global demand.

Challenges Facing the Soybean Industry

- Climate Change: Unpredictable weather patterns affect yields.

- Deforestation: Expanding farmland in regions like Brazil raises environmental concerns.

- Geopolitical Issues: Trade disputes and conflicts disrupt supply chains.

Conclusion

The top soybean-producing countries, including Brazil, the United States, and Argentina, play a pivotal role in meeting global demand. With advancements in farming technology and increasing sustainability efforts, these nations continue to lead the way in soybean production. However, challenges such as climate change and geopolitical tensions must be addressed to ensure the long-term stability of the soybean industry.