Australian Agriculture Outlook for 2025-26: A Comprehensive Analysis

The Australian agricultural sector is poised to achieve significant milestones in the coming years, with the value of agriculture projected to reach $91 billion in 2025-26. This figure is anticipated to be the third highest on record, as highlighted in the recent Australian Bureau of Agriculture and Resource Economics (ABARES) conference held in Canberra. The projections, presented by executive director Dr. Jared Greenville, underscore the resilience and growth potential of Australian agriculture, which encompasses not only farming but also fisheries and forestry.

In addition to the overall agricultural value, the livestock sector, particularly beef, is set to experience notable growth. ABARES forecasts that cattle saleyard prices, which reflect the average price of heavy steers and processor cows, will rise by 9% in 2025-26, reaching 674 cents per kilogram. This increase is indicative of a robust demand for red meat, driven by both strong export volumes and rising prices. The total value of meat exports is expected to soar to $22 billion in the current financial year, further solidifying the significance of the livestock sector in Australia’s agricultural landscape.

When considering the broader agricultural framework, including fisheries and forestry, the sector’s total value is expected to reach approximately $98 billion. While this figure represents a slight decline from the exceptional performance of 2024-25, the livestock and livestock products segment is projected to achieve a new record value of $40 billion. This growth can be attributed to sustained demand for meat products in both domestic and international markets.

Crop Production and Financial Performance

On the cropping front, national winter crop production is estimated to have surged to 59.8 million tonnes for the 2024-25 season, marking a 27% increase above the ten-year average and positioning it as the third largest on record. Conversely, summer crop production is anticipated to experience a slight decline, estimated at 4.7 million tonnes, while still remaining 28% above the ten-year average.

The favorable conditions for winter crops across New South Wales and Queensland, coupled with timely rainfall in Western Australia, have contributed to this robust production. However, regions such as Victoria and South Australia faced challenging seasonal conditions, resulting in lower crop yields. Nevertheless, the overall trends in livestock and cropping are expected to bolster the average financial performance of broadacre farms, with national broadacre farm cash income forecasted to rise from $124,000 to $213,000 in 2024-25. This increase is primarily driven by higher livestock prices and improved crop production.

Looking ahead, average farm incomes are projected to climb even further to $262,000 per farm as input costs ease and prices for both crops and livestock remain favorable. While certain regions have experienced below-average financial performance due to dry conditions, improving climate forecasts suggest a rebound in production and profitability in these areas for the upcoming financial year.

A Closer Look at the Beef Sector

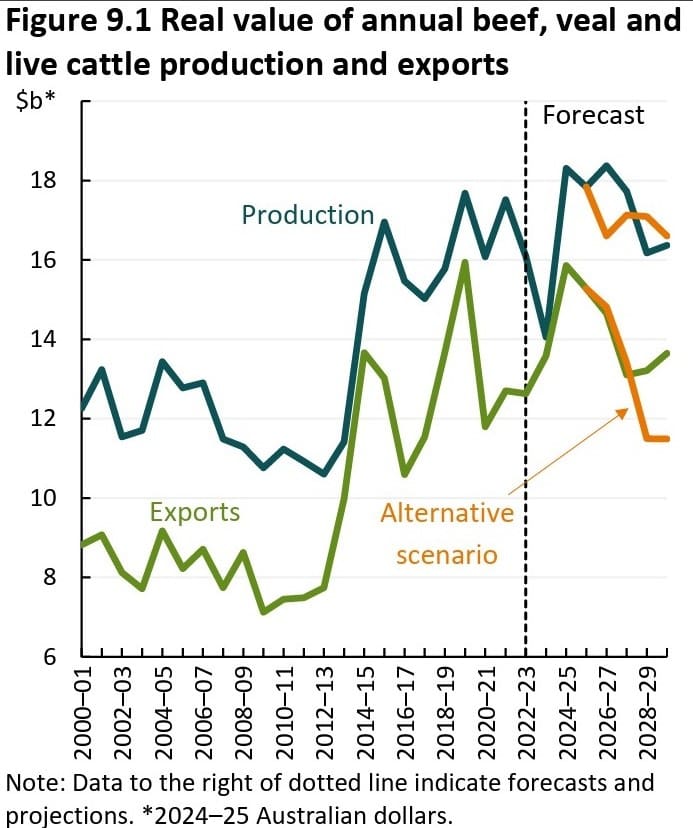

As the spotlight turns to the beef sector, ABARES anticipates a significant rise in the nominal values of beef, veal, and live cattle, projecting an increase to $18.3 billion in 2024-25. This represents a 34% jump from an estimated $13.7 billion for the 2023-24 period. The projected growth in production values reflects both increased cattle saleyard prices and production volumes.

However, the outlook for 2025-26 suggests a slight dip in beef production, even as the nominal value of beef, veal, and live cattle is expected to reach $18.4 billion, up by 1%. The anticipated decline in production is attributed to ongoing herd rebuilding efforts, which may offset the rise in saleyard prices.

Over the medium-term outlook extending to 2029-30, real production values for beef, veal, and live cattle are projected to fluctuate, ultimately concluding at around $16.4 billion. This expected decline in production values is primarily due to a reduction in beef output, even as saleyard prices remain high.

Export Trends and Future Implications

In terms of exports, nominal values for beef, veal, and live cattle are forecast to rise to $15.9 billion in 2024-25, reflecting a 20% increase from the previous year. This growth is driven by higher export volumes and prices. However, a slight decrease in export values is anticipated for 2025-26, projected to reach $15.8 billion, as lower production volumes are expected to result in reduced export quantities.

Despite this short-term growth, medium-term projections indicate a decline in real export values for beef, veal, and live cattle, expected to stabilize towards the end of the outlook period. This trend is attributed to anticipated lower Australian export prices in real terms, alongside decreasing export volumes. In an alternative scenario, real export values are projected to conclude at approximately $11.5 billion by 2029-30.

Overall, the forecasts presented by ABARES provide a comprehensive overview of the Australian agricultural landscape, highlighting both opportunities and challenges ahead. As the sector continues to adapt to evolving market demands and climatic conditions, the resilience of Australian agriculture remains a focal point for stakeholders and policymakers alike. For those interested in further details, the complete Agricultural Commodities Report from March 2025 is available for review.