Introduction

The global turkey meat industry plays a significant role in the poultry sector, contributing to food security, trade, and economic growth. As we step into 2025, the turkey meat market continues to evolve, shaped by shifting consumer preferences, advancements in farming technology, sustainability efforts, and geopolitical influences. This report provides a comprehensive analysis of the state of the turkey meat industry, highlighting market trends, key players, challenges, and future opportunities for stakeholders.

1. Global Market Overview

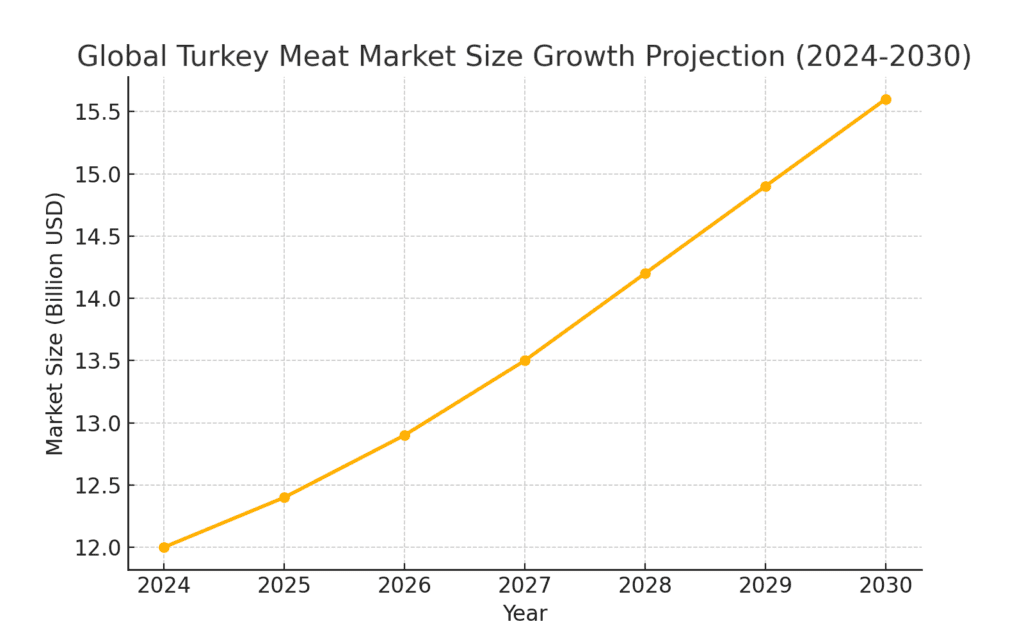

1.1 Market Size and Growth Trends

The global turkey meat market was valued at approximately $12 billion in 2024 and is projected to grow at a CAGR of 3.5% through 2030. Key factors driving growth include:

- Increased consumer demand for lean and high-protein poultry options.

- Rising international trade in turkey meat, particularly in North America and Europe.

- Expansion of turkey farming in emerging markets, driven by government subsidies and incentives.

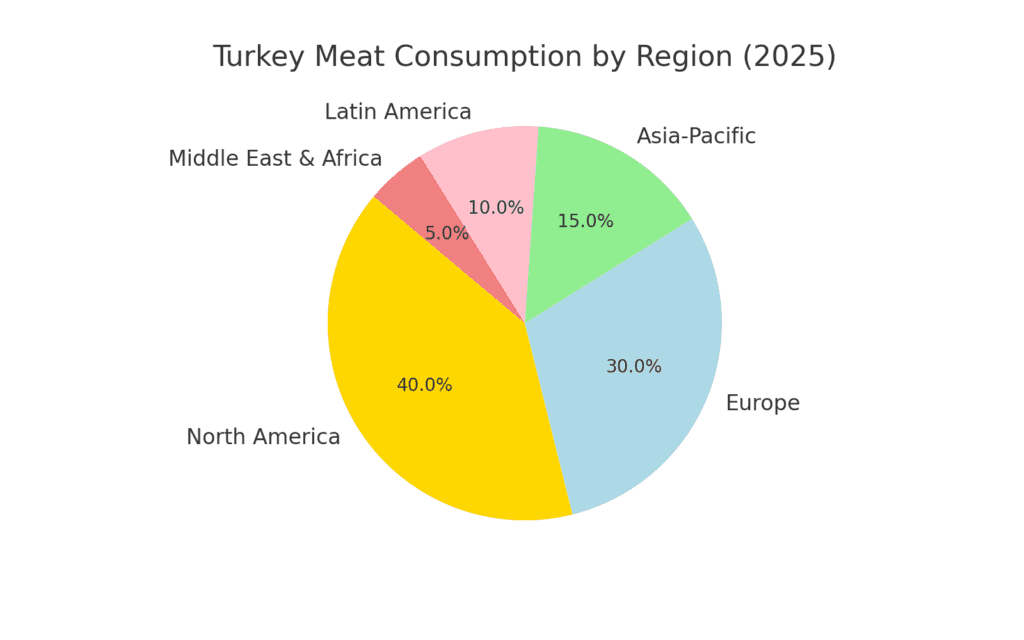

1.2 Key Consumer Markets

The major consumers of turkey meat worldwide include:

- North America: The U.S. remains the largest turkey meat consumer, with Canada following closely.

- Europe: France, Germany, and the UK lead in turkey consumption due to cultural preferences and holiday traditions.

- Asia-Pacific: China and Japan are increasing their imports of turkey meat, driven by rising demand for high-protein diets.

- Latin America: Brazil and Mexico are emerging markets for turkey meat consumption and exports.

2. Key Players and Competitive Landscape

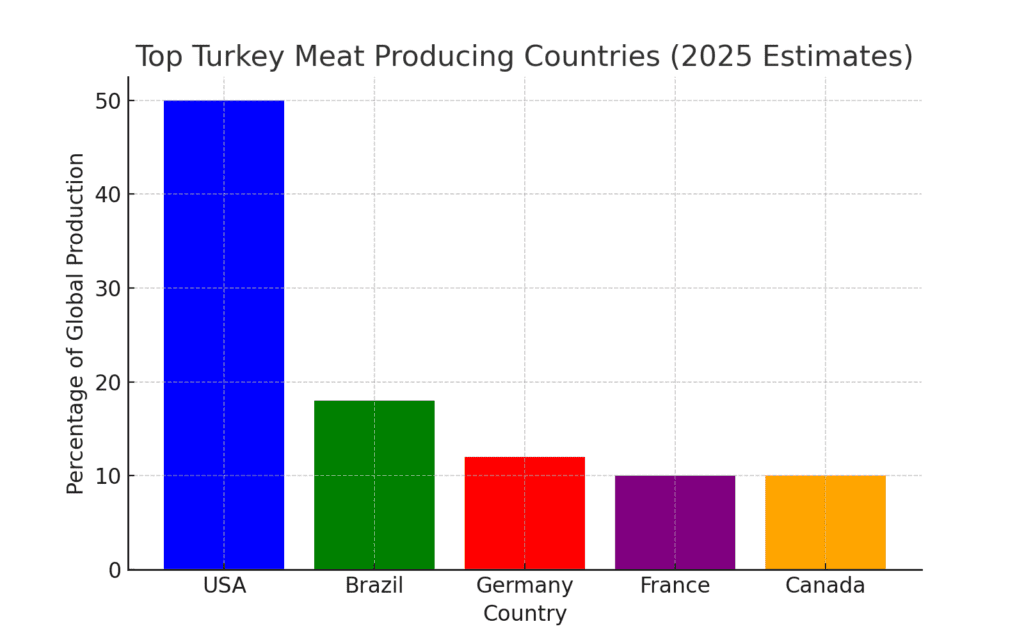

2.1 Leading Turkey Meat Producers

The top turkey-producing countries are:

- United States: The largest producer, accounting for nearly 50% of global turkey production.

- Brazil: A rapidly growing turkey meat exporter to global markets.

- Germany & France: European leaders in turkey meat processing and innovation.

- Canada: A strong supplier of fresh and frozen turkey meat.

2.2 Major Companies in the Turkey Meat Industry

- Butterball LLC (USA)

- Hormel Foods Corporation (USA)

- Cargill, Inc. (USA)

- Perdue Farms (USA)

- Fleury Michon (France)

- BRF S.A. (Brazil)

- Cooper Farms (USA)

- Avril Group (France)

These companies invest in vertical integration, automation, and sustainable farming practices to maintain their market positions.

3. Production and Sustainability Challenges

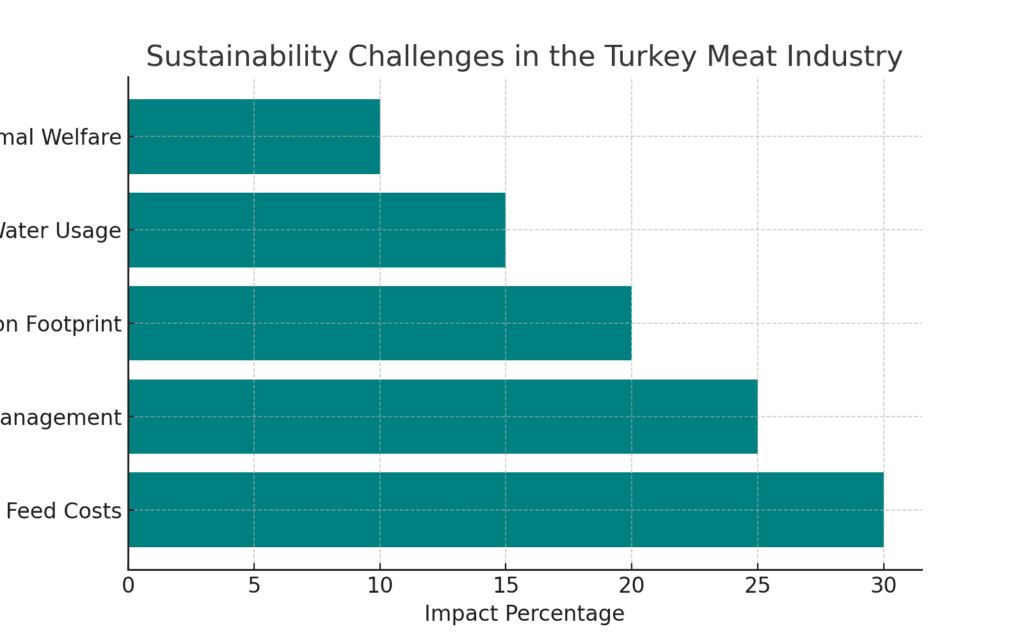

3.1 Feed and Resource Efficiency

Turkey production requires efficient feed conversion rates. Rising grain prices and climate-induced shortages impact production costs and farm sustainability.

3.2 Disease Management

Outbreaks of avian influenza (H5N1 and H5N8) and other poultry diseases have led to fluctuations in turkey meat supply. Biosecurity measures and vaccination programs are crucial for disease prevention.

3.3 Environmental and Ethical Concerns

- Carbon footprint of turkey farming due to feed production and waste management.

- Consumer demand for free-range and antibiotic-free turkey meat is shaping farming methods.

- Water usage in poultry farms is under scrutiny due to global water scarcity concerns.

3.4 Alternative Turkey Farming Approaches

- Organic turkey farming is growing in popularity, particularly in the U.S. and Europe.

- Lab-grown and cultivated turkey meat is in early-stage development as an alternative to conventional farming.

4. Trade and Regulations

4.1 Global Trade and Export Trends

- The U.S., Brazil, and Canada are the top exporters of turkey meat.

- European imports have increased due to regional production declines.

- China and Southeast Asia are new import markets as dietary preferences shift toward poultry.

4.2 Tariffs and Trade Barriers

- The U.S.-China trade agreement influences global turkey exports.

- The EU has implemented stricter import standards regarding antibiotic usage in poultry farming.

- Turkey meat exports from South America face sanitary compliance challenges in North American and European markets.

4.3 Certification and Eco-Labeling

- GlobalG.A.P., USDA Organic, and EU Eco-label certifications are increasingly influencing purchasing decisions.

- Ethical labeling, such as Animal Welfare Approved (AWA), is gaining traction.

5. Consumer Trends and Market Shifts

5.1 Rise in Health-Conscious Consumers

Consumers are prioritizing lean, high-protein, and antibiotic-free turkey meat, particularly in Western markets.

5.2 Growth of Turkey Meat-Based Convenience Foods

- Pre-cooked and ready-to-eat turkey products are in high demand.

- Deli meats, sausages, and turkey burgers are key retail growth segments.

5.3 Online Sales and E-Commerce Expansion

- Digital platforms like Amazon Fresh and Alibaba are increasing turkey meat sales.

- Direct-to-consumer turkey subscriptions are growing in the U.S. and Europe.

6. Future Outlook and Investment Opportunities

6.1 Market Projections for 2025-2030

- The global turkey meat market is expected to exceed $15 billion by 2030.

- Growth in sustainability initiatives and alternative meat technologies will shape the industry’s future.

6.2 Investment in Sustainable Practices

- Greenhouse gas emission reduction programs in turkey farming.

- Expansion of alternative protein and cultivated turkey meat research.

- Increased investment in poultry feed efficiency technologies.

6.3 Potential Challenges to Overcome

- Trade restrictions and geopolitical tensions affecting turkey exports.

- Climate change impacting feed crop production and livestock farming conditions.

- Shifting consumer preferences and competition from plant-based poultry alternatives.

Conclusion

The turkey meat industry in 2025 stands at a critical juncture, balancing growth with sustainability. With increasing demand, technological advancements, and evolving trade policies, the market presents significant opportunities for investment and innovation. However, addressing sustainability challenges, biosecurity risks, and shifting consumer trends will be essential for long-term success.

As global food security and ethical sourcing concerns rise, the industry must adapt to regulatory requirements, consumer expectations, and climate challenges to ensure continued growth in the years ahead.