Project Café USA 2025: Insights into the Branded Coffee Shop Market

Project Café USA 2025 reveals the US branded coffee shop market has grown to $54 billion, with over 42,700 outlets. Despite strong growth, operators face challenges from high inflation and rising competition, emphasizing the need for value.

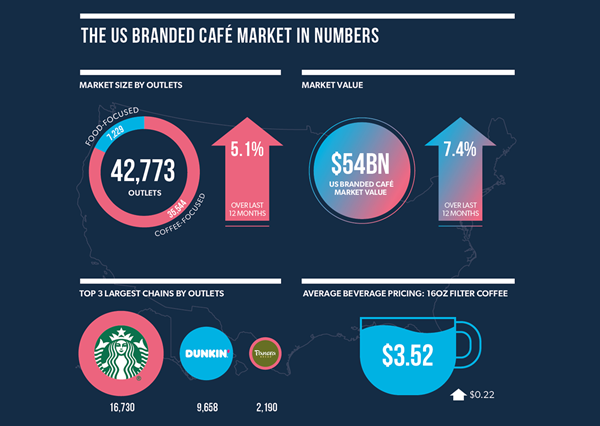

World Coffee Portal’s Project Café USA 2025 report reveals a dynamic landscape for the US branded coffee shop market, which now boasts a staggering $54 billion in value and encompasses over 42,700 outlets operating under 500 unique brands. While most operators are enjoying year-on-year sales growth, industry leaders are proceeding with caution in light of high inflation, fluctuating consumer confidence, and the pressure of rising value-focused competition.

Strong Growth Amid Challenges

The branded coffee shop market in the US has experienced robust post-pandemic growth, adding 2,062 net new outlets in the past year, a 5% increase that brings the total to 42,773 stores. Major players like Starbucks and Dunkin’ continue to expand their footprints, while emerging chains such as Dutch Bros and Scooter’s Coffee have each opened over 100 new locations. Notably, Arkansas-based 7 Brew has emerged as the fastest-growing chain by outlet count, reflecting the intense competition within the sector.

In total, World Coffee Portal identifies 500 distinct branded chain concepts in the US market. The last year saw six new entrants, including Italy’s Café Barbera, the UK’s WatchHouse and Black Sheep Coffee, as well as Vietnam’s Trung Nguyên Legend. Additionally, 44 independent US coffee shops successfully transitioned to branded chain status by surpassing five locations, indicating a vibrant market ripe for innovation and diversification.

Pricing Pressures and Consumer Behavior

Despite the impressive outlet growth, US coffee chains are grappling with significant pricing pressures stemming from rising property, labor, and green coffee costs. Over the past year, many have raised prices, with the average cost of a 16oz latte now exceeding $5. In some cases, blended frappes of the same size are priced at over $6. As inflation bites, operators are exercising caution regarding further price increases, particularly as consumers become more discerning about discretionary spending.

The need for value has become a critical battleground in the competitive landscape. Market leaders like Starbucks and Dunkin’ have responded by introducing lower-cost food and beverage options to counteract the rising competition from value-focused non-specialist operators such as McDonald’s and 7-Eleven. This shift highlights the necessity for brands to adapt to consumer preferences while maintaining profitability.

Long-Term Growth Potential Despite Short-Term Challenges

While the current environment presents hurdles, many operators remain optimistic about the future. A survey conducted by World Coffee Portal found that only 39% of industry leaders expect trading conditions to improve within the next year, reflecting a near 20% decline from the previous year. A fifth of respondents anticipate a deterioration in market conditions, signaling underlying concerns.

However, despite the short-term outlook, 82% of surveyed industry leaders believe that there is significant growth potential for branded coffee chains in the US. World Coffee Portal forecasts a compound annual growth rate (CAGR) of 3.7% for the total US branded coffee shop market over the next five years, predicting it will surpass 59,900 outlets by 2029. Total sales are expected to exceed $72 billion in the same timeframe, with a CAGR of 5.9%.

Industry Expert Insights

Jeffrey Young, Founder and CEO of Allegra Group, expressed optimism regarding the findings of Project Café USA 2025. He noted, “I’m encouraged to see that both larger chains and boutique concepts are demonstrating strong growth in the robust US branded coffee shop market. There continues to be a tremendous thirst for coffee across the US, with the growing popularity of iced beverages and a shift towards indulgence providing fuel for the next generation of coffee shop consumers. I’ve no doubt there remains plenty of room for growth in this behemoth market.”

Project Café USA 2025 serves as the definitive annual study of the US branded coffee shop market, encompassing all 50 states. The comprehensive research includes market sizing, sector-by-sector insights, beverage pricing, brand profiles, and an in-depth survey of over 5,000 US coffee consumers.