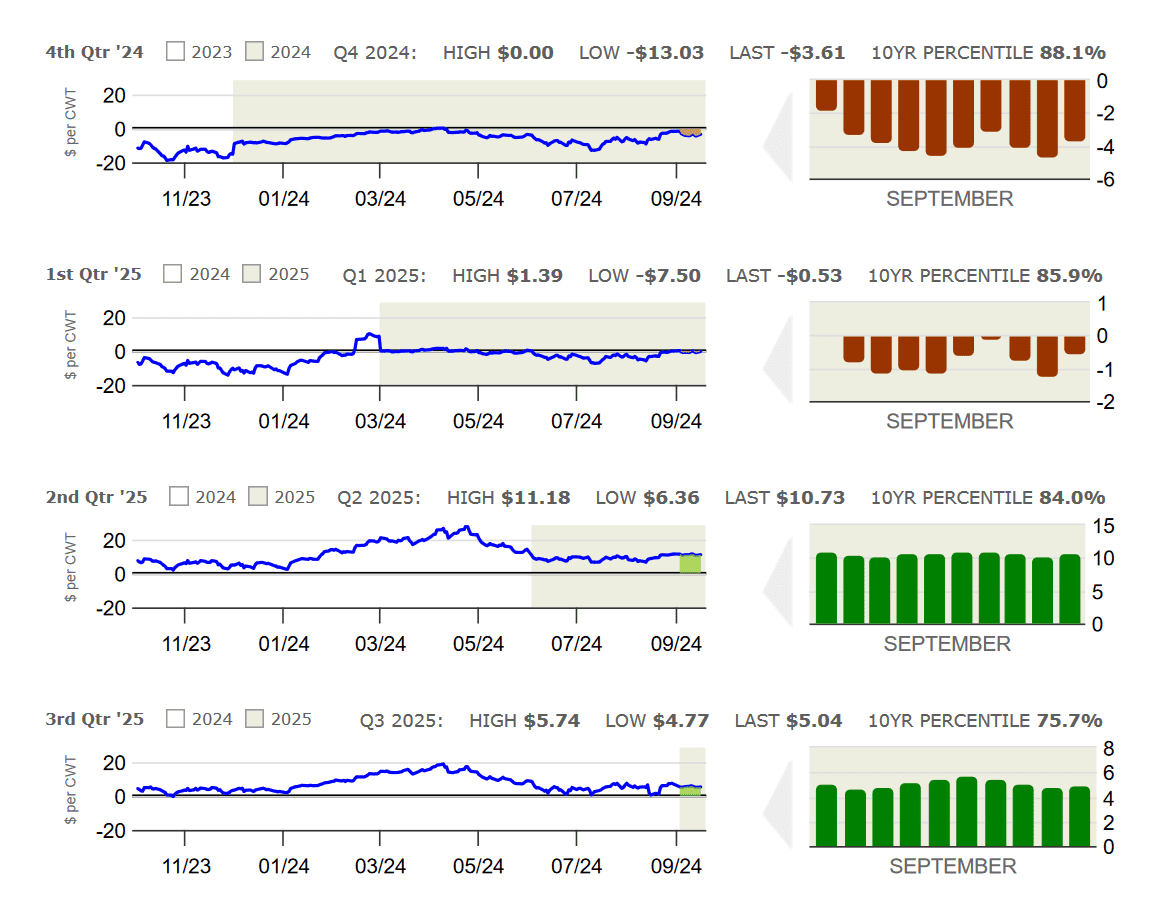

Margins deteriorated over the first half of September as hog prices declined, particularly in nearby futures, while the feed markets were steady to slightly firmer. Both hog slaughter and weights are tracking above year-ago levels, consistent with data from the June Hogs and Pigs report as industry participants wait for the next quarterly update at the end of the month. Hog slaughter last week was estimated at 2.571 million head, up 1.4% from last year with the prior four-week average slaughter run averaging 1.8% above a year ago. Slaughter last year between mid-September and mid-October averaged 2.586 million head/week, projecting this year’s slaughter over the next month to average 2.63 million head/week. Slaughter weights are currently averaging about 1% higher than a year ago and will be watched closely in weeks ahead to see how well producers are positioned heading into the fall and winter. The pork cutout has held in the low-$90’s but is down around 6% since the beginning of the month with a 10% decline in ham primal values over that period contributing around 40% of the total drop in pork cutout. A recent weakening of the Mexican Peso relative to the U.S. dollar has not been helpful, although export sales and

shipments have generally held up well in recent weeks. With increased slaughter and higher carcass weights, more product has been available in the spot market, making exports critical in helping to clear that supply. Our clients have benefited from adding new coverage in deferred marketing periods recently to take advantage of the recent margin improvement ahead of the upcoming September USDA Hogs & Pigs report.

The Hog Margin calculation assumes that 73 lbs of soybean meal and 5.3 bushels of corn are required to produce 100 lean hog lbs. Additional assumed costs include $44 per cwt for other feed and non-feed expenses.