Dive Brief:

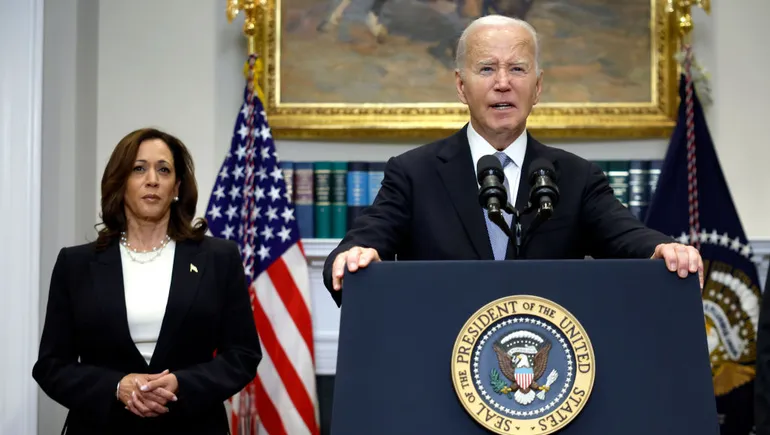

- The Biden-Harris administration plans to limit the types of goods that can be shipped via the de minimis exemption while enhancing information collection for such shipments, according to a Friday announcement.

- Although not yet officially issued, through multiple notices of proposed rulemaking, the administration would exclude shipments containing products covered by certain tariffs from using the de minimis exemption while requiring additional data, such as tariff classification numbers and the filing of Certificates of Compliance, at time of entry.

- The administration also urged Congress to pass reform legislation by the end of this year, specifically calling for the exclusion of import-sensitive products like textiles and apparel from de minimis eligibility.

Dive Insight:

The actions being taken by the Biden-Harris administration come after more than a year of mounting pressure to reform or eliminate the de minimis exemption. Most recently, House democrats in a letter asked President Joe Biden to use executive authority to update policy related to the exemption.

According to the administration, Section 301 tariffs make up roughly 40% of U.S. imports. Its proposed rulemaking would eliminate de minimis eligibility for such shipments, as well as those covered by Section 201 and 232 tariffs.

“Improving compliance obligations these new rules will ensure that foreign businesses cannot exploit the de minimis privilege, protecting American consumers and disadvantaged American companies,” the Retail Industry Leaders Association said in a statement emailed to Supply Chain Dive. The organization noted it still opposes section 301 tariffs on consumer goods.

”We also believe that as long as such tariffs remain in place, they should be applied evenly and fairly,” the RILA said.

In terms of enhanced information collection on de minimis shipments, the Biden-Harris administration is proposing the inclusion of 10-digit tariff classification numbers and the name of the person claiming the exemption with each shipment. Such action “will improve targeting of de minimis shipments and facilitate expedited clearance of lawful de minimis shipments,” per a fact sheet from the administration.

Another element of the actions announced Friday would require consumer product importers to file certificates of compliance electronically with U.S. Customs and Border Protection and the Consumer Product Safety Commission when a shipment — de minimis eligible or otherwise — enters the U.S.

“American workers and businesses can outcompete anyone on a level playing field, but for too long, Chinese e-commerce platforms have skirted tariffs by abusing the de minimis exemption,” said U.S. Secretary of Commerce Gina Raimondo in a statement. “With these new actions, the Biden-Harris Administration is standing up for American consumers and cracking down on Chinese companies’ efforts to undercut American workers and businesses.”

The Biden-Administration said that “further comprehensive de minimis reforms are needed,” specifically by congressional action. Beyond formalizing many of its proposed rules in legislation, the administration is also calling on Congress to pass previously proposed de minimis reforms related to fentanyl shipments.

To date, multiple pieces of legislation have been introduced in both chambers, including The Import Security and Fairness Act in June 2023, the End China’s De Minimis Abuse Act in April and the Fighting Illicit Goods, Helping Trustworthy Importers, and Netting Gains for America Act (Fighting for America Act) in August. However, no legislation has been passed by either the House or the Senate.

The de minimis exemption, which currently allows companies to avoid duties and taxes for imports below $800, has been part of U.S. trade law for nearly 100 years, but its use by e-commerce giants like Temu and Shein has pushed it into the spotlight. The exemption has buoyed air cargo and parcel delivery demand, but its impact on other sectors has been more muddied.

For example, manufacturers are split over the impact of the exemption on U.S. production. While groups like the National Association of Manufacturers have espoused the benefits of de minimis, other parties, particularly those in the textile and apparel sector, are less convinced.

The Biden-Harris administration specifically noted the deleterious impact the de minimis threshold is having on U.S. textile and apparel manufacturers. As part of its proposed reforms, the administration announced its intention to increase procurement from U.S. sources and to continue to prioritize enforcement efforts against illicit textile and apparel imports.

“This is an important, common-sense reform and critical first step,” said Kim Glas, president and CEO of the National Council of Textile Organizations, which has been a vocal supporter of eliminating the de minimis exemption, in a statement. “We amplify the need to expedite rulemaking to the fullest extent possible and appreciate [the administration’s] strong engagement with our industry.”