Wheat is a staple crop and a critical part of global food security. As the demand for wheat continues to rise, a select group of countries leads the way in wheat imports to meet their domestic consumption needs. This report examines the largest wheat importers in the world, their import volumes, and their role in global trade.

1. Egypt

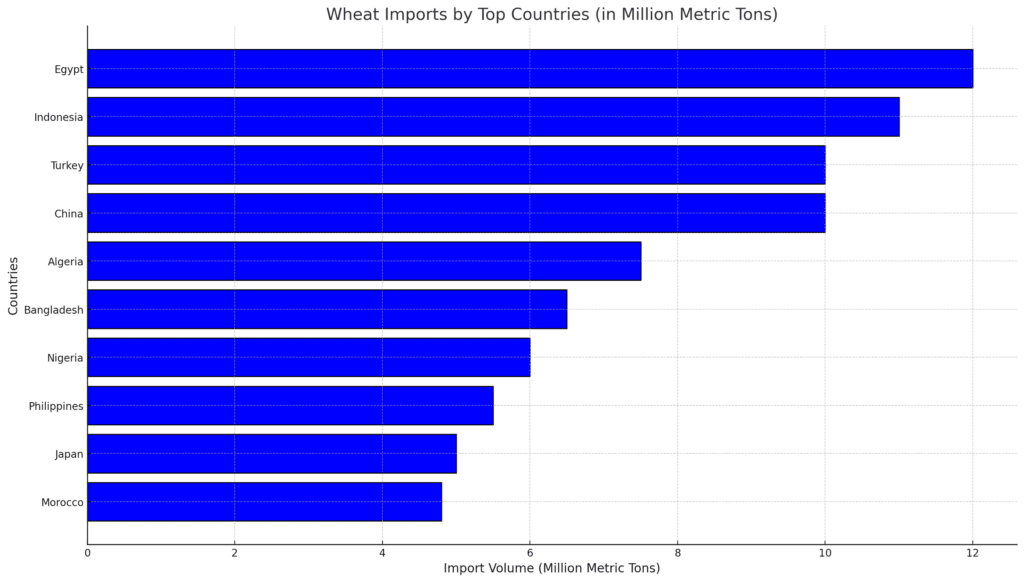

- Annual Import Volume: Approximately 12 million metric tons (2023).

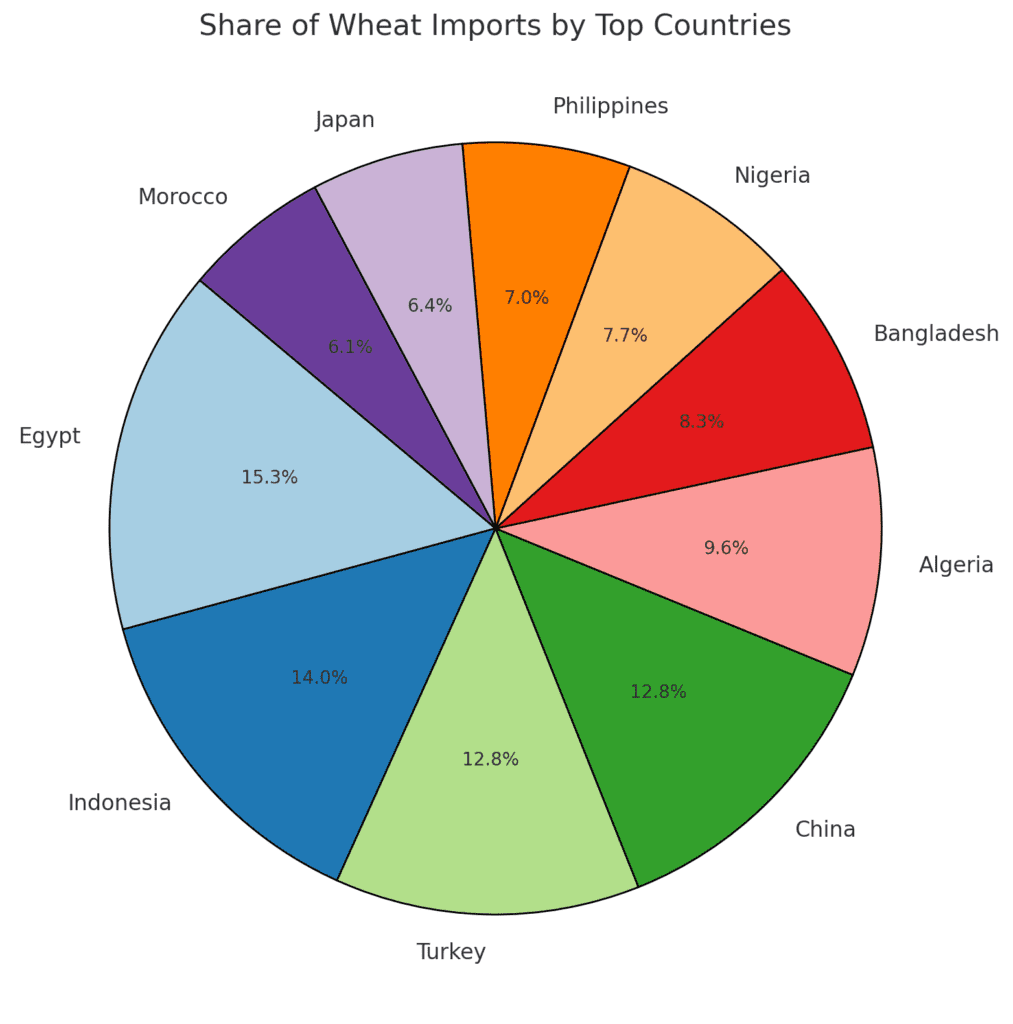

- Global Share: Around 7% of global wheat imports.

- Key Suppliers: Russia, Ukraine, and the European Union.

- Highlights:

- Egypt is the largest wheat importer globally, relying heavily on imports to meet domestic bread consumption.

- Subsidized bread programs make wheat a critical commodity for food security in the country.

- The Suez Canal facilitates wheat shipments from the Black Sea region.

2. Indonesia

- Annual Import Volume: Approximately 11 million metric tons.

- Global Share: Around 6.5% of global wheat imports.

- Key Suppliers: Australia, Ukraine, and Canada.

- Highlights:

- Indonesia imports wheat for its growing food industry, especially for noodle and bread production.

- Proximity to Australia ensures consistent supply and competitive pricing.

3. Turkey

- Annual Import Volume: Approximately 10 million metric tons.

- Global Share: Around 6% of global wheat imports.

- Key Suppliers: Russia and Ukraine.

- Highlights:

- Turkey imports wheat primarily for re-export as flour and pasta products.

- The country’s strategic location bridges European and Middle Eastern markets.

4. China

- Annual Import Volume: Approximately 10 million metric tons.

- Global Share: Around 6% of global wheat imports.

- Key Suppliers: Australia, Canada, and the United States.

- Highlights:

- While China is a major wheat producer, imports are used to meet rising domestic demand for high-quality wheat.

- Wheat is used for food products such as noodles, dumplings, and bread.

5. Algeria

- Annual Import Volume: Approximately 7.5 million metric tons.

- Global Share: Around 4.5% of global wheat imports.

- Key Suppliers: France, Germany, and Russia.

- Highlights:

- Algeria imports soft wheat primarily for bread production.

- The government manages import volumes to stabilize domestic prices.

6. Bangladesh

- Annual Import Volume: Approximately 6.5 million metric tons.

- Global Share: Around 4% of global wheat imports.

- Key Suppliers: Russia, Ukraine, and Canada.

- Highlights:

- Bangladesh relies on wheat imports for its growing food industry, including bread and baked goods.

- Rising population and urbanization drive demand for wheat-based products.

7. Nigeria

- Annual Import Volume: Approximately 6 million metric tons.

- Global Share: Around 3.5% of global wheat imports.

- Key Suppliers: Russia, the United States, and Canada.

- Highlights:

- Nigeria imports wheat for bread and pasta production.

- The country’s large population and urban growth drive wheat consumption.

8. Philippines

- Annual Import Volume: Approximately 5.5 million metric tons.

- Global Share: Around 3% of global wheat imports.

- Key Suppliers: United States, Canada, and Australia.

- Highlights:

- Wheat imports are essential for the Philippines’ bread and noodle industries.

- The country relies on high-quality wheat varieties for specific food products.

9. Japan

- Annual Import Volume: Approximately 5 million metric tons.

- Global Share: Around 2.5% of global wheat imports.

- Key Suppliers: United States, Canada, and Australia.

- Highlights:

- Japan imports wheat for a wide range of food products, including bread, noodles, and confectionery.

- The country prioritizes high-quality, premium wheat varieties.

10. Morocco

- Annual Import Volume: Approximately 4.8 million metric tons.

- Global Share: Around 2.5% of global wheat imports.

- Key Suppliers: France, Russia, and Ukraine.

- Highlights:

- Morocco relies on wheat imports for its bread and couscous industries.

- The government subsidizes wheat to ensure affordability for its population.

Key Factors Driving Wheat Imports

- Food Security Needs: Countries with limited arable land rely on imports to meet domestic consumption.

- Rising Populations: Growing populations in countries like Egypt, Indonesia, and Nigeria drive higher wheat demand.

- Changing Dietary Preferences: Urbanization and Westernized diets increase demand for bread and wheat-based products.

Challenges for Wheat Importers

- Price Volatility: Fluctuations in global wheat prices can strain import budgets.

- Geopolitical Risks: Conflicts in key exporting regions, such as the Black Sea, disrupt supply chains.

- Climate Dependence: Poor harvests in exporting countries affect global supply and pricing.

Opportunities for Importers

- Diversification of Suppliers: Reducing dependence on a few exporting countries to stabilize supply.

- Investments in Storage Infrastructure: Reducing post-import losses through modern silos and warehouses.

- Trade Agreements: Strengthening trade partnerships to ensure reliable and affordable wheat imports.

Conclusion

Egypt, Indonesia, and Turkey are the leading wheat importers, driven by their food security needs and growing populations. As global wheat demand rises, these countries will play an increasingly important role in shaping international wheat trade. Addressing challenges such as price volatility and supply chain risks will be crucial to maintaining food security.