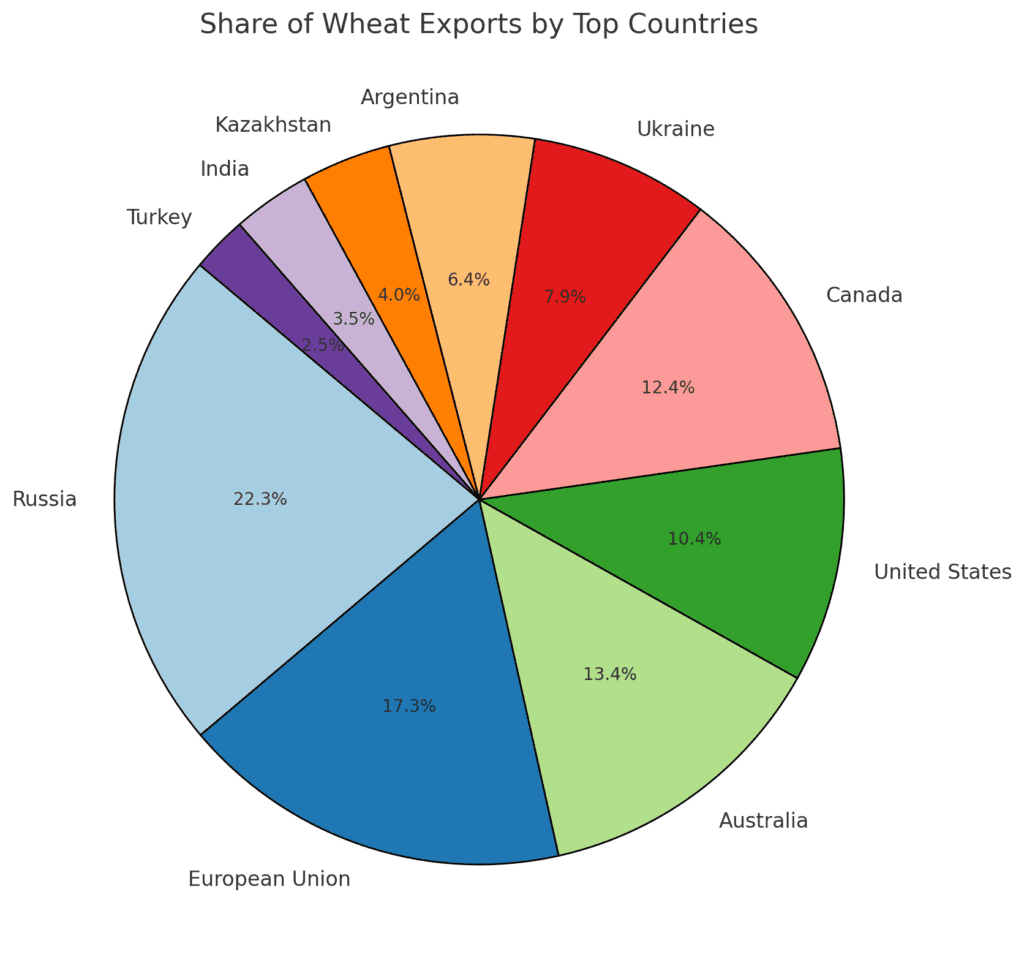

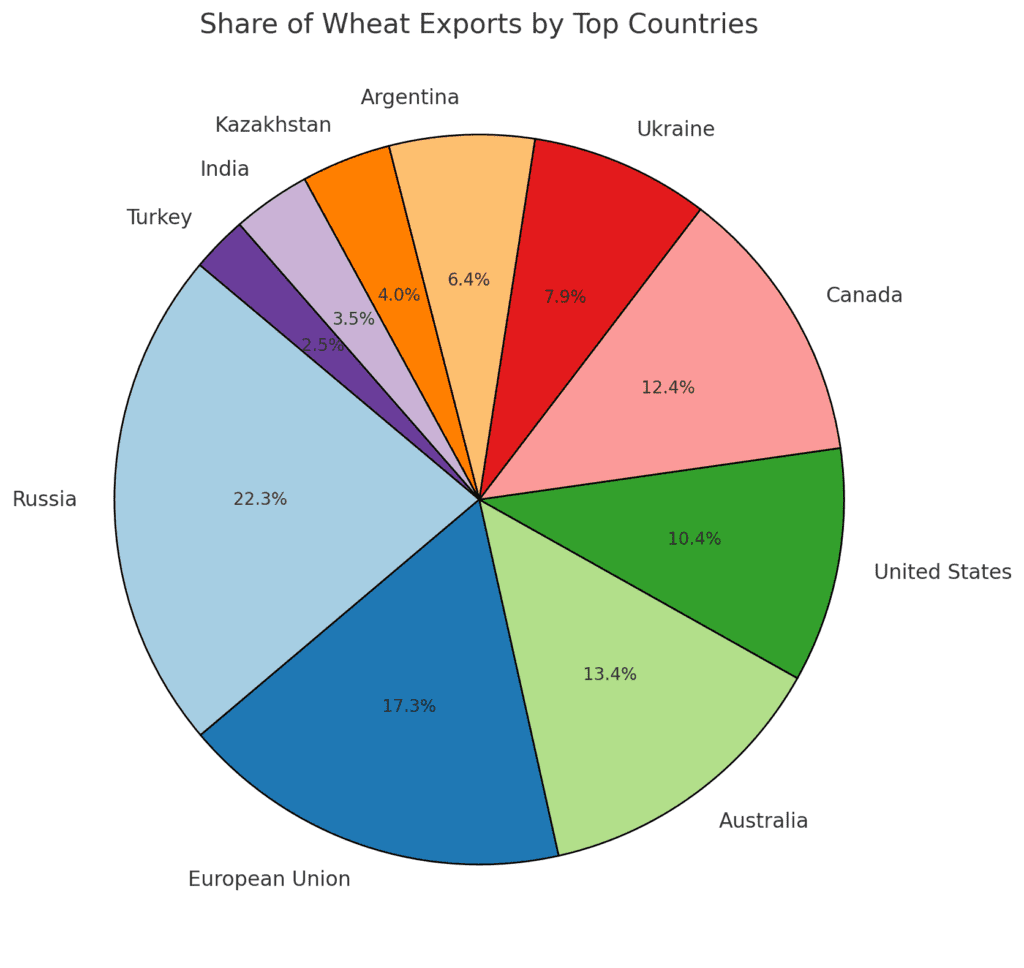

Wheat is one of the most traded agricultural commodities, serving as a staple food for billions of people worldwide. A handful of countries dominate global wheat exports, meeting the growing demand for this essential crop. This report highlights the largest wheat-exporting countries, their export volumes, key markets, and their significance in the global agricultural economy.

1. Russia

- Annual Export Volume: Approximately 45 million metric tons (2023).

- Global Share: Around 20% of global wheat exports.

- Top Markets: Egypt, Turkey, and Bangladesh.

- Highlights:

- Russia is the world’s largest wheat exporter, leveraging its vast arable land and favorable climate.

- The Black Sea region serves as a crucial hub for wheat exports.

- Competitive pricing and high-quality wheat varieties make Russian wheat highly sought after globally.

2. European Union (EU)

- Annual Export Volume: Approximately 35 million metric tons.

- Global Share: Around 15% of global wheat exports.

- Top Markets: Algeria, Morocco, and Saudi Arabia.

- Highlights:

- France and Germany are the largest wheat exporters within the EU.

- EU wheat is valued for its high protein content and quality.

- The EU also focuses on sustainable farming practices to meet global standards.

3. Australia

- Annual Export Volume: Approximately 27 million metric tons.

- Global Share: Around 12% of global wheat exports.

- Top Markets: Indonesia, Vietnam, and the Philippines.

- Highlights:

- Australia benefits from its proximity to major Asian markets.

- High-quality durum and hard wheat varieties drive demand.

- The country’s modern agricultural practices ensure consistent supply.

4. United States

- Annual Export Volume: Approximately 21 million metric tons.

- Global Share: Around 10% of global wheat exports.

- Top Markets: Mexico, Japan, and the Philippines.

- Highlights:

- The U.S. exports several wheat varieties, including hard red winter and soft white wheat.

- Advanced farming and storage infrastructure support consistent export quality.

- The Mississippi River and Gulf ports are critical for export logistics.

5. Canada

- Annual Export Volume: Approximately 25 million metric tons.

- Global Share: Around 11% of global wheat exports.

- Top Markets: China, Japan, and Indonesia.

- Highlights:

- Canada is known for its high-protein wheat, particularly durum wheat used in pasta.

- Efficient rail and port infrastructure facilitate large-scale exports.

- Canada’s focus on sustainable farming practices attracts global buyers.

6. Ukraine

- Annual Export Volume: Approximately 16 million metric tons.

- Global Share: Around 7% of global wheat exports.

- Top Markets: Egypt, Indonesia, and Turkey.

- Highlights:

- Ukraine, part of the Black Sea wheat belt, has a strategic location for global exports.

- Despite geopolitical challenges, Ukraine remains a vital player in the global wheat trade.

7. Argentina

- Annual Export Volume: Approximately 13 million metric tons.

- Global Share: Around 6% of global wheat exports.

- Top Markets: Brazil, Algeria, and Chile.

- Highlights:

- Argentina’s wheat exports primarily serve South American and North African markets.

- The country’s efficient agricultural practices support steady export growth.

8. Kazakhstan

- Annual Export Volume: Approximately 8 million metric tons.

- Global Share: Around 4% of global wheat exports.

- Top Markets: Uzbekistan, Afghanistan, and China.

- Highlights:

- Kazakhstan exports wheat to neighboring countries and key Asian markets.

- The country’s wheat is known for its high gluten content.

9. India

- Annual Export Volume: Approximately 7 million metric tons.

- Global Share: Around 3% of global wheat exports.

- Top Markets: Bangladesh, United Arab Emirates, and Indonesia.

- Highlights:

- India’s wheat exports are driven by surplus production and competitive pricing.

- The government supports wheat exports to stabilize domestic markets.

10. Turkey

- Annual Export Volume: Approximately 5 million metric tons.

- Global Share: Around 2% of global wheat exports.

- Top Markets: Iraq, Syria, and African countries.

- Highlights:

- Turkey is a significant re-exporter of wheat products like flour and pasta.

- Its strategic location connects Europe, Asia, and the Middle East.

Key Factors Driving Wheat Exports

- Global Demand: Wheat is a staple food, ensuring consistent demand worldwide.

- Climate and Geography: Favorable climates and large arable land areas boost production.

- Infrastructure: Efficient storage and transport systems are critical for global trade.

- Trade Agreements: Strong trade partnerships facilitate exports to key markets.

Challenges Facing Wheat Exporters

- Geopolitical Conflicts: Trade disruptions due to wars and sanctions.

- Climate Change: Unpredictable weather patterns affect yields.

- Price Volatility: Fluctuations in global wheat prices impact export competitiveness.

Opportunities for Growth

- Sustainable Farming: Increasing demand for sustainably sourced wheat.

- Market Diversification: Expanding into emerging markets in Africa and Asia.

- Value-Added Products: Exporting processed wheat products like flour and pasta.

Conclusion

Russia, the European Union, and Australia lead the global wheat export market, fulfilling the world’s growing demand for this essential crop. With advancements in sustainable farming and export infrastructure, these countries are poised to maintain their dominance in the wheat trade. However, addressing challenges such as climate change and geopolitical risks is crucial for long-term growth.