Introduction

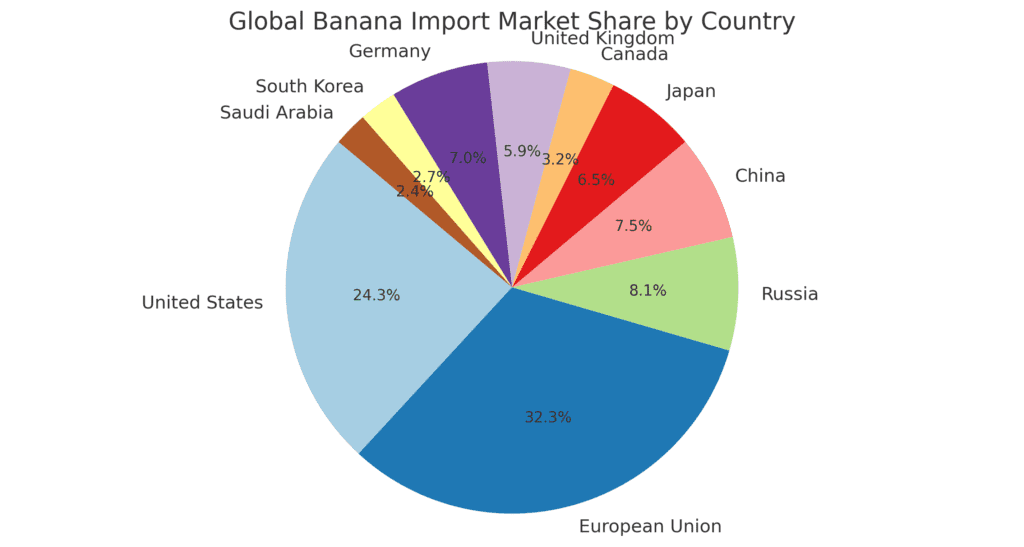

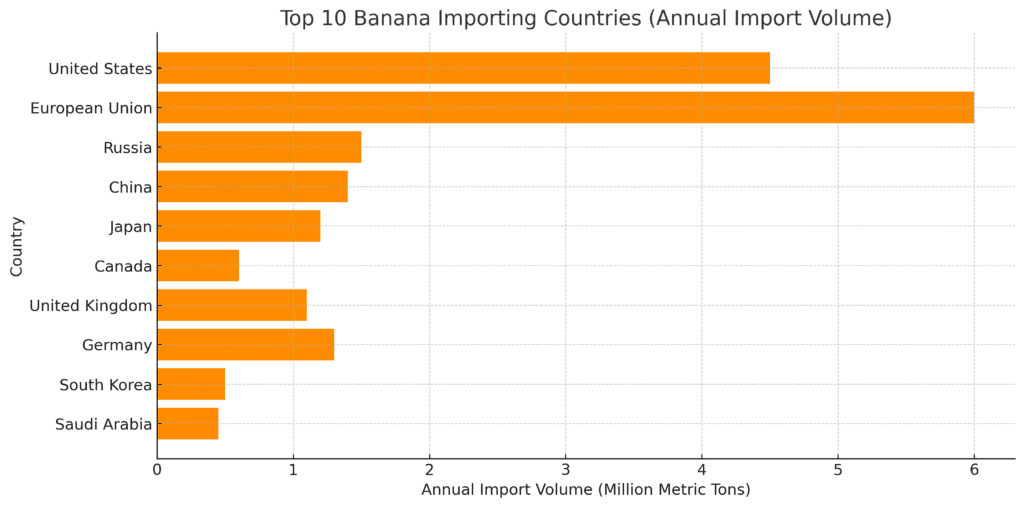

Bananas are one of the most consumed fruits globally, with millions of tons imported each year to meet demand. While production is concentrated in tropical regions, the majority of banana consumption occurs in developed economies with limited local production. This article explores the top 10 banana-importing countries, their annual import volumes, and their role in the global banana trade.

1. United States – The Largest Banana Consumer

- Annual Import Volume: Over 4.5 million metric tons

- Key Suppliers: Ecuador, Guatemala, Colombia, Honduras

- Why It Leads: The U.S. is the world’s largest banana importer, with bananas being a staple fruit in households. Major retailers like Walmart, Kroger, and Costco drive high demand, ensuring a steady flow of imports from Latin America.

2. European Union – The Biggest Regional Importer

- Annual Import Volume: Over 6 million metric tons (combined)

- Key Suppliers: Ecuador, Colombia, Costa Rica, Dominican Republic, Ivory Coast

- Why It’s Important: The EU imports more bananas collectively than any single country. Nations like Germany, the Netherlands, France, and the UK have high banana consumption. The EU prioritizes fair-trade and organic bananas, driving demand for ethical sourcing.

3. Russia – A Growing Import Market

- Annual Import Volume: Around 1.5 million metric tons

- Key Suppliers: Ecuador, Philippines, Costa Rica

- Why It’s Thriving: Despite sanctions affecting trade routes, Russia remains one of the largest banana importers, relying heavily on Ecuadorian bananas.

4. China – A Rising Banana Consumer

- Annual Import Volume: Over 1.4 million metric tons

- Key Suppliers: Philippines, Vietnam, Ecuador

- Why It Stands Out: China’s growing middle class and preference for fresh fruit have made it a key banana importer. The country sources most of its bananas from nearby Southeast Asia, particularly the Philippines.

5. Japan – Asia’s Premium Banana Market

- Annual Import Volume: Around 1.2 million metric tons

- Key Suppliers: Philippines, Ecuador, Mexico

- Why It’s Notable: Japan has a strong demand for high-quality, pesticide-free bananas. Consumers prefer premium-grade imports, especially from the Philippines.

6. Canada – High Per Capita Consumption

- Annual Import Volume: Around 600,000 metric tons

- Key Suppliers: Ecuador, Guatemala, Colombia

- Why It’s Growing: Bananas are a dietary staple in Canada, with strong retail demand from major supermarkets. Proximity to the U.S. supply chain ensures a reliable flow of imports.

7. United Kingdom – A Major European Importer

- Annual Import Volume: Around 1.1 million metric tons

- Key Suppliers: Ecuador, Colombia, Costa Rica, Dominican Republic

- Why It Matters: The UK prioritizes fair-trade bananas, influencing global ethical sourcing trends. The nation’s import market is largely controlled by major supermarkets like Tesco and Sainsbury’s.

8. Germany – Europe’s Largest Individual Importer

- Annual Import Volume: Over 1.3 million metric tons

- Key Suppliers: Ecuador, Colombia, Costa Rica, Dominican Republic

- Why It’s Expanding: Germany has one of Europe’s highest per capita banana consumption rates, with consumers favoring organic and sustainable options.

9. South Korea – A Growing Importer in Asia

- Annual Import Volume: Around 500,000 metric tons

- Key Suppliers: Philippines, Ecuador, Vietnam

- Why It’s Noteworthy: South Korea’s import market is growing, with bananas becoming a more popular fruit in local diets.

10. Saudi Arabia – A Key Market in the Middle East

- Annual Import Volume: Over 450,000 metric tons

- Key Suppliers: Philippines, Ecuador, India

- Why It’s Expanding: As one of the largest fruit importers in the Middle East, Saudi Arabia continues to increase its banana consumption, driven by growing retail and hospitality sectors.

Global Banana Trade Trends

- Sustainability Focus: Consumers in Europe and North America demand fair-trade and organic bananas, influencing supplier choices.

- Asia’s Growing Market: China, South Korea, and Japan are increasing banana imports, driving demand in the Asia-Pacific region.

- Climate Change Risks: Extreme weather events threaten banana production, impacting supply chains and prices.

- Ecuador’s Dominance: The country remains the primary supplier to most importers, securing its position in global banana trade.

Conclusion

The global banana market is driven by strong demand from the United States, Europe, and emerging Asian economies. With increasing focus on sustainability, fair trade, and organic production, importers are shaping the future of banana sourcing. As consumption trends evolve, suppliers will need to adapt to climate challenges and consumer preferences.