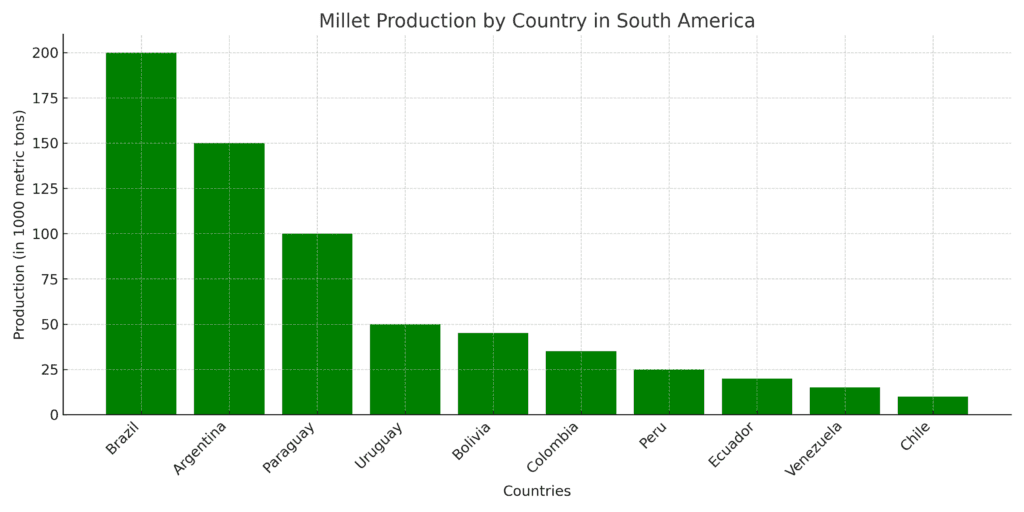

South America, with its vast agricultural lands and diverse climates, has emerged as a significant player in millet production. Millet is gaining popularity across the region due to its drought resistance, adaptability, and increasing demand for gluten-free and nutritious grains. Countries such as Brazil, Argentina, and Paraguay are leading the way in millet farming, contributing to both regional consumption and global exports. Below is an in-depth look at the top 10 largest millet producers in South America, their contributions, and their impact on the industry.

1. Brazil

Brazil is the largest millet producer in South America, thanks to its vast agricultural lands and favorable climate. The country’s millet is primarily used for animal feed and increasingly for gluten-free food products.

Key Strengths:

- Extensive farmland dedicated to millet cultivation.

- Advanced farming techniques and high yields.

- Significant domestic and export markets.

Annual Production: Approximately 200,000 metric tons

Key Markets: Domestic consumption, Asia, and Africa

2. Argentina

Argentina is a major producer of millet, leveraging its fertile pampas and advanced agricultural practices. The country’s millet is used for animal feed, birdseed, and health food products.

Key Strengths:

- Efficient farming techniques.

- Strong export network to North America and Europe.

- Focus on high-quality millet varieties.

Annual Production: Approximately 150,000 metric tons

Key Markets: North America, Europe, and regional markets

3. Paraguay

Paraguay is a growing player in millet production, thanks to its favorable climate and focus on agricultural exports. Millet is cultivated primarily by small and medium-sized farms.

Key Strengths:

- Increasing investment in millet farming.

- Strong ties with neighboring countries for export.

- Focus on sustainable and eco-friendly farming practices.

Annual Production: Approximately 100,000 metric tons

Key Markets: Brazil, Argentina, and Europe

4. Uruguay

Uruguay’s millet production is relatively small but growing steadily. The country focuses on high-quality millet for food processing and animal feed.

Key Strengths:

- High-quality production standards.

- Small-scale but efficient farming practices.

- Niche export markets for premium millet.

Annual Production: Approximately 50,000 metric tons

Key Markets: Regional markets, North America

5. Bolivia

Bolivia has been gradually increasing its millet production, primarily for domestic consumption and neighboring countries. Millet is grown in semi-arid regions where it thrives due to its drought resistance.

Key Strengths:

- Adaptation to semi-arid climates.

- Strong domestic demand for millet-based foods.

- Emerging export potential.

Annual Production: Approximately 45,000 metric tons

Key Markets: South America, Central America

6. Colombia

Colombia’s millet production is relatively small but growing, driven by demand for animal feed and gluten-free products. The country is exploring millet as an alternative crop in areas with poor soil conditions.

Key Strengths:

- Focus on animal feed markets.

- Exploration of millet’s potential in degraded lands.

- Growing domestic demand for gluten-free foods.

Annual Production: Approximately 35,000 metric tons

Key Markets: Domestic and regional markets

7. Peru

Peru is a niche producer of millet, focusing on high-altitude farming regions. Millet is mainly used for human consumption, with an emphasis on health-conscious and gluten-free food markets.

Key Strengths:

- Cultivation in high-altitude regions.

- Focus on millet for health food products.

- Small but growing export markets.

Annual Production: Approximately 25,000 metric tons

Key Markets: Domestic markets, North America

8. Ecuador

Ecuador produces millet on a small scale, primarily for domestic consumption and as animal feed. The country is exploring millet as a rotational crop to improve soil health.

Key Strengths:

- Millet cultivation as part of crop rotation strategies.

- Strong domestic demand for millet feed.

- Small-scale but sustainable production.

Annual Production: Approximately 20,000 metric tons

Key Markets: Domestic markets

9. Venezuela

Venezuela’s millet production has faced challenges due to economic instability, but the country continues to grow millet for animal feed and traditional dishes.

Key Strengths:

- Millet’s use in traditional Venezuelan foods.

- Focus on millet for livestock feed.

- Small-scale farming practices.

Annual Production: Approximately 15,000 metric tons

Key Markets: Domestic markets

10. Chile

Chile is a minor producer of millet, primarily focusing on niche markets for gluten-free and organic food products. The country has potential for expansion due to its diverse climates.

Key Strengths:

- High-quality millet for health food markets.

- Small-scale but efficient production.

- Opportunities for export to North America.

Annual Production: Approximately 10,000 metric tons

Key Markets: Domestic and North American markets

Why Millet Is Important in South America

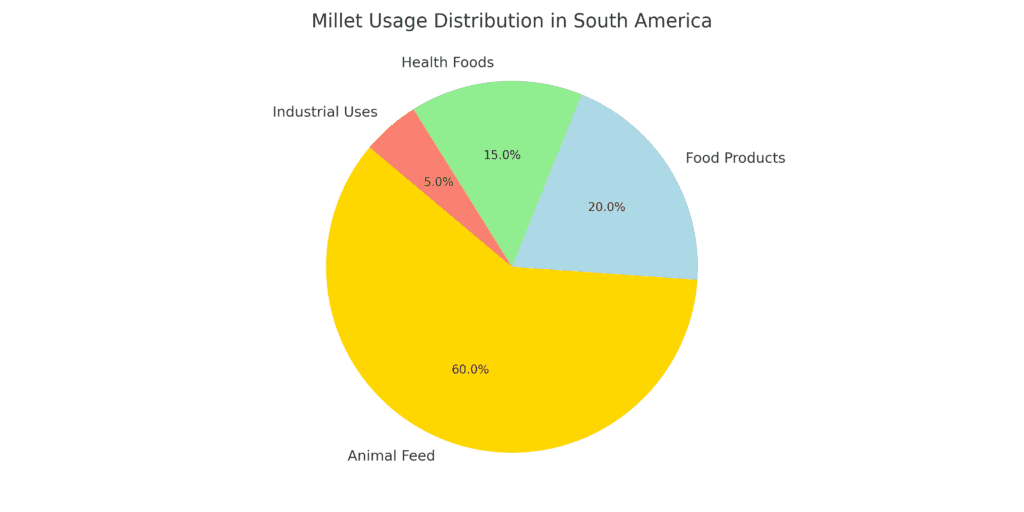

Millet plays a critical role in South American agriculture due to its:

- Drought Resistance: Millet thrives in semi-arid regions, making it a reliable crop in areas prone to drought.

- Nutritional Value: Millet is rich in protein, fiber, and essential nutrients, making it an ideal choice for health-conscious consumers.

- Versatility: Millet is used in animal feed, gluten-free foods, birdseed, and even biofuels.

Challenges and Opportunities in South America’s Millet Industry

Challenges:

- Market Awareness: Millet is less known compared to other staple crops like corn and wheat, limiting its demand.

- Infrastructure: Limited post-harvest storage and processing facilities can lead to losses.

- Climate Change: While millet is drought-resistant, extreme weather events can still impact yields.

Opportunities:

- Health Food Market: Growing interest in gluten-free and health-conscious diets offers significant potential for millet-based products.

- Export Growth: South America has the potential to expand millet exports to meet global demand.

- Innovation: Developing value-added millet products, such as snacks and ready-to-eat meals, can drive growth.

Conclusion

This report highlights the top 10 millet producers in South America and their vital role in the region’s agriculture. With a focus on sustainability, innovation, and meeting growing global demand, these producers are driving the expansion of millet farming and processing. As millet gains popularity for its health benefits and versatility, South America is well-positioned to strengthen its presence in the global millet market.