Global Chicken Industry Report 2024-2032

Introduction

The global chicken meat industry is experiencing significant growth, driven by economic factors, changing consumer preferences, and advancements in production technologies. The market, which was valued at $151.92 billion in 2023, is projected to reach nearly $253.25 billion by 2032, growing at a compound annual growth rate (CAGR) of 5.84%. This report provides an in-depth analysis of the market trends, key drivers, and significant players shaping the global and Asia-Pacific chicken industry from 2024 to 2032.

Market Overview

The global chicken meat market has become a pivotal segment of the food industry. Since the establishment of the contemporary chicken business a century ago, chicken has surpassed pork and beef in global popularity. Simple economics can explain some of the global transition from red to white meat: raising chickens is significantly less expensive than raising pigs or cattle because chickens are more effective at converting feed into meat.

People are increasingly turning to less expensive meats as a result of inflation and the stagnation of worldwide wages. Governments and consumers alike are considering environmental and health issues. Although raising chickens and fish is extremely harmful to the environment, the carbon footprint of these foods is significantly lower than that of red meat, and they are generally thought to be healthier than pork and beef.

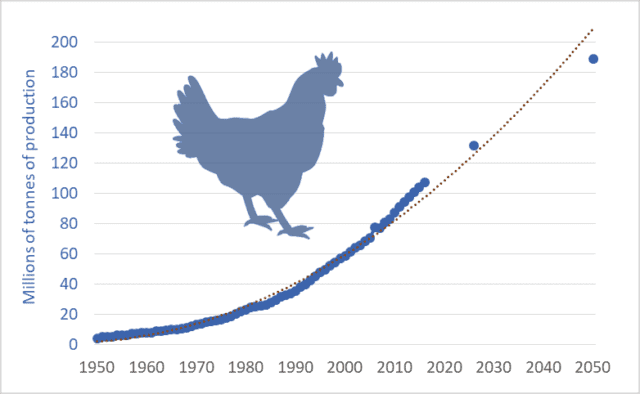

According to data projections released by the Food and Agriculture Organization (FAO) of the United Nations and the Organization for Economic Co-operation and Development (OECD), global production of poultry meat is expected to surpass 139 million metric tons (mt) in 2023, an increase of nearly 3% from 2022. This production of poultry meat continues to outpace that of other meat sources, including pig, beef, and sheep.

Production Trends

The FAO and OECD estimate that by 2032, humankind will raise and slaughter approximately 85 billion chickens annually, a 15 percent increase from the current staggering 74 billion. In contrast, by 2032, there will be about 1.5 billion pigs and 365 million beef cattle reared for meat. This shift in production is largely due to the efficiency and cost-effectiveness of poultry farming.

Growth in the poultry industry is supported by steady economic expansion, anticipated in many industrialized and emerging nations. Developing markets are expected to grow marginally faster than developed markets. Stable economic growth is anticipated to propel chicken meat manufacturing by increasing investment in the end-user chicken meat industry.

The Conference Board’s global real GDP forecast indicates that the world economy will expand by 3.1% in 2025 and by 3% this year. This economic growth is expected to drive further investment and expansion in the chicken meat industry.

Key Market Drivers

Several factors contribute to the robust growth of the global chicken meat market:

- Economic Factors: Inflation and stagnating wages drive consumers towards less expensive protein sources like chicken.

- Environmental Concerns: Chicken and fish have a lower carbon footprint compared to red meats, making them more attractive to environmentally conscious consumers and governments.

- Health Considerations: Chicken is generally perceived as a healthier alternative to pork and beef, contributing to its growing popularity.

- Technological Advancements: Innovations in poultry farming, such as lab-grown meat and automated processing, are enhancing production efficiency and sustainability.

- Rising Foodservice Demand: The increasing number of foodservice establishments and the growing demand for restaurant fare are boosting poultry meat sales.

Significant Industry Developments

The chicken meat industry has seen several noteworthy developments in recent years. These include investments, partnerships, and regulatory changes that are shaping the future of the market.

Mitsui’s Investment in Egypt In November 2023, Mitsui made an investment in an integrated production company in Egypt. This investment includes raising and breeding chickens, raising and processing broilers, producing processed food, and selling these goods. This move is expected to enhance Mitsui’s presence in the global chicken meat market and support the growth of the industry in Egypt.

Stampede Meat and DL Lee & Sons Partnership In February 2023, a new agreement between Stampede Meat, Inc. and DL Lee & Sons, Inc. was announced. This partnership will enable Stampede to expand its production footprint in the southeast region of the United States, boosting its capacity to meet the growing demand for chicken meat.

USDA Approval of Lab-Grown Meat In July 2023, the US Department of Agriculture authorized the sale of “cultivated” or lab-grown meat to American consumers. This approval opens up a new channel for the procurement and distribution of food. Upside Foods and GOOD Meat received the go-ahead to start producing and marketing their “cultivated chicken” products, which are made from animal cells grown in a lab rather than from slaughtering animals.

DCP Capital’s Acquisition of Cargill’s Poultry Operations in China In August 2023, Paul, Weiss began working with Beijing-based DCP Capital to execute the capital equity firm’s acquisition of Cargill’s poultry operations in China. This acquisition is expected to strengthen DCP Capital’s position in the Chinese poultry market.

Tyson Foods’ Expansion Plans In November 2023, Tyson Foods announced its plans to expand its facility in the Netherlands and construct additional production facilities in China and Thailand. These new facilities will increase Tyson’s capacity to produce approximately 100,000 tonnes of fully cooked poultry. The expansions are anticipated to create over 700,000 jobs in China and Thailand, and more than 150 positions in Europe.

Kraft Heinz and BEES Collaboration In March 2023, Kraft Heinz Company extended its cooperation with BEES to strengthen their B2B marketplace collaboration. The goal is to open up one million additional points of sale throughout Latin America, focusing on growing its presence in Mexico, Colombia, and Peru. This partnership is expected to boost Kraft Heinz’s market share in the region.

Asia-Pacific Chicken Meat Market

The Asia-Pacific region has witnessed significant growth in chicken meat production and consumption over the past decade. This growth is driven by rising regional and worldwide demand for poultry meat. According to the Food and Agriculture Organization of the United Nations, Asia accounted for 38% of the world’s production of chicken meat in 2020.

Quick-Service Restaurants and Wet Markets Poultry is particularly popular in quick-service restaurants, which are rapidly expanding across the region. While many Chinese consumers still purchase their meat from “wet” markets, there is a growing trend of city dwellers buying perishable goods from supermarkets. This shift is expected to continue, with per capita chicken consumption projected to rise by 2.4% annually over the next decade.

Economic Growth and Dietary Changes The International Monetary Fund (IMF) predicts that the Asia-Pacific region will continue to be a major contributor to global growth in 2023, with the region’s growth rate increasing from 3.9% in 2022 to 4.6% in 2023. As standards of living rise, low- and middle-class consumers tend to purchase more food and diversify their diets to include more meat, particularly chicken.

Competitive Meat Prices The costs of competitive meats and shifts in people’s attitudes toward food and eating habits are the main variables influencing the demand for chicken. As chicken remains a cost-effective and versatile meat option, its demand is expected to remain strong.

Key Players in the Global Chicken Market

The global chicken market features several key players that drive innovation and growth in the industry. These companies are involved in various aspects of the chicken meat supply chain, including production, processing, and distribution.

Kraft Heinz Company Kraft Heinz is a major player in the global food industry, with a significant presence in the chicken meat market. The company’s recent collaboration with BEES aims to expand its B2B marketplace in Latin America, enhancing its distribution network and market reach.

Tyson Foods, Inc. Tyson Foods is one of the largest chicken producers globally. The company’s expansion plans in the Netherlands, China, and Thailand highlight its commitment to increasing production capacity and meeting global demand. Tyson Foods’ focus on innovation, such as lab-grown meat, positions it as a leader in the industry.

Pilgrim’s Pride Corporation Pilgrim’s Pride, a subsidiary of JBS S.A., is another major player in the chicken meat market. The company is known for its extensive production and distribution network across North America, Europe, and Latin America.

Danish Crown Group Danish Crown Group is a leading meat processing company with a strong presence in the chicken meat market. The company’s focus on sustainability and efficient production practices contributes to its competitive advantage.

BRF S.A. BRF is a Brazilian multinational corporation that ranks among the largest poultry exporters in the world. The company operates an integrated supply chain, from feed production to poultry farming and meat processing.

WH Group WH Group, based in China, is a global leader in the meat processing industry. The company’s acquisition of Cargill’s poultry operations in China is expected to bolster its market position and expand its production capabilities.

Hormel Foods Corporation Hormel Foods is a diversified food company with a strong presence in the chicken meat market. The company’s innovative product offerings and strategic acquisitions support its growth in the industry.

Wens Foodstuff Group Wens Foodstuff Group, a leading Chinese agribusiness company, is a major player in the chicken meat market. The company’s focus on sustainable farming practices and advanced production technologies enhances its competitiveness.

Regional Production and Consumption

The production and consumption of chicken meat vary significantly across different regions. The United States, Brazil, China, and the European Union are among the largest producers and consumers of chicken meat.

United States The United States is one of the largest producers and consumers of chicken meat globally. The country’s advanced production technologies and efficient supply chain contribute to its leading position in the market. In 2023, the US is expected to produce over 20 million metric tons of chicken meat.

Brazil Brazil is a major exporter of chicken meat, supplying markets around the world. The country’s favorable climate and abundant feed resources support its large-scale poultry farming operations. Brazil’s chicken meat production is projected to reach 15 million metric tons by 2032.

China China is both a major producer and consumer of chicken meat. The country’s growing middle class and urbanization drive the demand for poultry products. China’s production capacity is expected to increase significantly with investments from companies like Tyson Foods and DCP Capital.

European Union The European Union is a significant player in the global chicken meat market, with countries like the Netherlands, Germany, and France leading production. The region’s focus on animal welfare and sustainable farming practices influences its production methods and market dynamics.

Future Outlook

The future of the global chicken meat market looks promising, with several trends expected to shape the industry:

- Sustainable Farming Practices: There is a growing emphasis on sustainable and ethical farming practices, driven by consumer demand and regulatory requirements. Companies are investing in technologies that reduce environmental impact and improve animal welfare.

- Technological Advancements: Innovations such as lab-grown meat, automated processing, and advanced feed formulations are expected to enhance production efficiency and meet the increasing demand for chicken meat.

- Market Expansion: Companies are expanding their operations in emerging markets, particularly in Asia and Latin America, to tap into the growing demand for poultry products.

- Health and Wellness Trends: The rising awareness of health and wellness is driving consumers towards lean protein sources like chicken. This trend is expected to continue, with companies developing new product offerings to cater to health-conscious consumers.

Conclusion

The global and Asia-Pacific chicken meat market is poised for significant growth over the next decade. Driven by economic factors, environmental concerns, and changing consumer preferences, the industry is expected to see increased production and consumption. Key players like Kraft Heinz, Tyson Foods, and Pilgrim’s Pride are leading the way with innovative strategies and investments. As the market evolves, sustainable practices and technological advancements will play a crucial role in shaping the future of the chicken meat industry.

Recent: Weekly Animal Protein Market Report: Challenges and trends in global food and agriculture.