Introduction

Quinoa has emerged as a superfood with high nutritional value, growing demand, and increased global trade. Once primarily cultivated in the Andean regions of South America, quinoa is now a staple in diets worldwide, driven by its health benefits, sustainability, and versatility in food applications. As we move into 2025, the quinoa industry is undergoing transformation, shaped by innovations in production, sustainability concerns, and evolving consumer preferences. This report provides a comprehensive analysis of the global quinoa industry, detailing its market trends, key players, challenges, and opportunities.

1. Global Market Overview

1.1 Market Size and Growth Trends

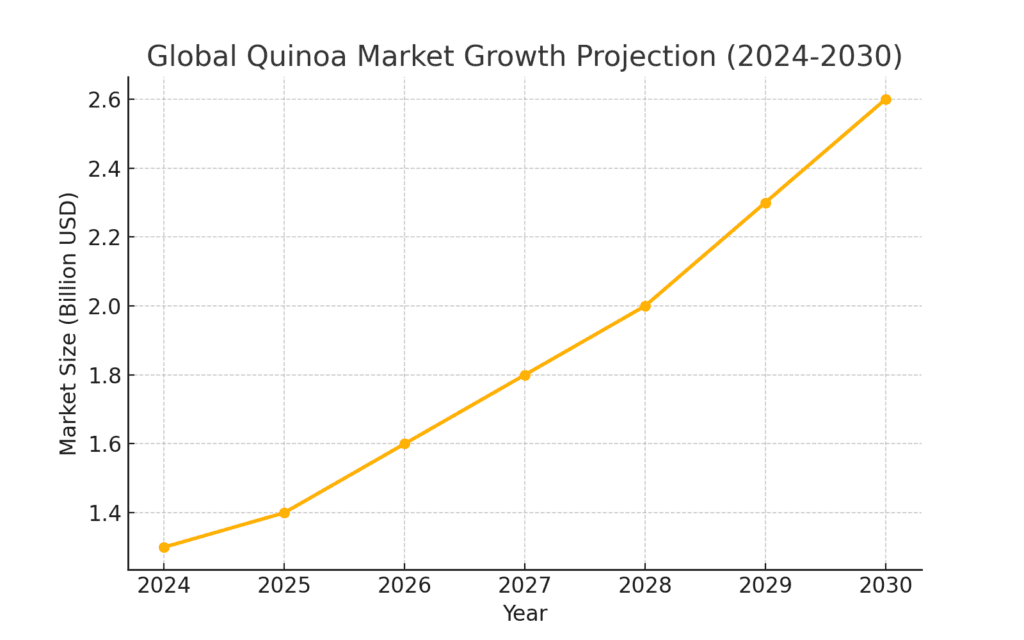

The global quinoa market was valued at approximately $1.3 billion in 2024 and is projected to grow at a CAGR of 7.8% from 2025 to 2030. Key factors fueling this growth include:

- Rising consumer awareness of quinoa’s nutritional benefits.

- Expansion of quinoa farming beyond South America to regions like North America, Europe, and Asia.

- Increased use in food processing, including ready-to-eat meals, cereals, and plant-based protein products.

1.2 Key Consumer Markets

- North America: The U.S. and Canada are leading consumers, with growing demand for organic and gluten-free quinoa products.

- Europe: Germany, France, and the UK drive quinoa consumption due to a shift toward plant-based diets.

- Asia-Pacific: China, India, and Japan are seeing rising interest in quinoa as a health food.

- Latin America: Peru and Bolivia remain leading producers, but local consumption is also rising.

2. Leading Producers and Market Players

2.1 Top Quinoa-Producing Countries

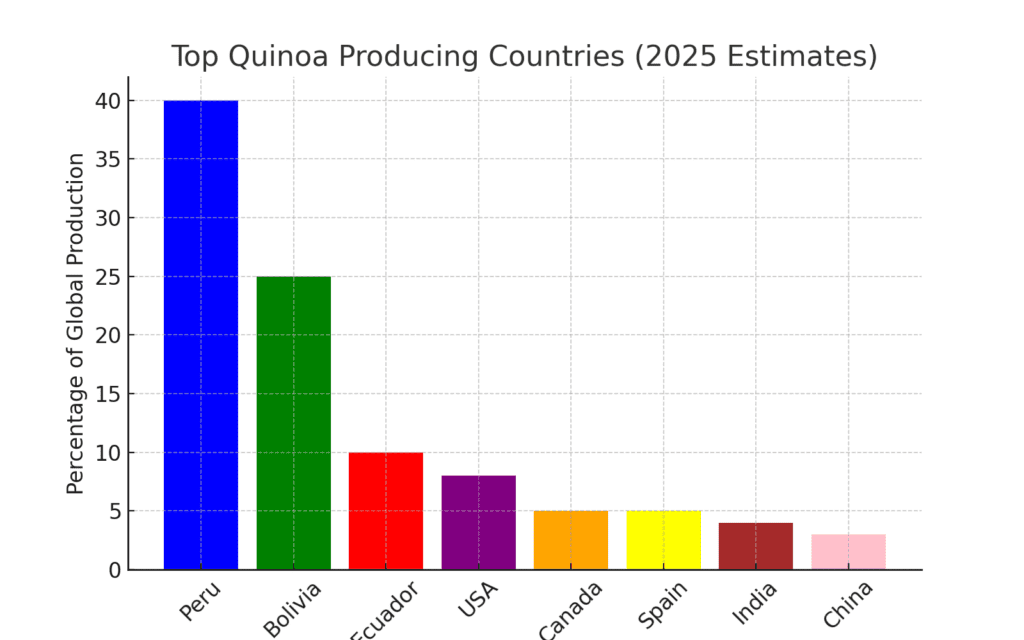

- Peru: The world’s largest quinoa producer, exporting to over 70 countries.

- Bolivia: A major supplier with premium organic quinoa production.

- Ecuador: Emerging as a strong competitor with increasing exports.

- United States: Expanding domestic production to meet rising demand.

- Canada: Developing as a key producer of organic and non-GMO quinoa.

- Spain: Leading European quinoa producer.

- India & China: Entering the quinoa farming sector to diversify food security.

2.2 Key Companies in the Quinoa Industry

- Andean Valley Corporation (Bolivia)

- Incasur (Peru)

- NorQuin (Canada)

- Adaptive Seeds (USA)

- Wholesome Harvest Foods (USA)

- Grain Millers (USA)

- Organic Andes (Peru)

- Ancient Harvest (USA)

- Quinoa Foods Company (Bolivia)

- Shiloh Farms (USA)

3. Sustainability and Environmental Challenges

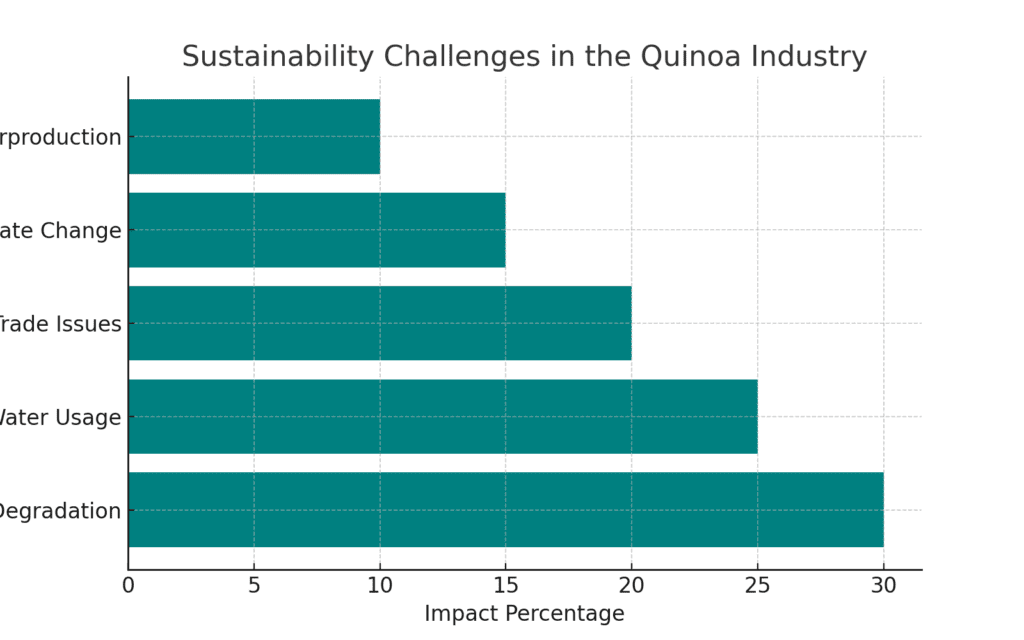

3.1 Soil Degradation and Overfarming

- Quinoa farming in South America has led to soil depletion, necessitating sustainable agricultural practices.

3.2 Water Usage and Climate Impact

- Climate change and unpredictable weather patterns are affecting quinoa yield.

- Expansion of quinoa farming to drought-prone regions raises sustainability concerns.

3.3 Fair Trade and Ethical Farming

- Concerns over small farmers receiving fair compensation are pushing brands toward Fair Trade certification.

3.4 Sustainable Alternatives and Innovations

- Development of climate-resistant quinoa varieties.

- Use of organic farming methods to reduce environmental impact.

4. Trade, Exports, and Regulations

4.1 Global Quinoa Trade Trends

- The U.S. and Europe remain the largest importers of quinoa.

- Rising demand in Asia-Pacific and the Middle East.

- Increased investment in quinoa processing facilities in export countries.

4.2 Tariffs and Trade Barriers

- The EU has imposed strict organic certification standards for quinoa imports.

- U.S.-China trade tensions impacting quinoa exports from North and South America.

4.3 Certification and Compliance

- USDA Organic, Fair Trade, and EU Organic certifications are increasingly sought by global buyers.

- Regulatory bodies are tightening GMO and pesticide restrictions on quinoa imports.

5. Consumer Trends and Market Shifts

5.1 Growth in Organic and Non-GMO Quinoa

- Consumers are prioritizing organic quinoa over conventionally farmed products.

- Brands are marketing quinoa as a clean-label superfood.

5.2 Expansion in Quinoa-Based Products

- Quinoa flour, pasta, and protein powders gaining popularity.

- Ready-to-eat quinoa meals and snacks are a major growth segment.

5.3 E-Commerce and Direct-to-Consumer Sales

- Platforms like Amazon, Alibaba, and Thrive Market are increasing online quinoa sales.

- Subscription quinoa meal kits are becoming a trend.

6. Future Outlook and Investment Opportunities

6.1 Market Projections for 2025-2030

- The quinoa industry is expected to surpass $2 billion by 2030.

- Growth in alternative protein research and plant-based food applications.

6.2 Innovations in Quinoa Farming and Processing

- Expansion of quinoa vertical farming and hydroponic production.

- AI-driven precision farming to optimize yield and sustainability.

6.3 Challenges to Overcome

- Climate-related yield reductions impacting global supply.

- Overproduction leading to price volatility.

- Need for stronger fair-trade agreements to support small-scale farmers.

Conclusion

The global quinoa industry in 2025 presents both opportunities and challenges. As demand for healthy and sustainable food options grows, quinoa is set to remain a key staple in global diets. However, ensuring sustainable farming practices, addressing trade complexities, and investing in innovation will be crucial to maintaining the industry’s growth trajectory.

Stakeholders in the quinoa industry, including producers, exporters, retailers, and policymakers, must work together to create a resilient, equitable, and environmentally responsible supply chain for the future.