Introduction

The global mushroom industry has experienced significant growth in recent years, driven by rising consumer demand for functional foods, sustainable agriculture, and plant-based alternatives. With an expanding market size and increased investment in innovative production methods, the mushroom sector is evolving at an unprecedented pace. This article provides a detailed analysis of the current state of the mushroom industry, including key trends, trade dynamics, challenges, and future growth opportunities.

Market Overview

Global Production and Market Size

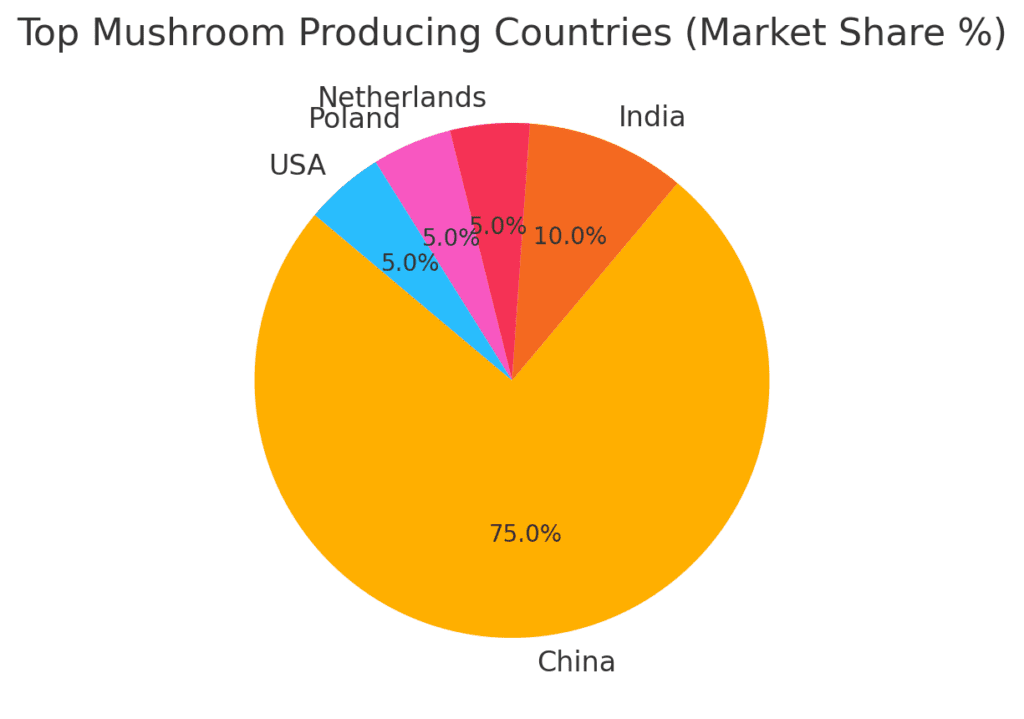

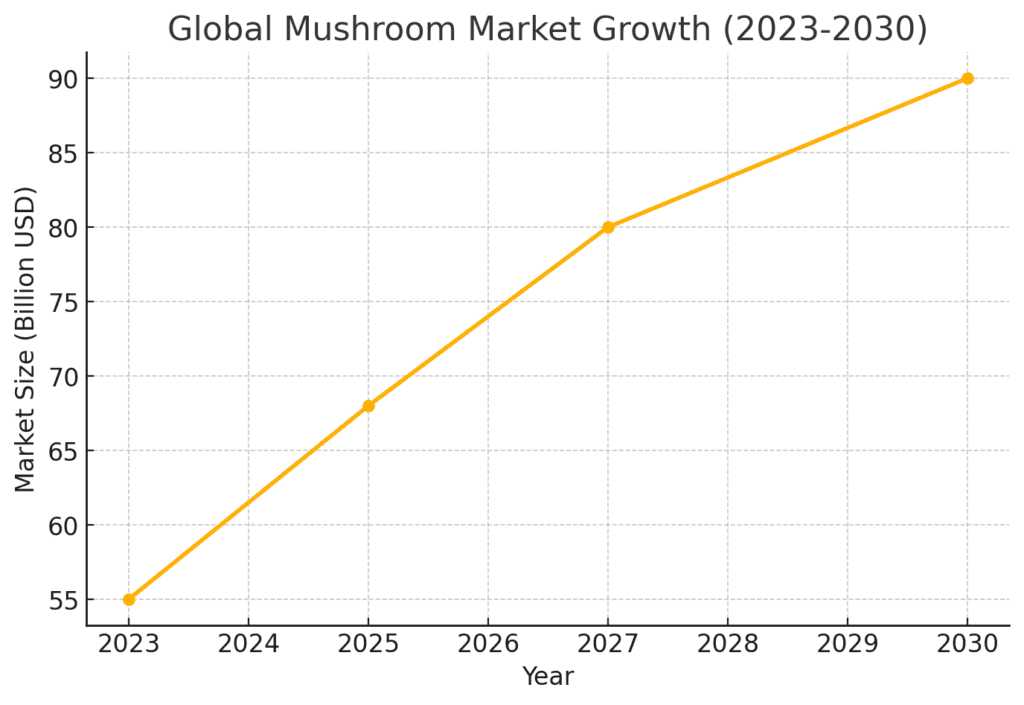

The mushroom industry is a multi-billion-dollar market, with an estimated CAGR of 8.5% from 2023 to 2030. The global market value stood at approximately $55 billion in 2023, and analysts predict it will surpass $90 billion by 2030. Asia-Pacific dominates production, with China leading as the world’s largest mushroom producer, followed by India, Japan, and South Korea.

Europe and North America also contribute significantly to global mushroom production, particularly in organic and specialty mushrooms, catering to the increasing demand for plant-based and health-focused foods. Countries such as the Netherlands, Poland, and the United States are major producers supplying fresh and processed mushrooms to global markets.

Key Mushroom Varieties in Demand

The demand for functional and medicinal mushrooms is surging, particularly for varieties such as:

- Button Mushrooms (Agaricus bisporus): The most commonly cultivated mushroom, widely used in culinary applications.

- Oyster Mushrooms (Pleurotus spp.): Popular for their mild flavor and fast-growing properties.

- Shiitake Mushrooms (Lentinula edodes): Known for their umami-rich taste and medicinal properties.

- Reishi Mushrooms (Ganoderma lucidum): Highly valued in traditional medicine for immune-boosting benefits.

- Lion’s Mane Mushrooms (Hericium erinaceus): Gaining popularity for their potential cognitive and neurological benefits.

- Chaga Mushrooms (Inonotus obliquus): Used in herbal teas and supplements for their antioxidant properties.

Trade and Export Trends

Leading Mushroom Producing & Exporting Countries

China remains the largest mushroom producer, accounting for over 75% of the world’s total production. Other key exporters include:

- Netherlands: A major supplier of high-quality fresh and processed mushrooms to European markets.

- Poland: One of the largest exporters of fresh mushrooms in Europe, catering to markets in Germany, the UK, and France.

- United States: Leading in organic mushroom production and value-added products like mushroom-based supplements and powders.

- Canada: A rising player in the specialty mushroom sector, particularly in organic and medicinal mushrooms.

Global Import Trends

The United States, Germany, the United Kingdom, and Japan are among the top importers of fresh and processed mushrooms. The growing awareness of the health benefits associated with mushrooms is driving demand for organic and medicinal varieties. Additionally, the rise of vegan and plant-based diets is further boosting mushroom imports in developed economies.

Key Market Drivers

1. The Rise of Functional Foods and Health-Conscious Consumers

Consumers are increasingly looking for nutrient-dense, functional foods, leading to a surge in demand for medicinal mushrooms. Reishi, lion’s mane, and chaga mushrooms are widely used in nootropics, adaptogens, and immune-boosting supplements.

2. Sustainable and Alternative Protein Sources

Mushrooms have emerged as a sustainable protein alternative, particularly in the plant-based food sector. With global food security concerns rising, mushrooms offer a low-resource, high-yield protein source that is rich in fiber, vitamins, and antioxidants.

3. Innovations in Mushroom Farming & Vertical Agriculture

Advancements in indoor farming, hydroponics, and vertical agriculture are optimizing production efficiency. Countries with limited agricultural land, such as Singapore and the UAE, are investing in high-tech mushroom farming to enhance food security.

4. Growth of Mushroom-Based Products

The mushroom industry is witnessing a boom in value-added products, including:

- Mushroom-based meat substitutes (e.g., mycelium-based burgers)

- Mushroom-infused coffee, tea, and functional beverages

- Mushroom-based supplements for immunity and cognitive health

- Mushroom leather and biodegradable packaging solutions

Challenges Facing the Mushroom Industry

1. Climate Change & Agricultural Sustainability

Mushroom farming requires consistent temperature and humidity levels, making climate change a major challenge. Rising temperatures and unpredictable weather patterns are affecting global yields and production costs.

2. Supply Chain Disruptions & Trade Barriers

The COVID-19 pandemic exposed vulnerabilities in global supply chains. Transport restrictions, labor shortages, and increased freight costs have impacted mushroom exports and imports.

3. High Production Costs & Energy Consumption

Mushroom cultivation is energy-intensive, requiring controlled environments. High electricity costs and sustainability concerns are pushing producers to invest in renewable energy solutions and automation.

4. Limited Awareness & Consumer Education

Despite their health benefits, medicinal and functional mushrooms are still underrepresented in mainstream consumer diets. Brands are investing in education, marketing, and influencer collaborations to drive awareness and adoption.

Future Trends & Growth Opportunities

1. AI & Smart Farming in Mushroom Production

The integration of AI, IoT sensors, and automated farming systems is expected to revolutionize the industry. AI-powered climate control systems can optimize yields, reduce waste, and cut down production costs.

2. Expansion of Medicinal Mushroom Market

The global medicinal mushroom market is projected to reach $25 billion by 2030, driven by increasing research on their neuroprotective, anti-inflammatory, and immune-boosting properties.

3. Growing Investments in Vertical Farming

Tech companies and agritech startups are investing in vertical mushroom farms, utilizing hydroponics, AI-driven climate control, and LED lighting to optimize production in urban areas.

4. The Rise of Mushroom-Based Packaging & Sustainability Solutions

Startups are developing mushroom-based biodegradable packaging, reducing reliance on plastic. Companies like Ecovative are pioneering mycelium-based sustainable materials for packaging, textiles, and even construction.

5. Mergers & Acquisitions in the Mushroom Industry

With increasing demand, food giants and agribusiness firms are investing in mushroom startups and specialty producers. Major brands are acquiring functional food companies to expand their product portfolios.

Conclusion

The global mushroom industry is poised for tremendous growth in the coming years, fueled by rising health consciousness, sustainable food trends, and technological innovations. While challenges such as climate change and supply chain disruptions persist, the sector’s adaptability and innovation-driven approach will ensure sustained expansion.

Businesses that capitalize on value-added mushroom products, sustainable farming practices, and digital transformation will emerge as industry leaders. As consumer interest in functional foods and plant-based alternatives continues to rise, the mushroom industry stands at the forefront of the next global food revolution.