Tariff Man Returns

The past few weeks have been a whirlwind since Donald Trump assumed the presidency for a second term on January 20. Trade analysts and observers have been closely monitoring the situation, anticipating a series of trade actions. The lingering question remains: what will take effect amid Trump’s unpredictable approach?

True to form, Trump wasted no time in imposing tariffs on imports from Colombia, Canada, and Mexico, only to retract them after these nations made minor concessions. Additionally, there was an attempt to annul the exemption on imports valued at less than $800—known as the de minimis rule—though this move was eventually reversed. This issue has gained traction, especially since the pandemic, as Chinese retailers like Temu have exploited the de minimis rule to ship over 1.3 billion small packages to the U.S. without incurring tariffs.

As of now, what appears to be sticking includes a 10% tariff on all shipments from China and a substantial 25% tariff on all steel and aluminum imports. These initial duties are noteworthy; the U.S. imported $438.9 billion worth of goods and commodities from China in 2024, while exporting only $134.6 billion back, resulting in a significant trade deficit of $295.4 billion, according to Trade Data Monitor (TDM). While theoretically, this could yield $43.9 billion in tariff revenue, it is important to note that tariffs generally tend to decrease imports, prompting Chinese exporters to seek alternative markets, particularly in Asia.

Fortress America

As the leading consumer market globally, the United States wields considerable leverage over access to its markets. Many manufacturers that once outsourced to China are now looking for alternative countries that offer more favorable terms for trade. Currently, Mexico has become the top source for U.S. imports, followed by China and Canada, with additional contributions from Germany, Japan, South Korea, Vietnam, Taiwan, Ireland, and India.

Among these, Ireland presents an intriguing scenario as it stands as the U.S.’s leading supplier of pharmaceuticals, exporting $42.8 billion worth in the first ten months of 2024. Given the political sensitivity surrounding pharmaceuticals, it seems unlikely that Washington will impose tariffs on this vital sector. Thus, there remains a robust demand for various products.

To date, however, the focus has predominantly been on industrial goods. In 2024, the U.S. imported $31.4 billion worth of iron and steel, with Canada, Brazil, and Mexico being the top suppliers. Additionally, aluminum imports reached $27.4 billion, primarily sourced from Canada, China, and Mexico. This strategic focus indicates that the U.S. is targeting automotive supply chains that span both North and South America.

Higher Costs for American Cars

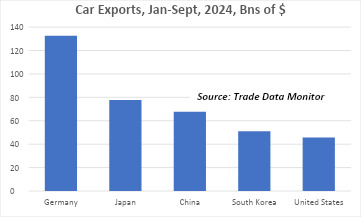

The increased costs imposed by the U.S. on its automotive supply chains are likely to benefit competitors, particularly Germany. Although the German export economy has encountered some challenges, with exports experiencing a slight downturn in 2024, it continues to be the world’s leading auto exporter. In the first three quarters of 2024, German auto exports surged by 18.8% to reach $132.7 billion.

In contrast, Japan’s car exports rose by 10.2% to $77.8 billion, while China’s shipments increased by 4.8% to $67.6 billion. The electric vehicle sector is dominated by Germany and China, with Germany exporting $29.1 billion in the first nine months of 2024, a decline of 4.7% year-on-year, while China exported $25.4 billion, marking a 1.4% increase. Other significant players in this sector include South Korea, Mexico, Japan, and the U.S.

Source: Trade Data Monitor

The Resilience of Global Trade

Despite the potential for widespread protectionist measures, the sheer scale of global trade suggests that a collapse is unlikely. Total exports in 2024 are projected to reach approximately $25 trillion, with the logistics sector alone valued at over $10 trillion. The World Trade Organization (WTO) forecasts a 2.7% increase in total goods trade by 2025, with further gains expected if geopolitical tensions, such as the ongoing conflict in the Middle East, are mitigated. In the first ten months of 2024, the U.S.—the world’s largest import market—increased its imports by 5%, totaling $2.7 trillion.

The Problem of Chinese Demand

A significant concern that could reshape geopolitical dynamics and have far-reaching implications for issues such as conflict, migration, and supply chains is the apparent decline in domestic demand within China. Amidst a shifting geopolitical landscape, this trend warrants close attention. Fortunately, many of China’s neighboring countries are experiencing newfound economic growth. While the dream of an open Chinese market for Western businesses may be fading, other Asian markets are emerging as significant players.

These nations have also benefited from globalization, leading to the expansion of their middle classes. Some of the fastest-growing import markets globally are located in Asia. For instance, Malaysia saw a 13.2% increase in imports to $248.5 billion in the first ten months of 2024, while Thailand’s imports rose by 6.7% to $259.6 billion, with most of their trading partners also situated in Asia. The WTO anticipates that Asian export volumes may rise by as much as 7.4% in 2024, contrasting with a 1.4% decrease expected in Europe.

High-Tech Trade Remains Strong

Although merchandise trade has decreased partly due to a rise in service and digital trade, the importance of silicon chips remains paramount. The trade of chips has become a strategic focal point. Taiwan, as the world’s leading chip exporter, plays a critical role as China’s primary supplier of electronics and electrical parts. In the first ten months of 2024, China imported $157.7 billion worth of electronics and parts from Taiwan, reflecting an 11.1% increase from the previous year. Taiwan’s position at the center of global high-tech trade complicates its relationship with Beijing.

Moreover, the rise of populist governments worldwide poses a challenge to the advancement of green energy initiatives. Total imports of solar panels and related components fell by 13.3% to $135.3 billion in the first nine months of 2024. China remains the largest importer, purchasing $19.9 billion, followed closely by the U.S., Germany, the Netherlands, and India. However, the upcoming elections in Germany, along with newly elected governments in the U.S. and India, leave the future of these initiatives uncertain.