Introduction

Smithfield Foods, one of the largest pork producers in the world, has played a defining role in shaping the global meat industry. From its humble beginnings in Virginia to its eventual acquisition by a Chinese conglomerate, Smithfield’s journey has been marked by rapid expansion, strategic acquisitions, financial ups and downs, and various controversies. This article explores the company’s history, its business strategy, key financials, successes, and challenges up to the present day.

Early History and Founding

Smithfield Foods was founded in 1936 in Smithfield, Virginia, by Joseph W. Luter and his son, Joseph W. Luter Jr. The company started as a small meat-packing operation, specializing in processing pork products. Smithfield quickly grew, benefiting from the rise of industrialized meat production and increasing consumer demand for pork. By the 1960s, Smithfield had expanded significantly, adopting modern slaughtering techniques and increasing production capacity.

Expansion and Acquisitions

During the late 20th century, Smithfield aggressively pursued a growth-through-acquisition strategy.

- 1981: The company acquired Gwaltney of Smithfield Ltd., strengthening its position in the processed meat sector.

- 1990s: Smithfield embarked on a series of acquisitions, purchasing John Morrell & Co. and Circle Four Farms, enhancing its pork production capabilities.

- 2000s: The company expanded further by acquiring Farmland Foods, Armour-Eckrich, and Butterball (although it later sold its stake in Butterball).

- 2013: Smithfield Foods was acquired by WH Group (formerly known as Shuanghui International), a Chinese company, for $4.7 billion, making it the largest-ever Chinese acquisition of an American company at the time.

This acquisition allowed Smithfield to tap into China’s growing demand for pork, particularly after the country’s struggles with swine flu outbreaks and supply chain issues.

Business Strategy and Operations

Smithfield Foods operates as a fully integrated pork producer, meaning it controls every aspect of production, from raising hogs to processing and distributing meat. The company’s business strategy has revolved around:

- Vertical Integration: Smithfield owns its own hog farms, ensuring a steady supply of pigs for its processing plants. This model reduces costs and improves efficiency.

- International Expansion: With the backing of WH Group, Smithfield has expanded its global footprint, particularly in China and Europe.

- Sustainability and Animal Welfare: The company has committed to reducing greenhouse gas emissions, eliminating the use of gestation crates, and improving animal welfare standards.

- Innovation in Meat Products: Smithfield has introduced plant-based alternatives and organic meat products to cater to changing consumer preferences.

Financial Performance

Smithfield Foods, as a private subsidiary of WH Group, does not disclose as many financial details as publicly traded companies. However, key indicators of its financial health include:

- Revenue Growth: The company generates over $15 billion in annual revenue, with strong sales in both domestic and international markets.

- Profitability: Profit margins fluctuate depending on feed costs, trade policies, and market demand, but the company remains a dominant player in the U.S. pork market.

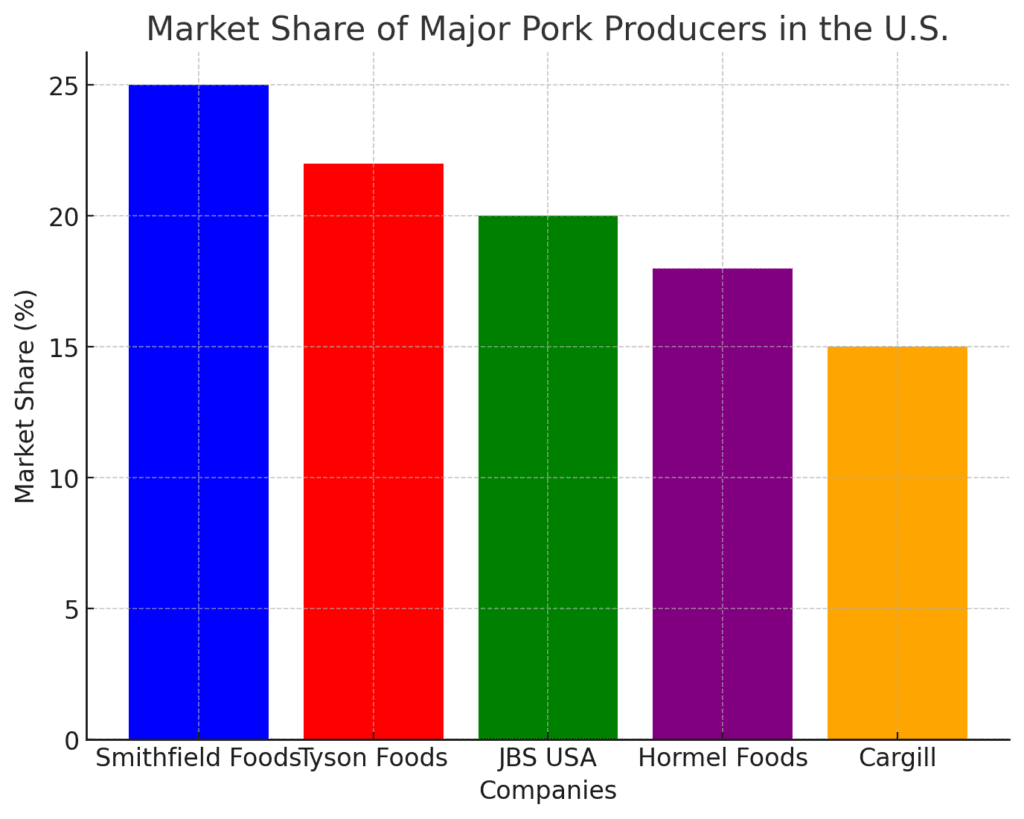

- Market Share: Smithfield is the largest pork processor in the United States, controlling approximately 25% of the domestic pork supply.

Challenges and Controversies

Despite its success, Smithfield Foods has faced several challenges:

Labor Issues

Smithfield has frequently faced criticism for poor working conditions at its plants. During the COVID-19 pandemic, several Smithfield processing facilities became virus hotspots, leading to widespread employee illnesses and temporary shutdowns.

Environmental Concerns

The company has been accused of causing significant pollution through its large-scale hog farming operations. Lawsuits have been filed against Smithfield for contaminating water sources with hog waste, and it has been fined for failing to meet environmental standards.

Food Safety Concerns

Smithfield has been subject to various food safety recalls over the years, including incidents related to contamination and improper handling of meat products.

Trade and Tariff Issues

As a major exporter of pork, Smithfield has been impacted by trade wars, particularly between the U.S. and China. Tariffs on American pork have led to increased costs and fluctuations in export revenue.

Recent Developments

- 2023: Smithfield announced new investments in sustainable farming and alternative proteins, reflecting a shift toward environmentally friendly meat production.

- 2024: The company continues to expand its operations in China, leveraging WH Group’s distribution network to increase pork exports.

- Ongoing Legal and Regulatory Scrutiny: Smithfield remains under pressure to improve labor conditions and reduce its environmental footprint.

- New Product Lines: Smithfield has entered the alternative protein market with plant-based and hybrid meat options to appeal to health-conscious consumers.

Conclusion

Smithfield Foods stands as a powerhouse in the pork industry, boasting a rich history of growth, innovation, and global expansion. While it has achieved significant financial success and international reach, the company continues to grapple with challenges related to labor practices, environmental impact, and regulatory scrutiny. Looking ahead, Smithfield’s ability to adapt to changing market trends, implement sustainability initiatives, and navigate geopolitical trade tensions will determine its long-term success.

Despite these challenges, Smithfield Foods remains a dominant force in global pork production, playing a crucial role in shaping the future of the meat industry.

Read: Nestlé: The Making of a Global Food and Beverage Giant

Watch

External References & Sources

📄 Official Smithfield Foods Website: https://www.smithfieldfoods.com

📄 WH Group Official Website: http://www.wh-group.com

📄 USDA Pork Industry Reports: https://www.usda.gov