Introduction

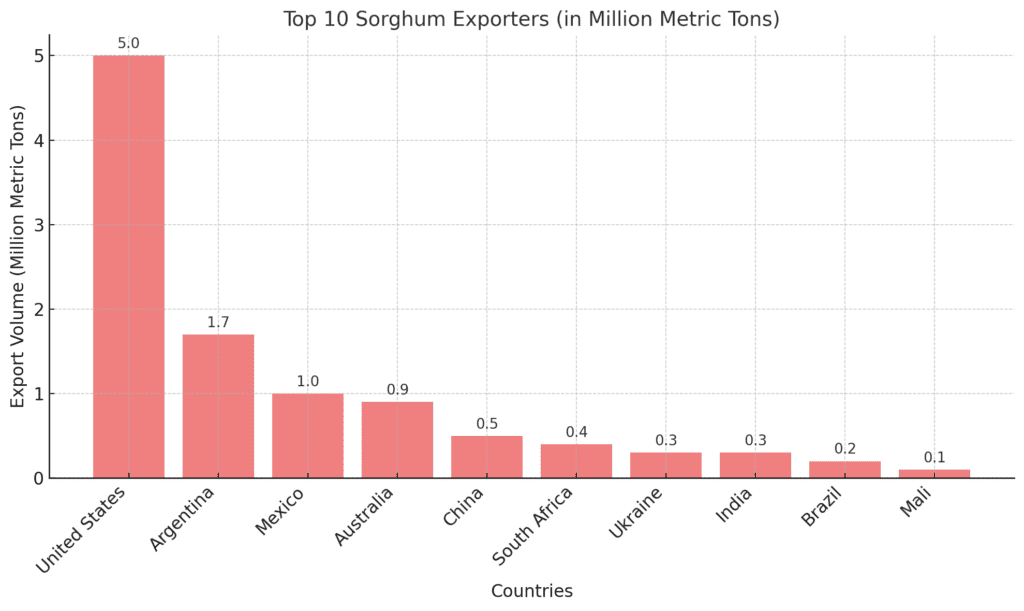

Sorghum is a versatile and drought-resistant grain, widely used for animal feed, food products, and biofuel production. As demand for sorghum grows globally, especially in regions with challenging agricultural conditions, the export market for this cereal has seen significant growth. This report explores the world’s top 10 sorghum exporters, highlighting the countries that dominate the global sorghum trade and their contributions to the global market.

🚀 Supercharge Your Insights with ESS Pro

Access over 50,000 expert market reports and connect with more than 500,000 verified industry contacts across the global food & beverage value chain.

Includes exclusive insights, top 10 rankings, live market indicators, and up to 10 custom research reports annually.

🔓 Join ESS Pro – Unlock Full Access

1. United States – The World’s Leading Sorghum Exporter

Export Volume: Approximately 5 million metric tons

The United States is by far the largest exporter of sorghum, accounting for nearly 60% of global sorghum exports. The U.S. produces a significant amount of sorghum, especially in states like Kansas, Texas, and Oklahoma, and is a key supplier to countries like China, Mexico, and Japan. Sorghum from the U.S. is primarily used for animal feed and biofuel production, with growing demand from international markets.

Global Market Share: 60% of global sorghum exports.

In recent years, the U.S. has seen a steady increase in sorghum export volumes due to the growing demand for biofuels and animal feed.

2. Argentina – A Major Supplier in South America

Export Volume: Approximately 1.7 million metric tons

Argentina is the second-largest exporter of sorghum, contributing to global supply with its abundant production. Most of Argentina’s sorghum is exported to neighboring countries, including Brazil and other parts of South America, as well as to the United States for animal feed. Argentina’s climate and efficient agricultural practices make it an ideal region for growing sorghum, particularly in its central and northern provinces.

Global Market Share: 17% of global sorghum exports.

Argentina’s sorghum exports have gained importance in recent years, with increasing demand from international markets and a steady production capacity.

3. Mexico – Close Neighbor with Growing Exports

Export Volume: Approximately 1 million metric tons

Mexico is another significant exporter of sorghum, benefiting from its proximity to the United States. Most of Mexico’s sorghum is produced in its northern states, such as Sonora and Sinaloa. It is used mainly for animal feed and is exported to the U.S. as well as other countries in Latin America and Asia. Sorghum plays an important role in Mexico’s agricultural economy, and the country continues to increase its export capacity.

Global Market Share: 10% of global sorghum exports.

As Mexico expands its agricultural practices and seeks to increase its role in global trade, its sorghum exports are expected to grow.

4. Australia – An Emerging Exporter

Export Volume: Approximately 0.9 million metric tons

Australia is an emerging player in the global sorghum export market. While it is not as large a producer as the U.S. or Argentina, Australia has been steadily increasing its sorghum export volumes, particularly to Asia. The grain is used primarily for animal feed, and the demand from markets like China and Japan has spurred growth in Australian sorghum production and export activities.

Global Market Share: 8% of global sorghum exports.

With growing production and rising export opportunities, Australia’s role in the sorghum export market is set to increase in the coming years.

5. China – A Key Importer and Supplier

Export Volume: Approximately 0.5 million metric tons

While China is primarily known as the world’s largest importer of sorghum, it also exports a significant amount to neighboring countries in Asia. Sorghum is produced in smaller quantities domestically but is used heavily for animal feed, especially in regions with intensive livestock farming. China has also increased its sorghum exports to neighboring countries like South Korea and the Philippines.

Global Market Share: 5% of global sorghum exports.

China’s role as both an importer and exporter of sorghum makes it a critical player in the global sorghum market.

6. South Africa – A Growing Exporter in Africa

Export Volume: Approximately 0.4 million metric tons

South Africa is one of the largest exporters of sorghum in Africa, and its role in the global sorghum market has been growing in recent years. Most of South Africa’s sorghum is exported to nearby countries within the Southern African Development Community (SADC), including Zimbabwe, Mozambique, and Zambia. The country also exports sorghum to international markets in the Middle East and Europe.

Global Market Share: 4% of global sorghum exports.

As Africa’s sorghum production increases, South Africa’s exports are expected to continue their upward trajectory.

7. Ukraine – A New Entrant in the Sorghum Export Market

Export Volume: Approximately 0.3 million metric tons

Ukraine has become an emerging exporter of sorghum in recent years, with production increasing due to favorable growing conditions. Ukrainian sorghum is mainly exported to Eastern Europe and parts of Asia. The country’s sorghum production is still small compared to the global leaders, but its market share is growing due to increasing demand for animal feed.

Global Market Share: 3% of global sorghum exports.

With agricultural reforms and increased production capacity, Ukraine is expected to expand its sorghum exports in the future.

8. India – Growing in the Global Market

Export Volume: Approximately 0.3 million metric tons

India produces sorghum primarily for domestic consumption, but in recent years, the country has started exporting to nearby markets in the Middle East and Asia. India’s warm climate and agricultural practices make it an ideal region for growing sorghum, especially in states like Maharashtra and Rajasthan.

Global Market Share: 3% of global sorghum exports.

As India continues to expand its sorghum production, its export volumes are expected to grow.

9. Brazil – A New Player in Sorghum Exports

Export Volume: Approximately 0.2 million metric tons

Brazil, known for its extensive agricultural sector, has started exporting sorghum in recent years. The country’s exports are primarily directed to neighboring South American countries and parts of Asia, where the demand for animal feed is high. Brazil’s sorghum export market is still in its early stages but is expected to grow due to rising production and increased demand for animal feed.

Global Market Share: 2% of global sorghum exports.

Brazil’s expanding agricultural capacity and export infrastructure make it a promising player in the global sorghum market.

10. Mali – A Key African Exporter

Export Volume: Approximately 0.1 million metric tons

Mali, located in West Africa, is a notable exporter of sorghum in the African continent. The country primarily exports sorghum to neighboring countries like Burkina Faso, Senegal, and Ivory Coast. Sorghum is an important staple crop in Mali, and its export contributes to the country’s agricultural economy.

Global Market Share: 1% of global sorghum exports.

Mali’s role in the sorghum export market may grow as demand in West Africa increases and production capacity expands.

Conclusion

The global sorghum export market is led by the United States, followed by Argentina, Mexico, and Australia. Other countries like China, South Africa, and Ukraine are emerging as important players in the sorghum trade. As demand for animal feed, biofuels, and food products increases, the sorghum export market will continue to grow, with countries across the globe vying for a share of the international market.