Read: The Global Turkey Meat Industry – Market Trends, Challenges, and Future Outlook

Introduction

The global turkey meat industry has experienced significant transformation over the years, influenced by changing consumer preferences, health trends, and economic factors. This report delves into the current state of the industry, forecasts for 2025, and key trends shaping the market. With the increasing demand for protein-rich diets and the growing popularity of turkey meat as a healthier alternative, the industry is poised for continued growth.

Market Overview

The global turkey meat market was valued at approximately USD 75 billion in 2020 and is projected to reach USD 107 billion by 2025, growing at a CAGR of 7%. The primary drivers of this growth include rising health consciousness among consumers, increased disposable income, and a shift towards lean protein sources.

Production and Consumption

As of 2023, the United States remains the largest producer of turkey meat, accounting for about 60% of global production. Other significant producers include Brazil, Germany, and France. The U.S. produced approximately 6 billion pounds of turkey in 2020, with projections suggesting a modest increase to 6.5 billion pounds by 2025.

On the consumption side, turkey meat is gaining popularity in several regions, notably North America and Europe. In 2020, the average per capita consumption of turkey meat in the U.S. was around 16 pounds per person, and it is expected to rise to 18 pounds by 2025. In contrast, the European market is witnessing a gradual increase, with an average consumption of 8 pounds per person expected to grow to 10 pounds.

Market Segmentation

The turkey meat market can be segmented based on product type, distribution channel, and region.

By Product Type

1. Fresh Turkey: This segment is expected to dominate the market due to the increasing preference for fresh meat over processed alternatives.

2. Processed Turkey: Includes products like turkey bacon, turkey sausages, and deli meats. This segment is expected to grow at a faster rate due to the convenience factor and rising demand for ready-to-eat products.

By Distribution Channel

1. Supermarkets/Hypermarkets: These channels account for the largest share of the market, providing a wide range of turkey meat products.

2. Online Retail: This segment is expected to witness the highest growth rate, driven by the increasing trend of online shopping and home delivery services.

By Region

1. North America: Dominates the market, with the U.S. being the major contributor.

2. Europe: Expected to witness steady growth, particularly in countries like Germany and the UK.

3. Asia-Pacific: This region is projected to experience the fastest growth due to rising populations and increasing meat consumption.

Market Trends

The turkey meat industry is shaped by various trends that reflect changing consumer preferences and market dynamics.

Health and Wellness Trends

Consumers are becoming more health-conscious, leading to a growing preference for leaner protein sources. Turkey is perceived as a healthier alternative to red meat due to its lower fat content and higher protein levels. As a result, many health organizations are promoting turkey meat as part of a balanced diet.

Sustainable Practices

Sustainability is becoming a crucial factor in purchasing decisions. Many producers are adopting sustainable farming practices to reduce their environmental impact. This includes organic farming, reduced antibiotic use, and better animal welfare practices. Brands that emphasize sustainability are likely to attract more consumers.

Innovation in Product Offerings

The introduction of new and innovative products is driving market growth. Companies are launching ready-to-eat meals, turkey-based snacks, and gourmet options to cater to changing consumer preferences. For instance, turkey jerky and turkey burgers have gained traction in the snack and fast-food segments, respectively.

Challenges Facing the Industry

While the turkey meat industry presents numerous opportunities, it also faces several challenges that could impact growth.

Supply Chain Disruptions

The COVID-19 pandemic underscored the vulnerability of global supply chains. Disruptions in production, processing, and distribution have raised concerns about food security. Companies are now focusing on building more resilient supply chains to mitigate future risks.

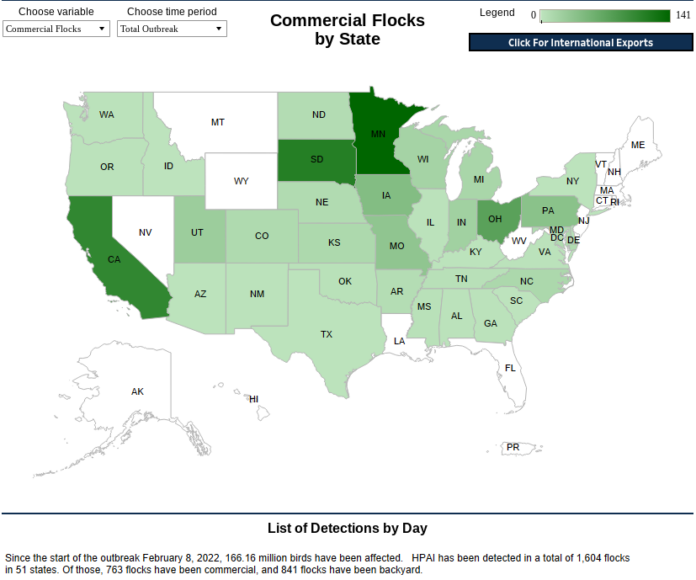

Health Concerns

Despite the positive perception of turkey meat, concerns over food safety and avian diseases can pose challenges. Incidents of salmonella and other pathogens can lead to recalls and reduced consumer trust. Ongoing efforts to enhance food safety protocols are essential to address these concerns.

Competition from Alternative Proteins

The rise of plant-based proteins and alternative meat products presents intense competition for the turkey meat industry. As consumers explore various protein sources, it is crucial for turkey producers to differentiate their products and emphasize their health benefits.

Future Outlook

Looking ahead to 2025, the global turkey meat industry is expected to undergo several changes driven by emerging trends and consumer preferences.

Market Growth Projections

Based on current trends, the turkey meat market is projected to grow at a CAGR of 7% from 2021 to 2025. This growth will be fueled by increasing health awareness, rising income levels, and the popularity of turkey as a versatile meat option.

Technological Advancements

Advancements in technology, including precision farming and genetic improvements, will enhance production efficiency and sustainability. These innovations will enable producers to meet growing demand while minimizing environmental impact.

Changing Consumer Preferences

As consumers continue to prioritize health and convenience, the demand for ready-to-eat and processed turkey products will rise. Companies that can quickly adapt to these changes will be better positioned for success.

Conclusion

The global turkey meat industry is poised for significant growth over the next few years, driven by health trends, sustainability, and innovation. While challenges exist, proactive measures and strategic adaptations will help producers navigate the evolving market landscape. As consumers increasingly seek healthier, more sustainable protein sources, the turkey meat industry stands to benefit from these shifts. By 2025, the market is expected to not only grow in size but also in its commitment to meeting consumer demands for quality, sustainability, and health.