Executive Summary

The global sheep industry in 2025 continues to experience dynamic shifts, driven by consumer demand, evolving regulatory frameworks, technological advancements, and environmental challenges. The global sheep meat market is expected to witness a compound annual growth rate (CAGR) of 1.6% from 2025 to 2034, reaching an estimated 19 million metric tons in carcass weight equivalent (CWE) by 2034.

China remains the largest producer, followed by Australia and New Zealand, which dominate the export markets. Meanwhile, demand in the Middle East, Europe, and the United States is shaping trade flows. Key challenges include climate change impacts, fluctuating feed costs, disease outbreaks, and shifting consumer preferences towards alternative proteins.

This report provides an in-depth analysis of the global sheep farming industry, including market trends, challenges, production statistics, and future outlooks.

Table of Contents

- Introduction

- Global Sheep Meat Production Overview

- Major Producing Countries

- Key Statistics & Trends

- Global Consumption Patterns

- Regional Demand Breakdown

- Consumption Preferences

- Trade & Export Market Dynamics

- Leading Exporting & Importing Countries

- Price Trends & Tariffs

- Challenges Facing the Sheep Industry

- Climate Change Impacts

- Disease Outbreaks & Biosecurity

- Economic & Trade Barriers

- Technological Innovations in Sheep Farming

- Genetic Modification & Breeding

- Blockchain for Traceability

- Sustainable Farming Techniques

- Future Outlook & Market Predictions

1. Introduction

The sheep industry plays a significant role in global agriculture, providing meat, wool, and dairy products to diverse markets. The industry is shaped by regional climates, cultural consumption habits, and economic factors influencing supply and demand.

In recent years, alternative protein sources, trade restrictions, and sustainability concerns have impacted the sector. However, demand for premium lamb and mutton products in regions like the Middle East, North America, and Europe remains strong.

This report provides a data-driven overview of global sheep production, key market players, industry challenges, and future growth potential.

2. Global Sheep Meat Production Overview

Major Producing Countries

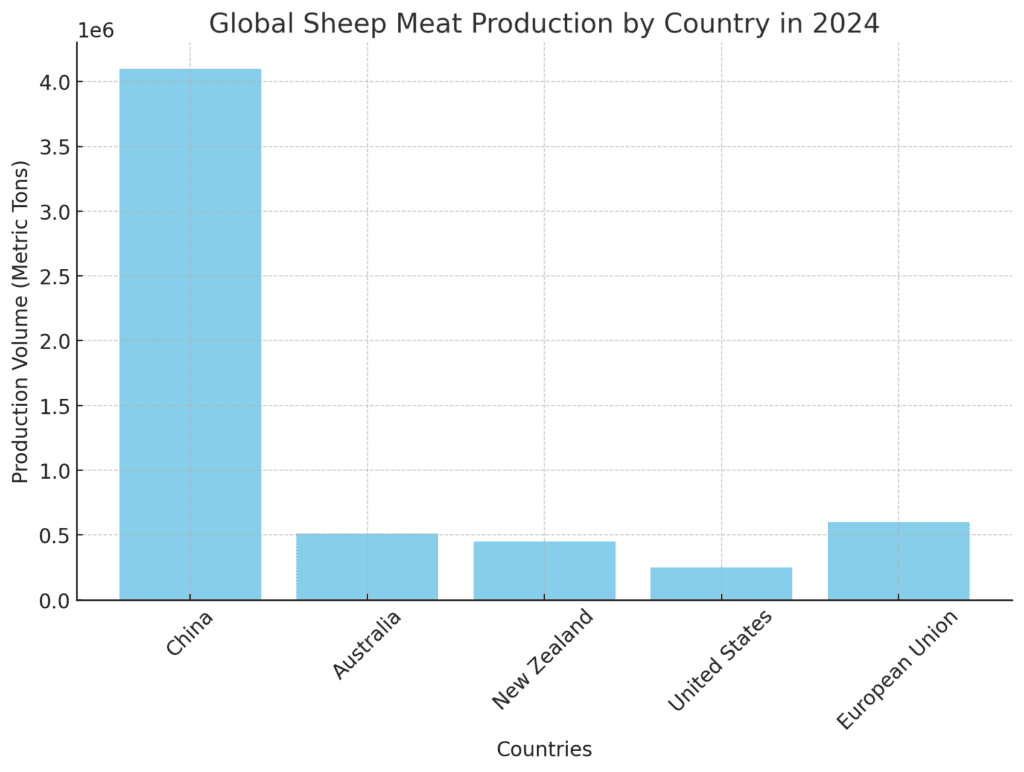

- China – World’s largest producer, with 4.1 million metric tons of sheep meat annually. Government-backed large-scale farming operations contribute to sustained growth.

- Australia – Leading exporter, producing 512,000 metric tons in 2024, with a slight projected decline of 1% in 2025 due to climate variability.

- New Zealand – Once dominant, its sheep population fell to 23.3 million in 2024, with production shifting towards premium lamb exports.

- United Kingdom – Strong domestic market but affected by Brexit-related trade disruptions.

- Sudan, Iran, Turkey, India, Pakistan, Ethiopia – Emerging players, with increasing regional demand driving local production.

Key Statistics & Trends

- Global sheep meat production in 2024: ~15 million metric tons

- Projected growth to 2034: 19 million metric tons CWE

- Top regions by production growth: China, Australia, Sudan, Iran, India

3. Global Consumption Patterns

Regional Demand Breakdown

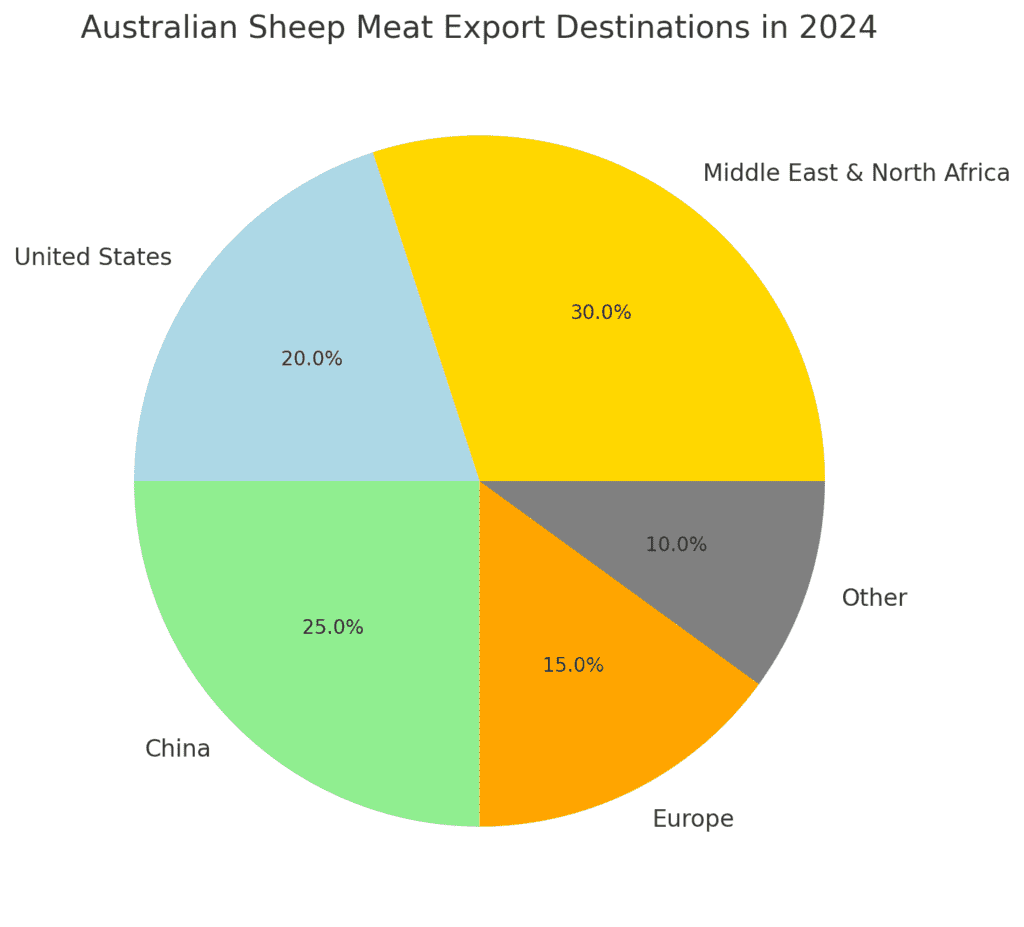

- Middle East & North Africa (MENA) – Strongest demand, with imports making up 60% of total consumption.

- European Union – Consumption declining due to high prices and changing dietary habits.

- United States – Niche market but growing demand for grass-fed and halal lamb.

- China – Growing urban consumption despite reduced import volumes.

Consumption Preferences

- High-income regions prefer: Lamb over mutton, premium grass-fed products.

- Developing markets: Strong demand for affordable mutton options.

- Fast-food sector: Increasing use of lamb in kebabs, burgers, and fusion cuisines.

4. Trade & Export Market Dynamics

Leading Exporters

- Australia – 512,000 metric tons exported in 2024

- New Zealand – Major supplier to the UK, US, and China

- United Kingdom – Largest European exporter

Leading Importers

- China – 365,000 metric tons imported in 2024

- United States – 90 million pounds imported in Q3 2024

- European Union – Increasing reliance on imports

5. Challenges Facing the Sheep Industry

Climate Change Impacts

- Drought conditions affecting pasture availability in Australia & South America.

- Extreme weather events reducing sheep fertility rates.

Disease Outbreaks & Biosecurity

- Foot-and-mouth disease threats impacting global trade.

- Stronger regulations for live sheep transport.

Economic & Trade Barriers

- Tariffs on sheep meat exports to the EU.

- Unstable commodity prices affecting producer margins.

6. Technological Innovations in Sheep Farming

Genetic Modification & Breeding

- Selective breeding for high-yield, disease-resistant sheep breeds.

- Cloning and gene editing research for productivity enhancements.

Blockchain for Traceability

- Major exporters integrating blockchain for supply chain transparency.

- Real-time tracking for meat quality and origin verification.

Sustainable Farming Techniques

- Adoption of regenerative grazing practices to combat desertification.

- Investment in carbon-neutral sheep farming initiatives.

7. Future Outlook & Market Predictions

- Market Growth: CAGR of 1.6% until 2034.

- Expanding Markets: Demand surging in India, Pakistan, Ethiopia.

- Sustainability Focus: Industry shift toward green energy.

- Tech Investments: AI-driven herd monitoring and precision farming.

Conclusion

The global sheep industry in 2025 is marked by steady growth, evolving market dynamics, and significant technological advancements. While climate change and regulatory shifts present challenges, innovative solutions in breeding, sustainability, and supply chain management will shape the industry’s future.

For investors, producers, and policymakers, understanding emerging trends and market forecasts will be essential in navigating this evolving landscape.

Sources referenced in the Global Sheep Industry Report 2025:

- Global Sheep Meat Market Growth: The global sheep meat market is projected to grow at a CAGR of 1.6% between 2025 and 2034, reaching approximately 19 million metric tons in carcass weight equivalent (CWE) by 2034. expertmarketresearch.com

- China’s Sheep Meat Production: China remains the world’s largest producer of sheep meat, with an annual production of 4.1 million metric tons. expertmarketresearch.com

- Australia’s Sheep Meat Production and Exports: In 2024, Australia produced 512,000 metric tons of sheep meat, with exports increasing by 16% year-on-year from January to October 2024. ahdb.org.uk

- New Zealand’s Sheep Population: New Zealand’s sheep population declined to 23.3 million in 2024, a significant decrease from its peak of 70 million in 1982. thetimes.co.uk

- UK Sheep Meat Production Forecast: The UK’s sheep meat production is forecasted to grow by 2% in 2025, reaching 272,000 tonnes. farmersguardian.com

- US Lamb and Mutton Imports: The United States increased its lamb and mutton import forecast for the third quarter of 2024 from 80 to 90 million pounds. ers.usda.gov

- Australian Sheep Meat Export Destinations: The Middle East and North Africa accounted for 30% of Australian sheep meat export volumes in 2024, an increase of 2% compared to 2023. ahdb.org.uk

- Global Meat Production Trends: Between 2016 and 2024, global meat production increased from 317 million metric tons to approximately 350.75 million metric tons. statista.com

- Australian Lamb Production Forecast: Lamb production in Australia is forecasted to rise to a record high of 654,000 tonnes in 2024–25. agriculture.gov.au

- Global Meat Products Market Size: The global meat products market is projected to grow from $1,804.88 billion in 2025 to around $2,710.39 billion by 2034, with a CAGR of 4.59% during this period. precedenceresearch.com