Introduction

The global prawn industry is a multi-billion-dollar sector, supporting millions of livelihoods through farming, processing, trade, and retail distribution. With rising consumer demand, technological innovations, and sustainability concerns, understanding the full value chain from production to consumption is crucial for industry stakeholders. This report delves into prawn aquaculture, harvesting, processing, logistics, market trends, and consumption patterns to provide a detailed overview of this thriving industry.

1. Global Prawn Production

1.1 Key Producing Countries

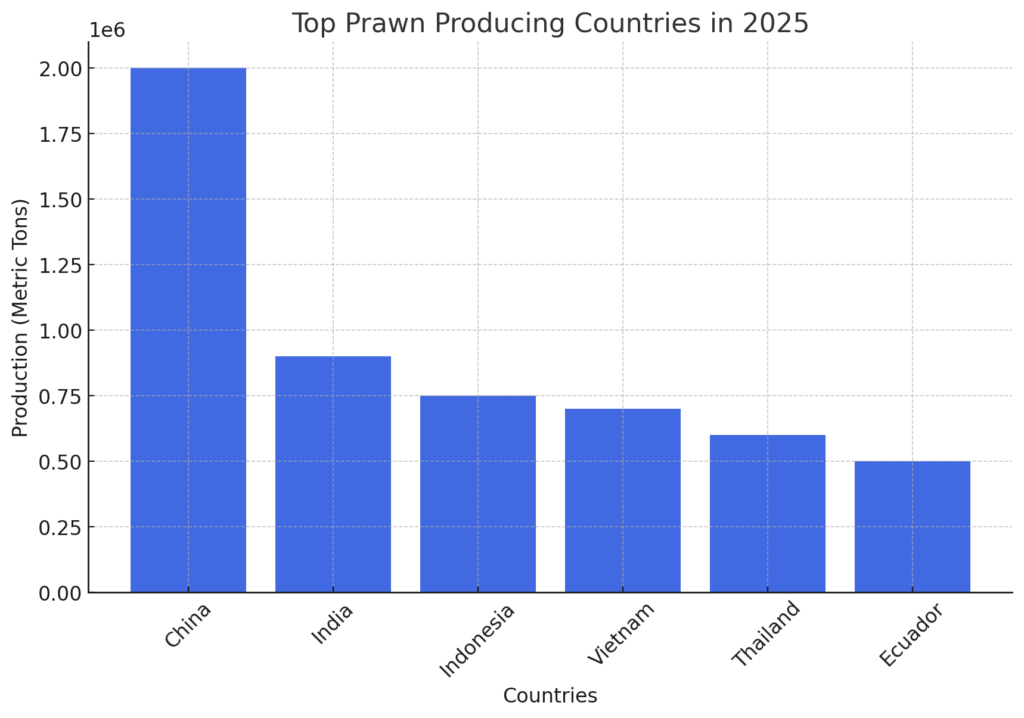

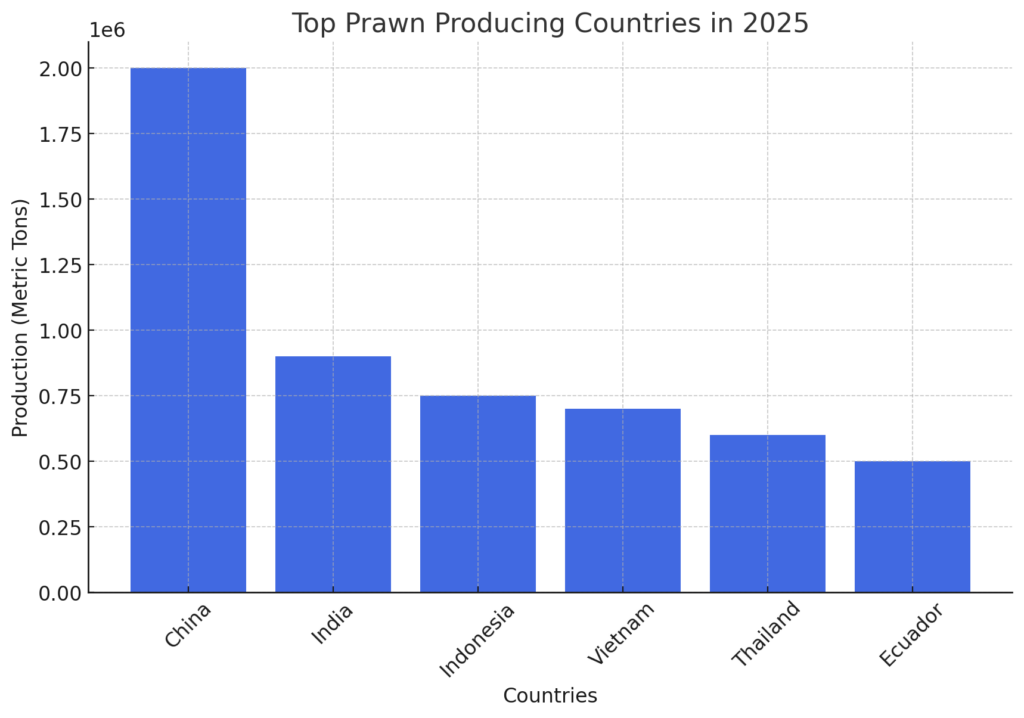

The leading prawn-producing nations contribute significantly to global seafood trade, with key players including:

- China: The largest producer, with extensive aquaculture farms in coastal provinces.

- India: A major exporter, primarily producing black tiger shrimp and vannamei prawns.

- Indonesia: Strong production driven by sustainable aquaculture initiatives.

- Vietnam: A leading supplier to the US and EU markets.

- Thailand: Known for advanced processing techniques and exports.

- Ecuador: The top producer in Latin America, exporting to Asia and the US.

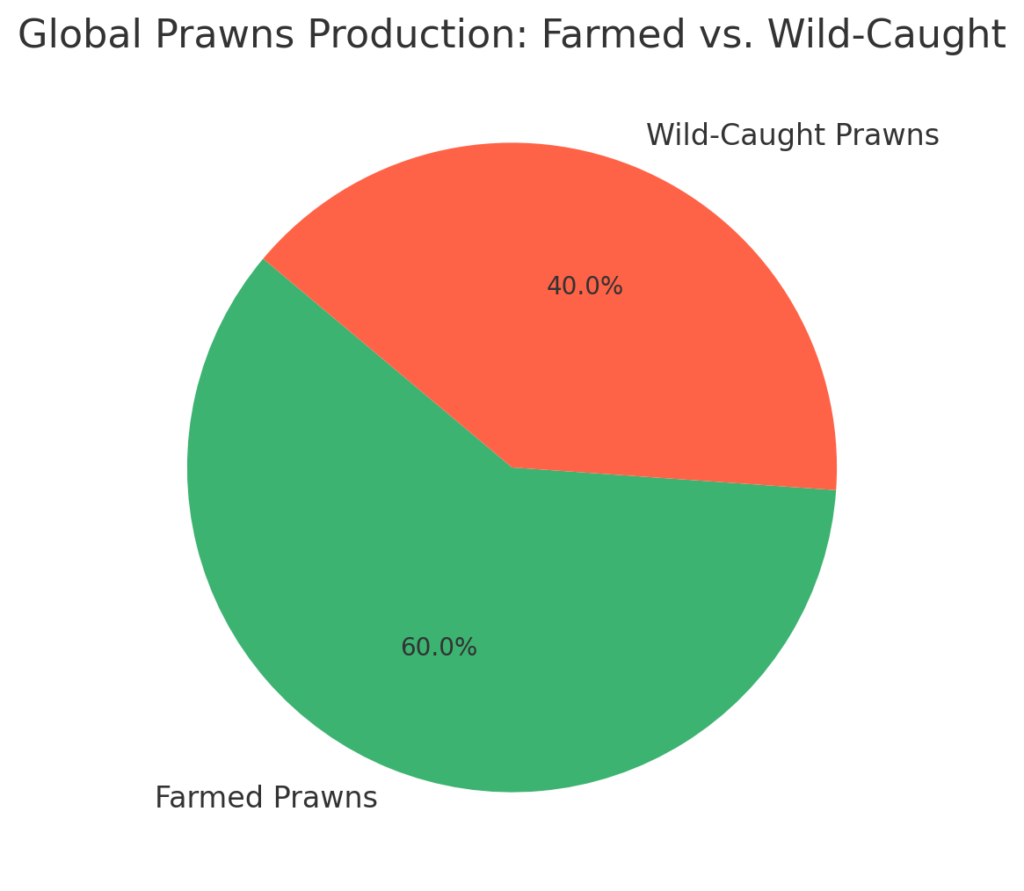

1.2 Aquaculture vs. Wild-Caught Prawns

- Aquaculture: Accounts for nearly 55-60% of global production, focusing on vannamei and black tiger shrimp.

- Wild-Caught: Represents 40-45% of supply, with harvests from South America, Southeast Asia, and the Gulf of Mexico.

1.3 Farming & Harvesting Methods

- Extensive Farming: Low-density prawn farming using natural water bodies.

- Intensive Farming: High-density, high-yield farming with controlled feed and water quality.

- Recirculating Aquaculture Systems (RAS): Advanced technology reducing environmental impact.

- Wild-Capture Fisheries: Primarily through trawling, which raises sustainability concerns.

2. Prawn Processing & Distribution

2.1 Processing & Value-Addition

Once harvested, prawns undergo multiple processing steps, including:

- Deheading & Deveining

- Freezing (IQF, Block Freezing, Blast Freezing)

- Cooking & Breaded Processing

- Marination & Ready-to-Eat Product Preparation

- Packaging & Labeling (ASC, MSC, Organic Certifications)

2.2 Supply Chain & Logistics

- Cold Chain Management: Essential for maintaining prawn quality during transport.

- Key Export Hubs: India, Ecuador, Vietnam, and Indonesia account for major global exports.

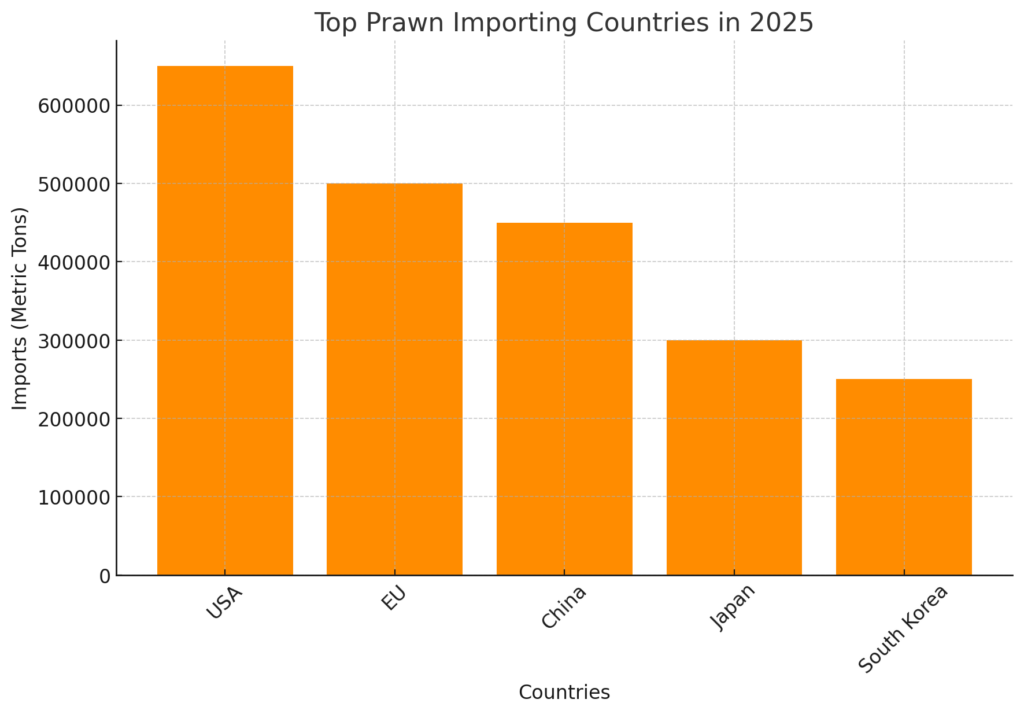

- Major Importing Countries: US, EU, China, Japan, and South Korea.

- Trade Challenges: Tariffs, phytosanitary standards, and sustainability regulations.

2.3 Blockchain & Traceability

- Blockchain Technology: Ensures product authenticity, tracing from farm to fork.

- IoT & AI in Logistics: Optimizing route planning and cold chain tracking.

3. Global Market & Consumption Trends

3.1 Demand Trends

- Rising Health Consciousness: Consumers prefer protein-rich, low-fat seafood options.

- Growth in Ready-to-Eat Prawns: Driven by convenience food trends.

- Sustainability Concerns: Growing demand for eco-certified seafood.

- Premiumization of Seafood: High-end markets for organic and wild-caught prawns.

3.2 Consumption by Region

- United States: One of the largest importers, consuming over 600,000 MT annually.

- European Union: Driven by Spain, France, and Italy.

- China: A major producer and consumer, showing growing demand for high-quality imports.

- Japan & South Korea: Preference for premium prawns and sustainable sourcing.

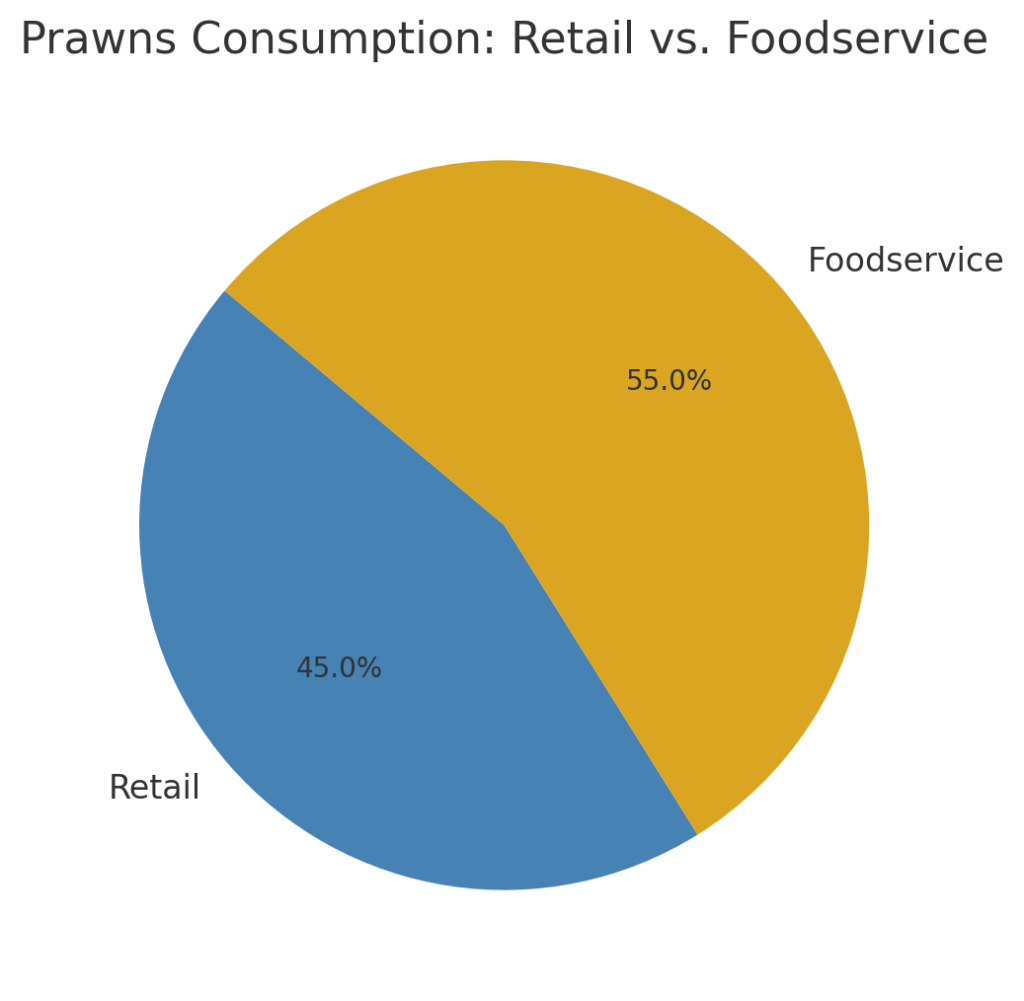

3.3 Retail vs. Foodservice Consumption

- Retail: Supermarkets, online grocery platforms, and direct-to-consumer seafood brands.

- Foodservice: Restaurants, sushi bars, QSRs, and fine dining seafood chains.

4. Challenges in the Global Prawn Industry

4.1 Sustainability & Environmental Concerns

- Deforestation of Mangroves: A major issue in some producing regions.

- Carbon Footprint: High emissions from cold storage and transportation.

- Overfishing & Bycatch Issues: Concerns over depletion of wild prawn populations.

4.2 Disease Management

- White Spot Syndrome Virus (WSSV)

- Early Mortality Syndrome (EMS)

- Necrotizing Hepatopancreatitis

4.3 Trade Barriers & Tariffs

- US-China Tariffs impacting global supply chains.

- EU Regulations on Antibiotic Use restricting certain suppliers.

- Sustainability Certifications (MSC, ASC) influencing buyer preferences.

5. Future Outlook & Opportunities

5.1 Growth in Alternative Prawns Production

- Lab-Grown Prawns & Cultivated Seafood: Potential disruptors in the market.

- Plant-Based Prawn Alternatives: Vegan-friendly prawn substitutes gaining traction.

5.2 Digitalization & E-Commerce

- Direct-to-Consumer (D2C) Seafood Delivery Models

- AI-Based Forecasting for Demand & Supply Management

5.3 Investment & Market Growth Forecasts

- Global Prawns Market Expected to Grow at a CAGR of 5.2% from 2025-2030.

- Ecuador & India Poised for Higher Market Share with sustainable practices.

- Automation & AI to Drive Operational Efficiency in farms and processing plants.

Conclusion

The global prawn industry continues to evolve, shaped by technological advancements, sustainability initiatives, and shifting consumer preferences. While challenges such as disease management, environmental concerns, and trade restrictions persist, opportunities in alternative proteins, digital traceability, and premium seafood markets present a strong growth potential for stakeholders across the value chain.

The future of the prawn industry will be defined by innovation, regulatory adaptation, and responsible farming practices, ensuring long-term sustainability and profitability for businesses worldwide.