“`html

The Day Ahead

Weather Concerns – The absence of snow cover across Russia has raised alarms in the agricultural sector. Although there is a minimal correlation between January weather conditions and final crop yields, the market remains sensitive to this situation due to current stock levels. An ideal spring season could still yield historically significant crop volumes; however, weather-related events will increasingly influence market trading. In Argentina, forecast models predict rainfall between 40-70mm over the next two weeks, albeit accompanied by record high temperatures.

Market Dynamics – The volatility in wheat prices was driven down on Wednesday by increased selling from growers, while the previous night saw significant fund buying activity. It seems that the speculative short positions had to be transferred from speculators back to farmers, particularly in light of crop conditions in the Northern Hemisphere.

Australian Market Outlook – In my assessment, speculative buying holds more weight than grower selling at this juncture. We have been closely monitoring the fundamentals, which have thus far been largely overlooked. If speculative investors seize upon this narrative, the futures markets may not reflect sufficient risk premiums. However, the lack of activity from Australian exporters will ultimately dictate local pricing trends. Today may see a push from continued interest in delivered feed grain within the domestic market.

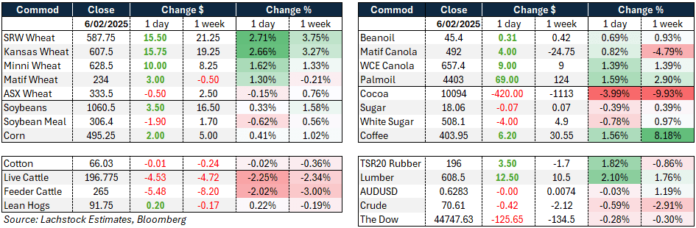

Offshore Markets

Australian-dollar-denominated wheat price, forward curves (left) and the December 2025 contract price comparisons Chicago and Matif (right). Source: Bloomberg data via Lachstock. Click to expand.

Last night’s market activity was characterized by significant fund buying, leading Chicago wheat to surpass Wednesday’s high and settle just below the 200-day moving average for the December 2025 contract. Speculators may be feeling apprehensive about potential trade developments between the U.S. and China, which seems a more plausible concern than the previously largely ignored Russian weather conditions. Technical indicators are becoming increasingly relevant; if a close above the 200-day moving average is achieved, it could spur additional buying activity. Conversely, failing to close above this level could diminish incentives for traders to maintain their positions. The USDA is set to release its WASDE report on February 11, marking the next critical data point. While estimates of South American row crops dominate the current landscape, attention will also be directed toward export predictions for various wheat classes.

Major U.S. agricultural corporations have uniformly downgraded their forecasts, citing uncertainties related to the administration of President Trump. While their profitability is closely linked to commodity values, the additional ambiguity surrounding biofuel policies contributes to a bearish outlook. This creates a peculiar dynamic, as many of the most politically conservative regions are agricultural hubs. A significant alteration to the Renewable Fuel Standard could adversely affect corn and soybean markets.

Wheat Weather Overview:

- North America: Wheat remains dormant in generally favorable conditions across the Central and Southern Plains, with limited precipitation but continued warmth. Recent rains have benefited dormant Soft Red Winter (SRW) wheat in the Delta and Midwest.

- Eastern Black Sea: Winter wheat is dormant but in poor condition.

- Europe: Scattered rainfall in Spain and Italy supports vegetative wheat, while excessive rain affects Northwestern Europe. Southeastern Europe remains dry and requires more precipitation.

- North Africa: Recent showers have improved wheat development and gradually enhanced conditions.

- China: Winter wheat is dormant and generally in favorable condition.

Japan procured 97,000 tons of wheat from the U.S. and Canada, while South Korea acquired 30,000 tons of milling wheat from the same suppliers. Notably, a recent review of U.S. foreign aid spending has halted grain purchases for food aid programs, impacting overall market dynamics.

Australia’s Agricultural Landscape

In Western Australia, canola prices are solidly bid around $870, with new crop estimates slightly higher at $805. Wheat is currently bid at approximately $375, with new crop bids reaching $390, while barley stands at $340 for the current season. In Eastern Australia, canola is priced around $765, with cereals remaining unchanged: wheat at $343 and barley at $315. The final shipments of chickpeas are expected to depart within the next month, with prompt delivery bids holding firm at around $905 delivered to Brisbane.

Rainfall projections for Eastern New South Wales and Victoria over the coming week indicate totals between 15-50mm across larger areas, with heavier falls potentially boosting growers’ confidence for the 2025/26 season, prompting some equipment to be readied for use.

“`