In the agricultural commodities market, various factors are at play that can impact prices and trading activities. Let’s delve into the latest developments and trends shaping the industry.

The day ahead:

Weather: With temperatures soaring to 35°C in Adelaide, the weather is making headlines, providing a brief respite from the usual conversations dominating the market.

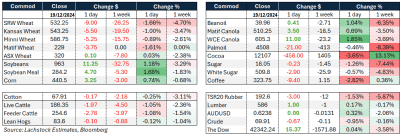

Markets: The wheat market is experiencing turbulence as Chicago wheat struggles amidst a strong USD. Despite robust wheat export sales, the market’s perplexing behavior as the year draws to a close is keeping traders on their toes.

Australian day ahead: The Australian market is witnessing a lack of movement in the AUD, maintaining the status quo. While domestic wheat prices are aligning with US futures, the underlying reasons differ. Export parity calculations are compelling, but the market sentiment seems indifferent to potential supply constraints.

Offshore developments:

South Africa and France: South Africa has revised its wheat crop estimate slightly lower, while France’s soft wheat ending stocks for the 2024/25 season have been adjusted upwards. These changes reflect the global dynamics influencing agricultural markets.

Tariffs on US imports: Proposed tariffs on US imports could have significant implications for the American agricultural sector. From farm incomes to trade agreements and market challenges, the interconnected nature of global trade underscores the potential risks and disruptions.

Wheat sales: Recent wheat sales data shows a notable increase in net sales, driven by key destinations like the Philippines, Venezuela, and Japan. Despite challenges, exports have shown resilience, highlighting the market’s adaptability in navigating uncertainties.

Australia’s market outlook:

Canola and cereals: Canola and cereals prices in Western Australia remained stable, with slight fluctuations in bid prices. In eastern Australia, prices witnessed a decline, despite the support from a weaker Aussie dollar, indicating market volatility and shifting dynamics.

Pulse bids: Pulse bids benefited from the lower dollar, with faba bean bids gaining momentum. The pulse market shows resilience amidst changing currency values and market conditions.

Market insights:

GM canola: The GM canola market in Melbourne is witnessing strong support from the container market, with bids commanding a premium to port prices. This trend underscores the demand dynamics and logistical considerations shaping commodity prices.

As the agricultural commodities market continues to evolve, staying informed about these developments and trends is crucial for industry participants. By monitoring market dynamics, policy changes, and global trade patterns, stakeholders can navigate the complexities of the market landscape and make informed decisions to optimize their trading strategies and operations.