In today’s market, there are several key factors influencing the agricultural commodity trade. Let’s take a closer look at the current trends and developments in the global and Australian markets.

Weather conditions play a crucial role in determining the pace of harvest activities. Clear skies across Australia are facilitating the progress of the Australian harvest, with only a small amount left to complete post-Christmas. This is a significant improvement from last year, where weather disruptions caused delays in harvesting. Globally, weather patterns are relatively stable, with no major disruptions expected to impact the market.

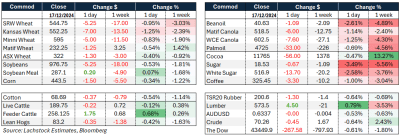

In terms of market movements, it was a down day for most agricultural commodities, with the exception of Feeder Cattle and Soybean Meal. The Australian dollar also lost ground, which is expected to provide some support to flat prices. Given the offshore market movements, the local market is likely to adopt a defensive stance. Traders are advised to monitor delivered markets closely, as short trades may emerge in response to the market conditions.

Turning our focus to the offshore market, recent developments in the Black Sea region have raised concerns about the Russian wheat crop. Sovecon, a market analyst, has revised its forecast for the 2025 Russian wheat crop downwards, citing poor crop conditions as the worst in decades. This has not been adequately priced into the market, indicating potential price volatility in the near future.

In Europe, Matif wheat has attracted the attention of traders, with concerns about Russian quotas and poor crop conditions driving market speculation. Speculators holding historically high short positions have recently shown signs of increased activity, with market movements reflecting a shift in sentiment. Additionally, Soybeans hit an 8-week low due to favorable weather conditions in South America, raising concerns about market reliance on Chinese demand.

In China, the DCE corn market experienced a downward trend, nearing previous lows set earlier in the month. Meanwhile, in the US, tight balance sheet conditions have led to a gradual increase in CME corn prices, with the March contract approaching the 200-day moving average. Of particular interest is the ongoing decline in the wheat versus corn spread, signaling potential changes in feeding dynamics in the wheat market.

In Australia, canola bids in Western Australia have seen a slight decline, with cereals also experiencing a downward trend. Similar trends were observed in eastern Australia, with canola bids lower and wheat prices steady. Faba bean bids have stabilized at a lower level, reflecting subdued export demand and increased arrivals in key markets. Delivered Darling Downs markets witnessed a slight decrease in barley bids, while wheat prices remained steady.

Overall, the agricultural commodity market is influenced by a combination of global and local factors, including weather conditions, market movements, and crop forecasts. Traders are advised to stay informed about these developments and adjust their strategies accordingly to navigate the dynamic market landscape effectively.