The escalating trade tensions between the United States and China have led to significant shifts in global agricultural trade dynamics. With the U.S. imposing steep tariffs on Chinese goods and China retaliating in kind, traditional trade flows are being disrupted, prompting China to seek alternative markets for its agricultural exports.

Key Agricultural Products Affected

1. Soybeans

Soybeans have long been a cornerstone of U.S.-China agricultural trade. However, recent tariffs have dramatically altered this landscape. China, the world’s largest soybean importer, has significantly reduced its reliance on U.S. soybeans, turning instead to Brazil. In 2024, Brazil accounted for over 70% of China’s soybean imports, a figure that has only increased with the ongoing trade tensions. Mexico Business News+2Reuters+2Atlantic Council+2

2. Pork

China’s demand for pork is immense, but U.S. pork exports have taken a hit due to tariffs. In 2024, China imported $4.6 billion worth of pork, with most of it sourced from non-U.S. markets. The European Union, particularly Spain, has stepped in to fill the gap, with China expanding access for Spanish pork amidst the trade tensions. Pork Business+1Reuters+1Reuters

3. Used Cooking Oil (UCO)

China’s exports of used cooking oil, previously valued at $1.1 billion annually, have been redirected from the U.S. to Europe and emerging Asian markets due to steep U.S. tariffs. Europe is expected to absorb over half of China’s UCO exports, driven by new mandates for sustainable aviation fuel. Reuters+1Reuters+1

Top 10 Agricultural Exports from China to the U.S.

- Processed Fruits & Vegetables

- Includes garlic, mushrooms, water chestnuts, bamboo shoots, etc.

- Used heavily in foodservice and packaged goods.

- Tea

- Particularly green tea and specialty varieties.

- China is one of the top global suppliers to the U.S.

- Spices and Seasonings

- Notably ginger, garlic, and star anise.

- China dominates in dehydrated garlic exports.

- Fish and Seafood (Aquaculture Products)

- Includes tilapia, shrimp, and other frozen varieties.

- Often processed or semi-processed.

- Fruit Juices and Concentrates

- Apple juice concentrate is a major item.

- China has historically been the top supplier to the U.S.

- Honey

- China is one of the largest exporters, though often subject to trade scrutiny.

- Includes both raw and processed honey.

- Pet Food Ingredients

- Dried meat products and flavorings for pet food formulations.

- Often exported in bulk for repackaging.

- Tree Nuts (e.g., Chestnuts)

- Seasonal exports, especially for ethnic markets in the U.S.

- Roasted and packaged products dominate.

- Herbal Medicines and Supplements

- Ginseng, goji berries, licorice root, and other botanicals.

- Growing demand through the wellness and supplement industry.

- Used Cooking Oil (UCO) for Biofuel

- Shipped for conversion into biodiesel or sustainable aviation fuel.

- Declining recently due to new U.S. tariffs.

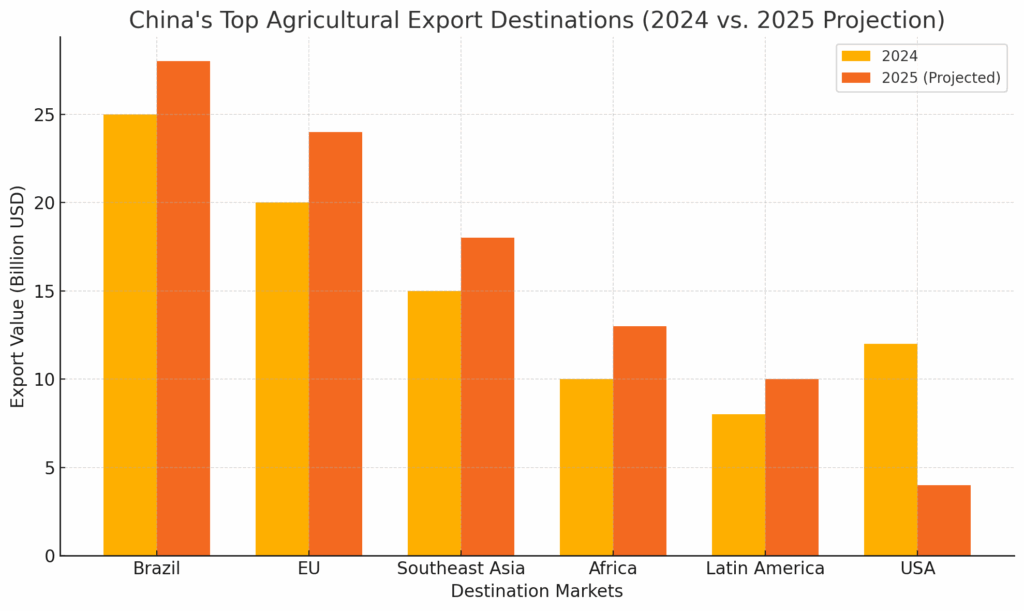

Emerging Markets for Chinese Agricultural Exports

With the U.S. market becoming less accessible, China is actively seeking alternative destinations for its agricultural products:

- Europe: The European Union has become a significant importer of Chinese UCO, and trade agreements have expanded access for products like Spanish pork. Reuters

- Southeast Asia: Countries such as Thailand, Malaysia, and Vietnam are emerging as key markets for Chinese agricultural exports, including UCO and other commodities. Reuters+1Reuters+1

- Latin America and Africa: China is strengthening trade ties with nations in these regions, seeking to diversify its export markets and reduce reliance on any single country.

1. Processed Fruits & Vegetables

Top Destinations:

- Japan

- South Korea

- Germany

- United Kingdom

- Netherlands

- Australia

- Canada

- Russia

- Vietnam

- Malaysia

2. Tea (Especially Green Tea)

Top Destinations:

- Morocco

- Uzbekistan

- Japan

- Russia

- Iran

- Pakistan

- Kazakhstan

- Indonesia

- Egypt

- Germany

3. Spices and Seasonings (Garlic, Ginger, Star Anise)

Top Destinations:

- Indonesia

- Vietnam

- Malaysia

- Thailand

- Philippines

- India

- UAE

- Brazil

- South Africa

- Egypt

4. Fish and Seafood (Tilapia, Shrimp, etc.)

Top Destinations:

- Japan

- South Korea

- Mexico

- Philippines

- Vietnam

- Malaysia

- Egypt

- Thailand

- Brazil

- Russia

5. Fruit Juices and Concentrates (Especially Apple Juice)

Top Destinations:

- Russia

- Japan

- Germany

- Netherlands

- Mexico

- UAE

- South Korea

- Brazil

- Philippines

- Indonesia

6. Honey

Top Destinations:

- Japan

- Germany

- United Kingdom

- UAE

- Saudi Arabia

- Australia

- Belgium

- France

- Spain

- South Korea

7. Pet Food Ingredients

Top Destinations:

- Japan

- South Korea

- Thailand

- Vietnam

- Mexico

- Russia

- Germany

- Netherlands

- UK

- Canada

8. Tree Nuts (Chestnuts, etc.)

Top Destinations:

- Japan

- Italy

- South Korea

- Germany

- Vietnam

- Taiwan

- Spain

- Turkey

- Malaysia

- France

9. Herbal Medicines and Supplements

Top Destinations:

- Japan

- South Korea

- Indonesia

- Thailand

- India

- Russia

- Germany

- UK

- UAE

- Vietnam

10. Used Cooking Oil (UCO)

Top Destinations:

- Netherlands

- Belgium

- Spain

- Italy

- Germany

- France

- UK

- South Korea

- Singapore

- Thailand

Future Outlook

The current trade dynamics suggest a continued shift in China’s agricultural export strategy:

- Diversification: China will likely continue to diversify its export markets, reducing dependency on the U.S. and mitigating risks associated with bilateral trade tensions.

- Domestic Consumption: With rising domestic demand, particularly in sectors like sustainable aviation fuel, China may allocate more agricultural products for internal use, potentially reducing export volumes. Reuters+1Reuters+1

- Trade Agreements: China is expected to pursue new trade agreements and strengthen existing ones to secure stable markets for its agricultural exports.

In conclusion, the trade rift between the U.S. and China has catalyzed a significant realignment in global agricultural trade. China’s proactive approach in seeking alternative markets and bolstering domestic consumption indicates a strategic pivot that may redefine international trade relationships in the agricultural sector for years to come.

Sources include:

Brazil takes the lead in soybean exports to China, leaving U.S. farmers behind

https://www.washingtonpost.com/world/2025/05/06/brazil-soy-exports-china-american-farmers/

China expands access for Spanish pork as trade tensions with U.S. mount

https://www.reuters.com/markets/commodities/china-expands-access-spanish-pork-trade-tensions-with-us-mount-2025-04-11/

China pivots to Europe for used cooking oil exports as tariffs hit U.S. shipments

https://www.reuters.com/sustainability/climate-energy/china-pivots-europe-used-cooking-oil-exports-tariffs-hit-shipments-us-2025-04-30/

China Briefing: Trump Raises Tariffs on China to 125%: Overview and Trade Implications

https://www.china-briefing.com/news/trump-raises-tariffs-on-china-to-125-overview-and-trade-implications/

Panic Slowly: China’s Cancellation of 12,000 Tons of U.S. Pork Sends Loud Message

https://www.porkbusiness.com/ag-policy/panic-slowly-chinas-cancellation-12-000-tons-u-s-pork-sends-loud-message

Chinese exports surge ahead of US reciprocal tariffs

https://www.eiu.com/n/chinese-exports-surge-ahead-of-us-reciprocal-tariffs/