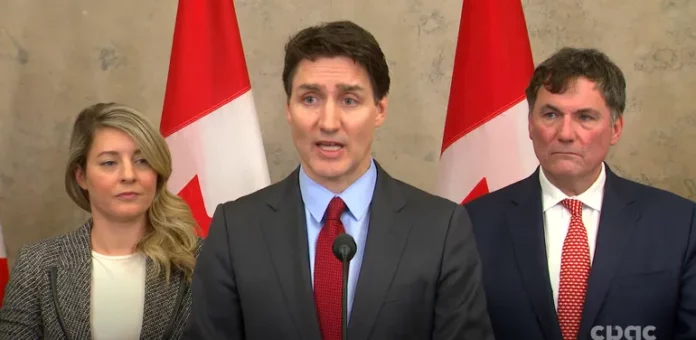

Canada has responded to U.S. tariffs with its own set of duties on imports from the country, in a move announced by Prime Minister Justin Trudeau. The country will institute a 25% tax on $155 billion worth of U.S. imports, as a direct response to 25% tariffs on Canadian goods put in place by U.S. President Donald Trump. The tariffs will be implemented in two phases, with the first tranche targeting $30 billion worth of goods and entering into force on Feb. 4. The second tranche will target $125 billion worth of goods and will undergo a 21-day comment period.

The first set of countermeasures is aimed at protecting and supporting Canada’s interests, workers, and industries, according to Dominic LeBlanc, the minister of finance and intergovernmental affairs. The targeted goods include items such as orange juice, peanut butter, wine, spirits, beer, coffee, appliances, apparel, footwear, motorcycles, cosmetics, and pulp and paper. The second tranche will include products like passenger vehicles, trucks, steel and aluminum products, fruits and vegetables, aerospace products, beef, pork, dairy, trucks and buses, recreational vehicles, and recreational boats.

Trudeau emphasized that Canada did not seek this situation but will not back down in standing up for Canadians and the relationship between Canada and the United States. He expressed hope for working with the American administration on various challenging issues facing the two countries and the world. In response to Trump’s executive order citing fentanyl and illegal immigration as reasons for the tariffs, Canadian officials highlighted their efforts in addressing these issues through a $1.3 billion border plan.

Both sides have issued warnings regarding potential escalations in tariffs. Trump warned of further escalation or broadening of tariffs if Canada retaliates, while Canadian officials stated that all options remain on the table for additional measures, including non-tariff options, if the U.S. continues to apply unjustified tariffs on Canada.

The ongoing trade dispute between Canada and the U.S. underscores the complexities and challenges in international trade relations. The imposition of tariffs and countermeasures can have significant economic implications for both countries, affecting industries, workers, and consumers. It is essential for both parties to engage in constructive dialogue and negotiation to address their trade differences and find mutually beneficial solutions.

As the situation continues to evolve, it is crucial for businesses and stakeholders to monitor developments and adapt their strategies accordingly. Understanding the potential impact of tariffs and trade disputes on supply chains, pricing, and market dynamics is essential for effective decision-making and risk management. Collaboration and communication between governments, businesses, and industry associations are key to navigating the complexities of international trade and promoting sustainable economic growth.