Cal-Maine Foods, a major player in the US egg industry, recently announced its plans to acquire Echo Lake Foods, a breakfast foods manufacturer, for approximately $258 million. The deal, which is expected to be completed by the end of fiscal 2025, represents a significant growth opportunity for Cal-Maine as it aims to expand and diversify its product portfolio and customer base.

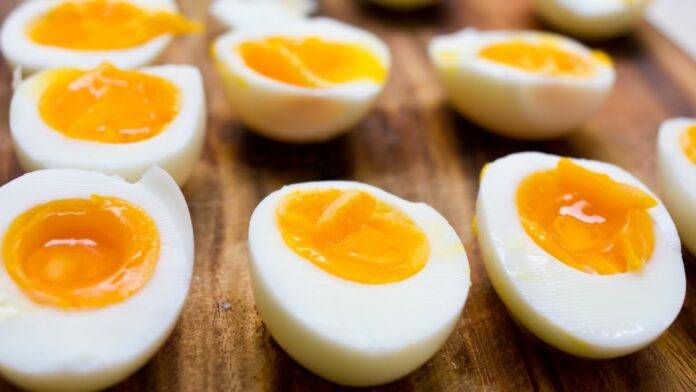

Established in 1941 and later acquired by the Meinerz family in 1981, Echo Lake Foods specializes in producing, packaging, and distributing a variety of ready-to-eat egg products and breakfast items such as waffles, pancakes, diced eggs, and frozen cooked omelettes. With a reported revenue of $240 million in 2024 and a five-year compound annual growth rate of around 10%, Echo Lake Foods has been a key player in the breakfast foods market.

Sherman Miller, the President and CEO of Cal-Maine Foods, expressed enthusiasm about the acquisition, stating that it represents an important milestone for the company in terms of growth and expansion. He emphasized the complementary nature of the two companies’ product lines and capabilities, as well as their shared values of operational excellence and customer satisfaction. Miller also highlighted the strategic benefits of the acquisition, including geographic market expansion, operational synergies, and expected financial returns.

Upon completion of the acquisition, Echo Lake Foods will operate as a stand-alone component of Cal-Maine Foods, utilizing its four production facilities strategically located across the Midwest. Kathy Brodhagen, the CEO of Echo Lake Foods, will join Cal-Maine’s senior leadership team as the President of Echo Lake Foods, ensuring a smooth transition and integration of the two companies.

Cal-Maine anticipates several advantages from the acquisition, including entry into the value-added food segment of the egg category, growth opportunities with retail and foodservice customers, and operational synergies in egg procurement and efficiency. The company also plans to leverage its existing sales and distribution infrastructure to support Echo Lake’s operations and maximize synergies.

This acquisition comes on the heels of Cal-Maine’s purchase of assets from local peer ISE America last year and is part of the company’s strategic growth initiatives. The announcement was made in conjunction with Cal-Maine’s third-quarter fiscal 2025 results, which showed significant increases in net sales, operating income, and gross profit compared to the previous year.

In addition, Cal-Maine recently reached an agreement with its founding family to potentially convert their super-voting Class A shares into common stock, leading to a new governance structure and potential diversification of the family’s financial holdings. This agreement reflects the company’s commitment to sustainable growth and long-term success.

Overall, the acquisition of Echo Lake Foods marks a significant milestone for Cal-Maine Foods, positioning the company for continued growth and expansion in the competitive egg and breakfast foods market. With a focus on innovation, operational excellence, and customer satisfaction, Cal-Maine is poised to capitalize on new opportunities and drive long-term value for its stakeholders.