Discover the challenges faced by a major meatpacker as it grapples with soaring costs and declining sales in the pork industry. Dive into the complexities of this narrative and its impact on both consumers and farmers.

A major meatpacking company is grappling with the challenge of high expenses and sluggish pork sales.

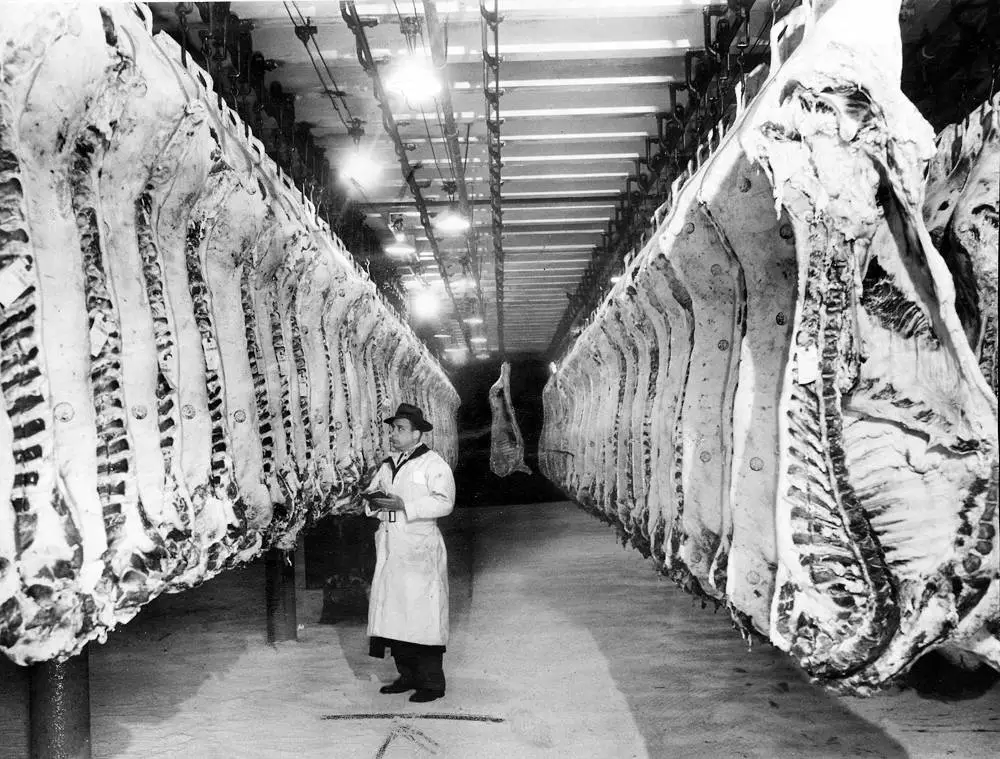

In the realm of meatpacking, a colossal struggle unfolds as one major player grapples with soaring costs and dwindling sales of pork. It’s a narrative that strikes a chord, not only with consumers feeling the pinch but also with the small-scale farmers that often operate behind the scenes of these corporate giants.

Consider, for a moment, WH Group, the Hong Kong-based proprietor of Smithfield Foods, a heavyweight in the American pork industry, and WH itself, the unrivaled global titan in the meat processing sector, boasting control over every facet of the meat production process, from hog farming to processing, packaging, and distribution. In the annals of 2022, Smithfield raked in an impressive $126 million in sales. But fast forward to the third fiscal quarter of 2023, and the company’s tune has undergone a somber transformation. Profits have plummeted noticeably, with no immediate signs of a comeback.

The numbers tell a stark story: Smithfield incurred an operating loss of a staggering $431 million from Q1 to Q3. This dramatic plunge has cast a long shadow over WH Group, with an overall profit decline of 36% compared to the previous year. Paradoxically, WH’s markets in Asia and Europe seem to be weathering the storm, with sales either holding steady or even showing improvement. According to the National Pork Producers Council’s report, the costs and breakeven points have surged by 9% in the past year alone, marking a jaw-dropping 60% increase over a span of three years. Despite farmers grappling with relentless production costs, the value of pork in Q3 of 2023 has dipped by 20% compared to the same period in 2022. In a recent earnings announcement, the WH Group’s board of directors offered a cautious glimmer of hope: “We will strive for the best results amid the highly uncertain external environment.”

This narrative of financial turbulence extends its reach to affect not just corporate bottom lines but also the livelihoods of farmers and the wallets of consumers alike. Pork belly prices have witnessed a meteoric rise, soaring by an astounding 106% year-to-date in 2023, leaving many inflation-weary shoppers bewildered. Yet, the truth is that farmers are grappling with inflation just as heavily as their grocery-store counterparts. Inputs such as corn feed (up 79%), gasoline (up 48%), and refrigerated trucking (up 50%) have witnessed exponential price hikes from January 2020 to April 2022. Furthermore, a wave of diseases has taken a toll on hogs in major production states, reducing their weight and consequently diminishing the amount of usable meat per animal.

Adding to the complexity of this narrative is California Proposition 12, a formidable regulatory challenge confronting Smithfield and other producers. The mandate stipulates the need for 24 square-foot stables to house pig livestock, a requirement fiercely contested by many farmers as excessively large. Simultaneously, consumer demand for meat and pork appears to be on a downward trajectory, possibly influenced by concerns over price or the growing popularity of plant-based protein alternatives, which have flourished and diversified in recent years.

To counterbalance the setback, WH Group has embarked on a journey of cost reduction, marked by a reduction in its operational scale. This strategy involves the closure of a processing plant in North Carolina, the shuttering of 35 farms in Missouri, and efforts to transform Smithfield Foods into a publicly-traded entity, with potential shares to be traded on the U.S. stock exchange. Yet, it’s essential to acknowledge that these strategic decisions carry tangible repercussions for farmers, as underscored by the unfortunate layoffs of 92 salaried and hourly employees resulting from the mass closures in Missouri.