Introduction

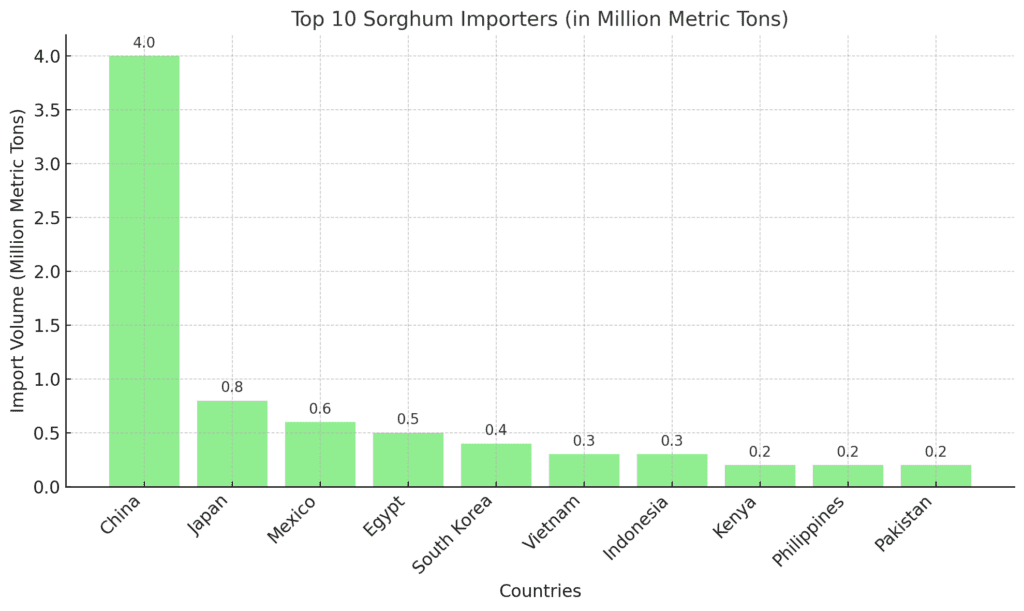

Sorghum, a versatile grain used for food, animal feed, and biofuels, is not only produced in vast quantities but is also heavily traded across international borders. While many countries produce sorghum, others rely on imports to meet domestic demand. The global sorghum import market has been growing due to increasing demand for animal feed, biofuels, and food products. This report examines the world’s top 10 sorghum importers, providing insights into their role in the global sorghum trade.

1. China – The Largest Sorghum Importer

Import Volume: Approximately 4 million metric tons

China is by far the largest importer of sorghum, accounting for over 40% of global sorghum imports. The country imports sorghum primarily for animal feed, as the demand for meat in China has skyrocketed in recent years. Sorghum is a key ingredient in livestock farming, particularly for pigs and poultry. The U.S. has historically been China’s primary source of sorghum imports, although this relationship has fluctuated due to trade tensions and policy changes.

Global Market Share: 40% of global sorghum imports.

China’s massive import demand plays a critical role in driving the global sorghum trade, particularly as it seeks to secure reliable feed sources for its rapidly expanding livestock industry.

2. Japan – A Major Animal Feed Market

Import Volume: Approximately 0.8 million metric tons

Japan is the second-largest importer of sorghum, with the majority of its imports used in animal feed production. As one of the world’s largest consumers of meat, Japan has a steady demand for sorghum to feed its livestock. The country also uses sorghum in food products, particularly in gluten-free diets, although this use is relatively small compared to its feed consumption.

Global Market Share: 8% of global sorghum imports.

Japan’s stable and sophisticated livestock industry ensures a consistent demand for sorghum, making it a significant player in the global sorghum import market.

3. Mexico – A Neighbor with Growing Demand

Import Volume: Approximately 0.6 million metric tons

Mexico is a key importer of sorghum, particularly from the United States. Sorghum is mainly used in Mexico for animal feed, though it is also used for food products like tortillas and porridge. As livestock production in Mexico grows, so does the demand for sorghum, which is used to feed poultry, cattle, and pigs. Additionally, Mexico’s proximity to the U.S. allows for efficient and cost-effective imports.

Global Market Share: 6% of global sorghum imports.

Mexico’s growing agricultural sector and close trade ties with the U.S. make it one of the top sorghum importers in the world.

4. Egypt – Expanding Livestock and Feed Demand

Import Volume: Approximately 0.5 million metric tons

Egypt is an important importer of sorghum, used primarily for animal feed. The country’s growing livestock sector, especially poultry production, is driving demand for sorghum as a cost-effective feed option. Egypt also imports sorghum to mitigate feed shortages caused by domestic grain production challenges.

Global Market Share: 5% of global sorghum imports.

As Egypt’s demand for sorghum increases, particularly from countries like the United States, it plays a key role in the Middle Eastern sorghum market.

5. South Korea – An Increasing Feed Market

Import Volume: Approximately 0.4 million metric tons

South Korea is a significant importer of sorghum, with most of its imports used in animal feed, particularly for poultry and pigs. As the country expands its meat production to meet the demands of its growing population, sorghum has become an increasingly important part of the livestock feed supply. South Korea imports a majority of its sorghum from the United States, which has reliable and affordable supplies.

Global Market Share: 4% of global sorghum imports.

With a large and expanding meat industry, South Korea’s sorghum import demand is expected to rise in the coming years.

6. Vietnam – Growing Sorghum Demand for Livestock

Import Volume: Approximately 0.3 million metric tons

Vietnam’s sorghum imports are steadily increasing, driven by its growing demand for animal feed, particularly for poultry. As Vietnam’s livestock sector continues to grow, so does its need for sorghum to provide an affordable and efficient feed source. The country imports sorghum primarily from the United States, Argentina, and other major producers.

Global Market Share: 3% of global sorghum imports.

Vietnam is emerging as a growing player in the global sorghum import market, driven by its expanding agricultural and livestock sectors.

7. Indonesia – A Rising Demand for Animal Feed

Import Volume: Approximately 0.3 million metric tons

Indonesia has seen a rise in sorghum imports as the country expands its livestock industry, especially poultry and cattle. Sorghum serves as an affordable and high-quality feed for Indonesia’s rapidly growing meat sector. The country imports sorghum primarily from neighboring countries and major exporters like the U.S. and Argentina.

Global Market Share: 3% of global sorghum imports.

As Indonesia’s livestock industry grows, so does the demand for sorghum, making it an emerging player in the global market.

8. Kenya – Increasing Feed Demand in East Africa

Import Volume: Approximately 0.2 million metric tons

Kenya’s growing agricultural sector, particularly its expanding poultry industry, has driven an increase in sorghum imports. Sorghum is used primarily for animal feed, with Kenya importing the grain from neighboring African countries and major exporters. The country’s demand for sorghum is expected to rise as its livestock industry continues to expand.

Global Market Share: 2% of global sorghum imports.

Kenya’s expanding livestock production sector positions it as an emerging sorghum importer in East Africa.

9. Philippines – A Growing Market for Animal Feed

Import Volume: Approximately 0.2 million metric tons

The Philippines has experienced increasing sorghum imports, particularly for use in animal feed. The country’s growing demand for poultry and livestock products drives the need for sorghum, as it is an efficient and cost-effective feed ingredient. The Philippines imports sorghum from major exporters like the U.S. and Argentina.

Global Market Share: 2% of global sorghum imports.

As the Philippines continues to expand its meat production industry, the demand for sorghum is expected to rise.

10. Pakistan – Expanding Sorghum Demand for Livestock

Import Volume: Approximately 0.2 million metric tons

Pakistan is a growing importer of sorghum, particularly for use in animal feed. The country’s rising demand for livestock products and increasing poultry and cattle farming are key drivers of this demand. Pakistan imports sorghum from neighboring countries and major exporters to meet its feed needs.

Global Market Share: 2% of global sorghum imports.

As Pakistan’s livestock sector continues to expand, its demand for sorghum is expected to rise in the coming years.

Conclusion

The top 10 sorghum importers—China, Japan, Mexico, Egypt, South Korea, Vietnam, Indonesia, Kenya, the Philippines, and Pakistan—play a significant role in the global sorghum trade. Their growing demand for sorghum, primarily for animal feed and livestock production, is driving the global market. As these countries continue to expand their agricultural sectors, the import of sorghum is expected to increase, ensuring its continued importance in the global supply chain.