Soybeans are a vital commodity in global agriculture, heavily traded to meet the rising demand for animal feed, soybean oil, and plant-based proteins. The majority of soybean imports are concentrated in a few countries, driven by their large populations, livestock industries, and processing capacities. This report highlights the top soybean-importing countries, their import volumes, and the factors driving their demand.

1. China

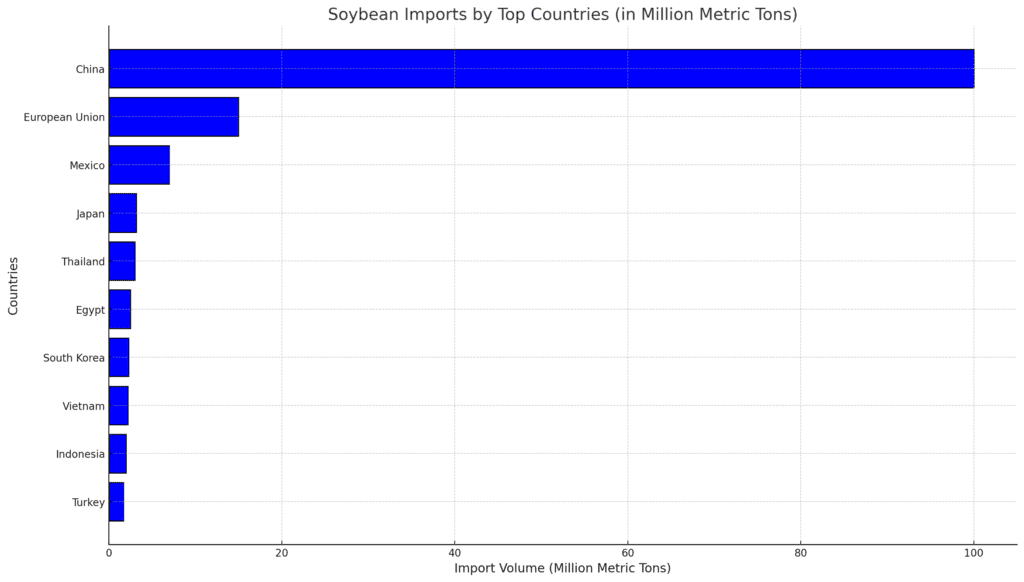

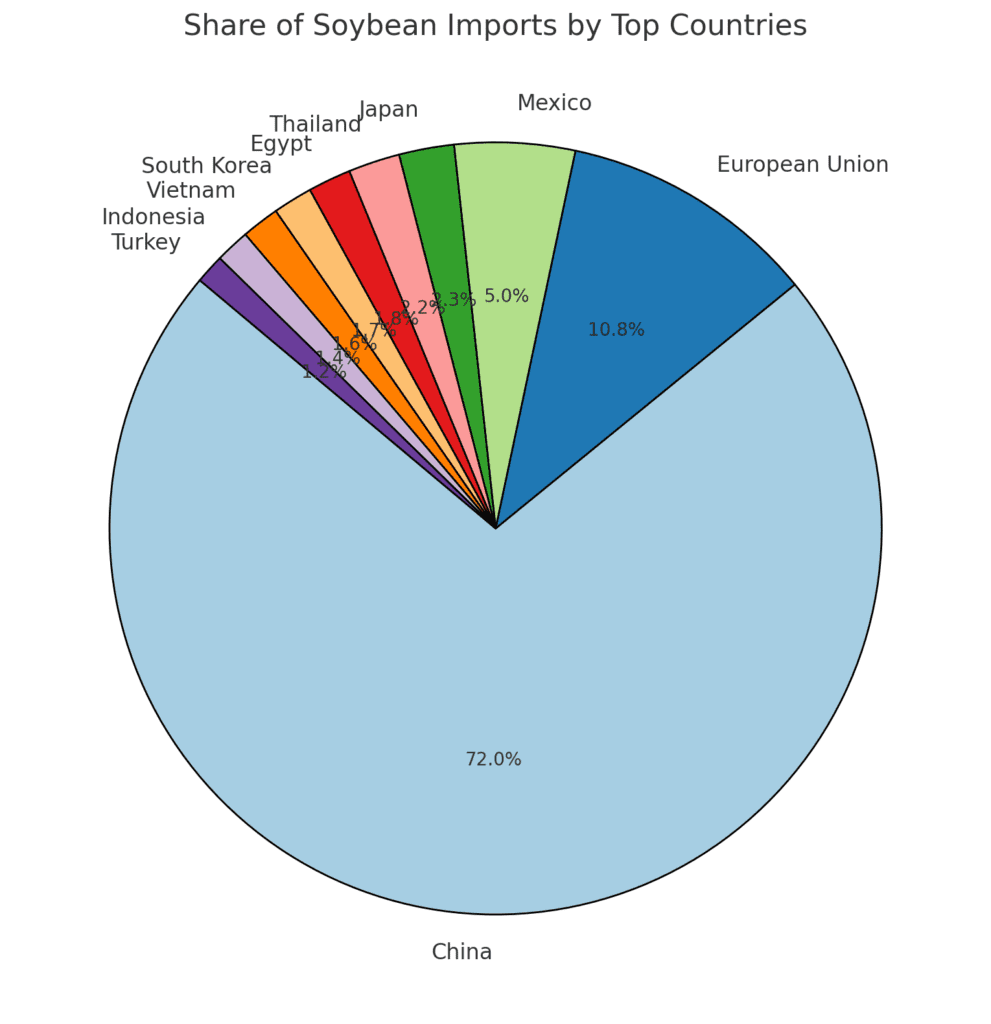

- Annual Import Volume: Approximately 100 million metric tons (2023).

- Global Share: Over 60% of global soybean imports.

- Key Suppliers: Brazil, the United States, and Argentina.

- Highlights:

- China is the largest importer of soybeans globally, driven by its massive livestock industry.

- Soybeans are primarily processed into soybean meal for animal feed and soybean oil for cooking.

- The country’s growing population and middle-class demand for meat drive imports.

2. European Union

- Annual Import Volume: Approximately 15 million metric tons.

- Global Share: Around 9% of global soybean imports.

- Key Suppliers: Brazil, the United States, and Canada.

- Highlights:

- The EU relies on soybeans for livestock feed, particularly in countries like Germany, Spain, and the Netherlands.

- Sustainable sourcing is a priority, with growing demand for deforestation-free soybeans.

3. Mexico

- Annual Import Volume: Approximately 7 million metric tons.

- Global Share: Around 4% of global soybean imports.

- Key Suppliers: United States.

- Highlights:

- Mexico’s imports are driven by its poultry and livestock industries.

- Proximity to the U.S. ensures lower transportation costs and steady supply.

4. Japan

- Annual Import Volume: Approximately 3.2 million metric tons.

- Global Share: Around 2% of global soybean imports.

- Key Suppliers: United States, Brazil, and Canada.

- Highlights:

- Japan uses soybeans for food products such as tofu, miso, and soy sauce, as well as animal feed.

- The country prioritizes high-quality soybeans, often opting for non-GMO varieties.

5. Thailand

- Annual Import Volume: Approximately 3 million metric tons.

- Global Share: Around 2% of global soybean imports.

- Key Suppliers: Brazil, the United States, and Argentina.

- Highlights:

- Thailand imports soybeans to support its large poultry and aquaculture industries.

- The country’s food processing sector also drives demand for soybean products.

6. Egypt

- Annual Import Volume: Approximately 2.5 million metric tons.

- Global Share: Around 1.5% of global soybean imports.

- Key Suppliers: Brazil, the United States, and Argentina.

- Highlights:

- Egypt’s soybean imports are essential for its growing poultry industry.

- The government encourages soybean imports to reduce reliance on other protein sources.

7. South Korea

- Annual Import Volume: Approximately 2.3 million metric tons.

- Global Share: Around 1.5% of global soybean imports.

- Key Suppliers: United States, Brazil, and China.

- Highlights:

- Soybeans are used in South Korea for both food products and animal feed.

- The country’s demand for plant-based proteins is rising with changing dietary preferences.

8. Vietnam

- Annual Import Volume: Approximately 2.2 million metric tons.

- Global Share: Around 1.4% of global soybean imports.

- Key Suppliers: Brazil, the United States, and Argentina.

- Highlights:

- Vietnam imports soybeans primarily for animal feed to support its aquaculture and poultry industries.

- The country’s food manufacturing sector is also driving growth in soybean imports.

9. Indonesia

- Annual Import Volume: Approximately 2 million metric tons.

- Global Share: Around 1.3% of global soybean imports.

- Key Suppliers: United States and Brazil.

- Highlights:

- Indonesia uses soybeans for traditional food products like tempeh and tofu.

- Imports are essential to meet domestic demand due to limited local production.

10. Turkey

- Annual Import Volume: Approximately 1.7 million metric tons.

- Global Share: Around 1% of global soybean imports.

- Key Suppliers: Brazil, the United States, and Argentina.

- Highlights:

- Turkey’s poultry and livestock industries drive its soybean imports.

- The country is expanding its feed manufacturing sector to support growing demand.

Key Factors Driving Soybean Imports

- Growing Livestock Industries: Soybean meal is essential for feeding poultry, swine, and cattle.

- Rising Population and Urbanization: Increased meat consumption in developing countries fuels demand.

- Plant-Based Protein Demand: The global shift toward plant-based diets boosts imports of soybeans for food products.

Challenges Facing Soybean Importers

- Trade Dependence: Heavy reliance on a few exporters like Brazil and the U.S. makes importers vulnerable to trade disputes.

- Price Volatility: Global soybean prices are influenced by weather, logistics, and geopolitical issues.

- Sustainability Concerns: Importers face growing pressure to source soybeans responsibly to avoid deforestation and environmental damage.

Opportunities for Growth

- Diversification of Supply Sources: Importers can explore new markets for soybean procurement to reduce dependence on major exporters.

- Value-Added Products: Increasing imports of processed soybean products like meal and oil to meet domestic needs.

- Sustainability Initiatives: Promoting partnerships with exporters for sustainable and certified soybean sourcing.

Conclusion

China, the European Union, and Mexico lead the global soybean import market, driven by their livestock and food processing industries. As global demand for soybeans continues to grow, importers must address challenges like trade dependencies and sustainability concerns. By fostering trade relationships and investing in sustainable sourcing, these countries can ensure a steady supply of soybeans to meet their needs.