In today’s market overview, we will be discussing the latest trends and developments in the commodities industry, particularly focusing on Australian markets and their impact on the global economy.

Starting with a look at the day ahead, we observe that the weather conditions are relatively stable, with no significant changes expected. Moving on to the markets, the Australian dollar (AUD) has been a key player in recent events. Following a Federal Reserve rate cut, the AUD and New Zealand dollar (NZD) experienced a decline, reflecting the market’s response to the news. However, the AUD has provided support in the Australian market, helping to stabilize prices despite fluctuations in other regions.

Looking offshore, the AUD remains a focal point, with recent developments such as the FOMC rate cut and signals of fewer cuts in 2025 impacting its performance. The disconnection between US futures and global trends continues to be a notable trend, with Russian cash prices showing a gradual increase while US futures remain stagnant. The upcoming year is expected to be eventful, with potential shifts in global trade dynamics and geopolitical factors influencing market outcomes.

In the agriculture sector, Malaysia aims to align its palm oil industry with the EU’s anti-deforestation policy, highlighting the importance of sustainability in commodity production. Meanwhile, US President-elect Donald Trump’s plans to boost domestic oil and gas production signal potential changes in the energy sector, with a focus on reducing costs and increasing production efficiency.

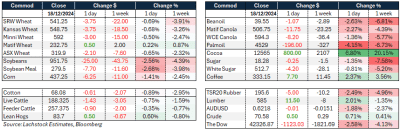

In Australia, canola and wheat prices have seen fluctuations, with bids varying across regions. Canola values in the east are lower, while wheat bids have decreased but barley remains stable. In the west, canola and wheat bids have also experienced declines, reflecting regional market dynamics. Chickpea bids in Brisbane and wheat markets in Geelong/Melbourne have maintained steady levels, indicating relative stability in these sectors.

Overall, the commodities market is influenced by a combination of global economic factors, geopolitical events, and regional dynamics. It is essential for industry players to stay informed about these developments to make informed decisions and navigate the volatile market conditions effectively.

For more news and insights on the commodities industry, subscribe to our newsletter and receive regular updates on market trends and analysis. Click here to sign up and stay ahead of the curve with Grain Central.