Key Insights for Food and Beverage Professionals in April 2025

As food and beverage professionals navigate the ever-changing landscape of consumer sentiment, inflation, and holiday sales, it is crucial to stay informed and adapt strategies accordingly. Here are some key insights from April 2025 to help you make informed decisions in the industry.

Consumer Sentiment and Spending Trends

- The University of Michigan’s Consumer Sentiment Index showed a significant year-over-year decline, reflecting heightened levels of uncertainty driven by various factors such as inflation, tariff talk, and personal finances.

- Consumer concerns about economic recession and tariffs have led to increased scrutiny of spending habits, with 66% of consumers watching their grocery budgets more closely and 44% cutting back on non-essential purchases.

- Despite these concerns, consumers are still making more frequent grocery trips, with a 4.4% increase in trips year-over-year. However, the average number of units per trip remains flat or down for most categories.

Inflation Insights

- In April 2025, the average price per unit for all foods and beverages increased by 2.5% over the previous year. Center-store prices saw a 1.0% increase, while fresh food prices rose by 4.8%.

- Eggs, in particular, experienced a significant price increase of 58.6% compared to April 2024, impacting overall fresh perimeter and total store price points.

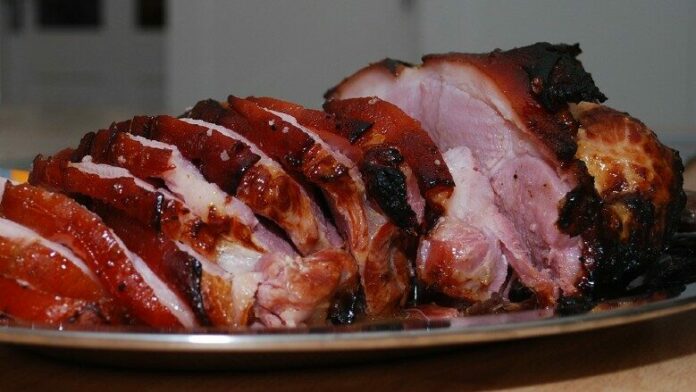

- Retailers invested in promotional strategies for smoked ham, leading to deflation in processed meat prices and lower average price per pound in the meat department.

Meat Sales and Assortment

- The shift in Easter timing had a substantial impact on meat sales in April, with a 9.8% growth in dollar sales and a 7.9% increase in pounds compared to the previous year.

- Retailers expanded their meat department assortment for the Easter holiday, with an average of 453 SKUs per store in April 2025.

- Fresh meat sales by protein showed strong growth rates for holiday classics like turkey and lamb, while processed meats like smoked ham, bacon, and breakfast sausage also performed well.

Easter Comparison and Future Outlook

- Core Easter weeks in 2025 saw significant gains in fresh and processed meat sales compared to the same period in 2024, indicating consumer willingness to spend during holiday celebrations.

- Looking ahead, food and beverage professionals can prepare for upcoming events like Mother’s Day and Memorial Day, leveraging cross-merchandising displays and online purchase suggestions to drive sales.

- Ongoing tariff talks and economic headwinds remain areas of concern, highlighting the importance of staying informed and adaptable in the face of industry challenges.

Industry Analysis

The developments in consumer sentiment, inflation, and holiday sales in April 2025 have significant implications for the global food and beverage industry. Here are some key points to consider:

- Supply chains may face increased pressure as consumers adjust their spending habits and retailers respond to shifting demand.

- Pricing strategies will need to be carefully managed to navigate inflation and promotional trends in the market.

- Trade dynamics could be impacted by consumer concerns about tariffs and economic uncertainty, leading to potential shifts in sourcing and distribution strategies.

- Looking forward, food and beverage professionals should focus on innovative solutions, consumer engagement, and strategic partnerships to drive growth and resilience in the industry.

By staying informed and proactive in response to these industry trends, food and beverage professionals can position themselves for success in a challenging and dynamic market landscape.