The day ahead in the commodities market is showing some interesting trends. Weather conditions in Russia are warmer than average, with rainfall running behind normal levels. However, the focus remains on spring production as it will determine the overall outcome. In the US, there is talk of winterkill/freeze, but its impact is still uncertain at this stage.

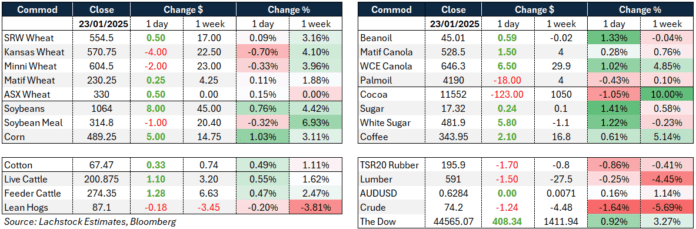

In the markets, veg oil rebounded from previous losses and closed higher following corn prices. Analysts suggest that fund traders are increasing their long positions in corn. Wheat prices were mixed, with Matif and SRW closing slightly higher.

Looking ahead in the Australian market, canola bids are expected to see a slight increase due to rises in Matif and Winnipeg prices, as well as a rebound in bean oil. Cereal bids are also likely to be slightly higher following the trend in corn prices.

Offshore, the Argentine government has announced a temporary reduction in grain export taxes, starting Monday until June. Taxes on soybeans have been lowered from 33 percent to 26 percent, and on wheat/corn from 12 percent to 9.5 percent. In Canada, optimism prevails as they have so far avoided Trump tariffs, with strong canola exports reported.

In Japan, MAFF has purchased milling wheat from the US, Canada, and Australia, with Australia accounting for a significant portion of the purchase. South Korea and Thailand have also been active in the market, with purchases of feed wheat and wheat tenders respectively.

Russian fob wheat prices have remained stable despite export restrictions, with prices quoted at US235/236 fob. Cattle futures have reached all-time highs for a second day, driven by the border ban on Mexican feeder cattle. The demand for US grain transportation has been strong, with higher demand for corn, soybeans, and wheat driving volumes.

In Australia, canola bids in Western Australia have seen a slight increase, while wheat bids have decreased. In the east, canola bids have dropped, wheat prices remain unchanged, and barley bids are firmer. Livestock feeding is beginning in SA and Western Vic, with feed barley trading at around $330 delivered.

The long-range forecast from Feb-Apr is indicating above median rainfall for most regions in Qld, NSW, Vic, and SA. This forecast is welcome news for growers, especially for Vic and SA.

Overall, the commodities market is showing a mix of trends and developments both locally and internationally. It will be important to monitor these factors closely to make informed decisions in the market.