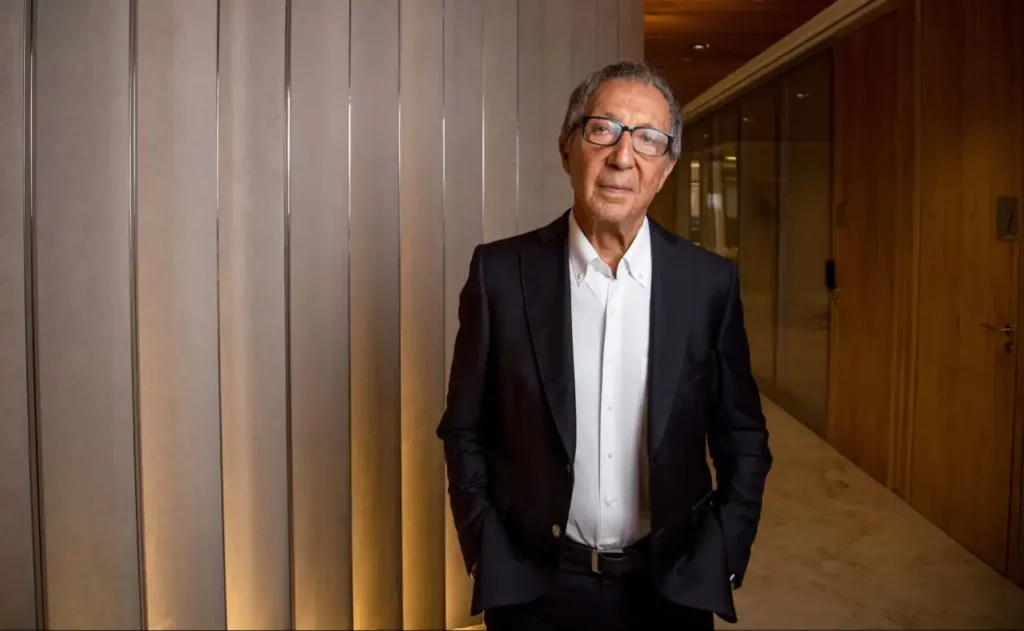

Brazilian Antitrust Agency Clears Abilio Diniz’s Stakes in BRF and Carrefour

In a significant development, Brazil’s antitrust agency, Cade, has dispelled concerns over Abilio Diniz’s investments in the local units of Carrefour SA and BRF SA, affirming that they do not pose a threat to competition.

Background

Abilio Diniz, a prominent figure in Brazil’s business landscape, has garnered attention due to his stakes in key players in the retail and food processing sectors. Cade’s ruling, issued late on Tuesday, marks a pivotal moment in the ongoing scrutiny surrounding Diniz’s business ventures.

Cade’s Verdict

Cade’s decision to dismiss apprehensions regarding Diniz’s holdings underscores the agency’s assessment that his involvement in Carrefour SA and BRF SA does not infringe upon antitrust regulations. This ruling effectively clears Diniz of any allegations of anti-competitive behavior in his investments.

Rental Arrangements with GPA SA

Furthermore, Cade ruled that Diniz’s leasing of real estate to GPA SA, a company he previously spearheaded, does not contravene antitrust laws. This aspect of the ruling sheds light on the intricacies of Diniz’s business dealings and his continued involvement in Brazil’s retail sector.

Implications for Competition

The decision holds broader implications for competition within Brazil’s retail and food processing industries. By validating Diniz’s positions in Carrefour SA and BRF SA, Cade has signaled confidence in the competitive dynamics of these sectors, suggesting that Diniz’s involvement does not unduly distort market forces.

Reactions and Market Response

The ruling has elicited varied responses from stakeholders and market observers. While proponents of Diniz’s ventures welcome Cade’s decision as a validation of his business acumen and commitment to competition, critics remain vigilant, emphasizing the need for ongoing scrutiny to ensure market integrity.

Global Significance

Beyond its local ramifications, Cade’s ruling carries global significance, especially in the context of international business partnerships and investments. The agency’s verdict provides clarity on regulatory standards and investor confidence in Brazil’s market environment.

Continued Monitoring

Despite the clearance provided by Cade, the regulatory landscape remains dynamic, necessitating continued monitoring of market activities. As Brazil’s economy evolves and undergoes structural changes, regulatory bodies such as Cade will play a crucial role in safeguarding competition and fostering a level playing field for businesses.

Related: BRF Pet Food Division Sees 1.8% Growth in Q4 2023

Source: PYMTS