Introduction

Brazilian food conglomerate JBS S.A. stands as a global powerhouse in the food processing industry, boasting over 400 facilities spanning 20 countries. Despite its expansive reach and diverse workforce, JBS faces scrutiny and skepticism, particularly concerning its Environmental, Social, and Governance (ESG) practices. Let’s delve into the complexities surrounding JBS and its aspirations for a New York Stock Exchange (NYSE) listing amidst mounting ESG concerns.

JBS: A Mixed Bag of Local Commitments and Global Controversies

JBS has garnered attention for its localized approach to business operations, emphasizing the importance of community engagement and local economies. Notably, during its acquisition of Tasmanian salmon farmer Huon Aquaculture, JBS highlighted its commitment to local employment, a strategy divergent from traditional multinational practices. Similarly, the celebration of diverse nationalities among its workforce at the Dinmore beef abattoir in Queensland underscores JBS’s emphasis on inclusivity and community integration.

ESG Pariah: Unraveling JBS’s Challenges

Despite its localized endeavors, JBS finds itself ensnared in a web of controversies that tarnish its ESG reputation. The resurgence of Brazilian billionaire brothers, Joesley and Wesley Batista, as board members, resurrects memories of past bribery scandals, casting shadows over JBS’s governance integrity. Moreover, allegations of greenwashing and misleading environmental claims further erode trust, as evidenced by a recent lawsuit filed by New York Attorney General Letitia James.

NYSE Listing: A Double-Edged Sword for ESG-Conscious Investors

JBS’s pursuit of a NYSE listing amplifies its ESG dilemmas, inviting scrutiny from investors and regulatory bodies alike. The proposed restructuring to establish JBS N.V. as a Dutch holding company listed on the NYSE sparks concerns over governance and transparency, particularly with the Batista brothers’ anticipated surge in voting power. ESG-conscious super funds face a conundrum as they navigate the implications of investing in a company marred by corruption allegations and environmental controversies.

Environmental Allegations: A Thorn in JBS’s Side

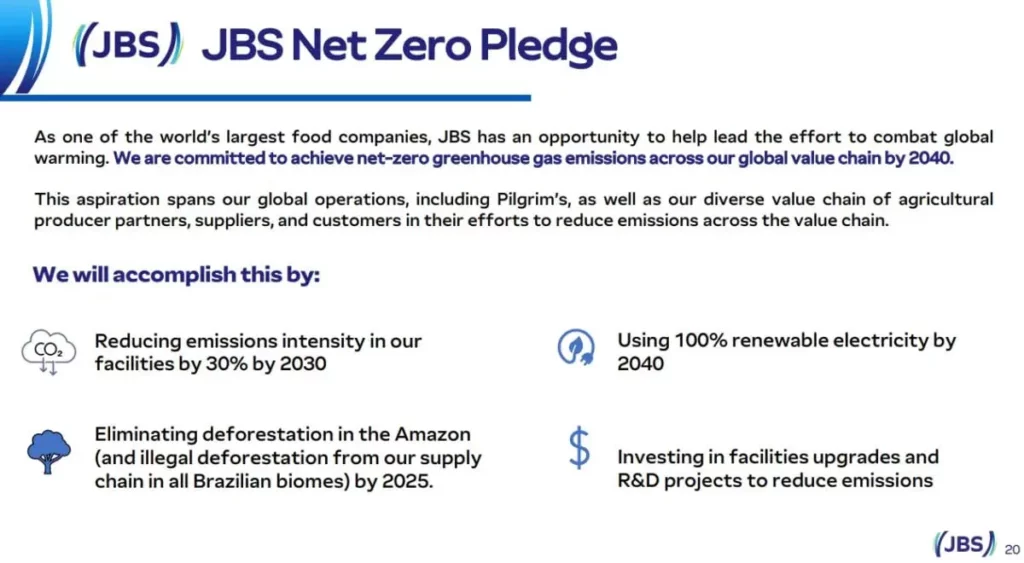

Accusations of environmental malpractice, including deforestation in the Amazon, loom large over JBS’s aspirations. The company’s ambitious net-zero emission pledges are met with skepticism, with critics pointing to a lack of concrete plans and transparency. Political and regulatory pressures intensify, with US senators urging the Securities and Exchange Commission (SEC) to scrutinize JBS’s environmental claims and potential risks to shareholders.

Governance Concerns: The Batista Brothers’ Grip on JBS

The impending return of the Batista brothers to JBS’s board reignites governance apprehensions, raising questions about minority shareholder rights and corporate decision-making. JBS’s dual-class share structure consolidates power in the hands of the Batista brothers, potentially undermining shareholder interests and corporate accountability. Index providers and shareholder advisory firms voice reservations, highlighting the inherent risks associated with such governance arrangements.

Conclusion

As JBS navigates the complexities of its global operations and ESG challenges, the path to a NYSE listing remains fraught with uncertainties. The juxtaposition of localized commitments with global controversies underscores the intricate landscape facing modern corporations. ESG-conscious investors are tasked with weighing financial prospects against ethical considerations, confronting the inherent tensions between profit motives and sustainability imperatives. In the pursuit of transparency and accountability, the fate of JBS serves as a poignant reminder of the evolving dynamics shaping corporate responsibility in the 21st century.

Related: JBS Proposes Return of Batista Brothers to Board

Source: Investment Magazine