In today’s market, there are several key factors influencing the outlook for commodities. Let’s take a closer look at the current state of affairs and what we can expect in the days ahead.

Weather conditions are showing signs of improvement, with some convergence between the EU and GFS outlooks. This has led to increased confidence in rainfall forecasts for the coming days, and a slight decrease in heat levels. These developments are important to monitor as they can have a significant impact on crop yields and production.

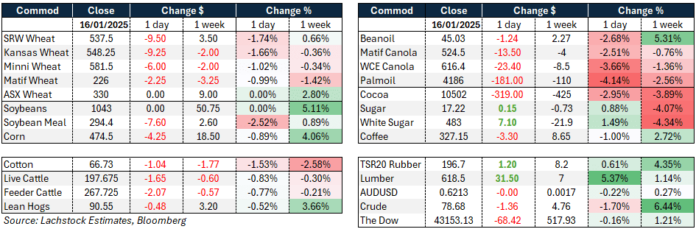

Market trends are also worth noting, as agricultural commodities experienced a decline across the board ahead of significant political events. Canola prices led the downward trend, while the Australian dollar remained relatively stable. This highlights the interconnectedness of global markets and the influence of external factors on commodity prices.

Looking specifically at Australia, the Australian dollar has shown some strength, surpassing the 0.6200 mark. While this increase lacks conviction, there is potential for further growth in the coming weeks. The recent reduction in USD risk premiums and easing of political tensions could contribute to a more stable market environment, although volatility is expected to persist.

On the international front, all eyes are on the developments surrounding the Trump administration. With promises of swift action and ongoing Senate hearings, the global community is eagerly awaiting the next steps. Additionally, recent data on Australia’s unemployment rate and underutilization rate provide insight into the country’s labor market dynamics and economic stability.

In the commodities market, canola and wheat prices are facing uncertainty. Changes in biofuel feedstock regulations and global demand patterns are contributing to market fluctuations. While fundamentals suggest a positive outlook for wheat, global buyers are hesitant to make large purchases until more clarity emerges on the supply side.

In Australia, canola and wheat prices have seen fluctuations, with bids varying across different regions. Domestic demand remains strong for feed wheat and barley, indicating a healthy appetite for these commodities. Canola continues to attract interest from domestic crushers, while barley export bids are supported by external factors such as Dalian corn prices in China.

Overall, the outlook for Australian commodities remains mixed, with potential for both growth and volatility in the near future. It is essential for market participants to stay informed and monitor key developments to make informed decisions. By keeping a close eye on market trends, weather patterns, and global economic dynamics, stakeholders can navigate the complex world of commodities trading with greater confidence.

For more insights and updates on the commodities market, subscribe to Grain Central’s newsletter to receive the latest news straight to your inbox. Stay informed and stay ahead in the ever-evolving world of commodities trading.