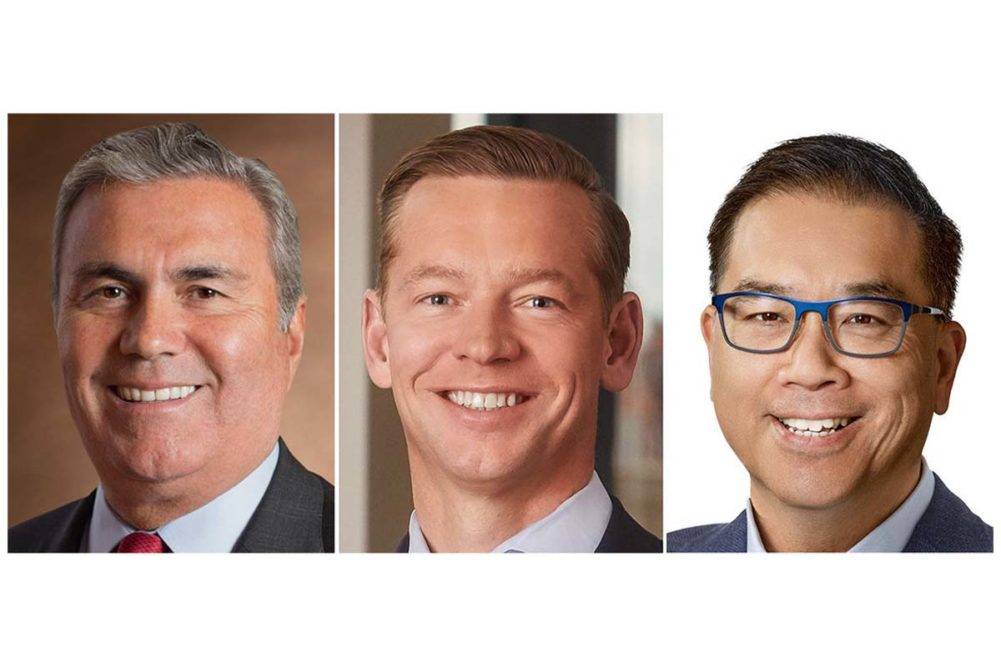

McDonald’s Corp. recently announced significant changes to its board of directors, marking a new chapter in the company’s leadership. Chris Kempczinski, the current CEO, will take on the additional role of chairman of the board following the retirement of Enrique “Rick” Hernandez Jr. Miles White will step into the position of lead independent director, while Mike Hsu, the chairman and CEO of Kimberly-Clark Corp., has been nominated as an independent director of the board.

Recognition of Service

Rick Hernandez, the outgoing non-executive chairman, reflected on his time with McDonald’s, expressing gratitude for the opportunity to witness the company’s evolution into a global powerhouse. During his 28-year tenure on the board, Hernandez played a pivotal role in steering McDonald’s to remarkable success, delivering substantial returns to shareholders and overseeing significant expansion efforts, including entering over 100 new markets.

Acknowledgment of Leadership

Chris Kempczinski, in recognizing Hernandez’s contributions, lauded his vision and dedication, emphasizing the invaluable guidance he provided to McDonald’s leadership over the years. Kempczinski expressed his commitment to building on the company’s momentum and maintaining its position as an industry leader, underscoring the importance of agility in navigating today’s dynamic business landscape.

Welcoming a New Director

Mike Hsu, a seasoned leader in the consumer products industry, brings over three decades of experience to his nomination to McDonald’s board of directors. With a background that includes serving as chairman and CEO of Kimberly-Clark, Hsu’s global perspective and track record of success position him as a valuable addition to McDonald’s board. Hsu expressed enthusiasm for the opportunity to contribute to McDonald’s continued growth and community impact.

Optimism for the Future

Chris Kempczinski expressed confidence in Hsu’s appointment, highlighting his leadership caliber and emphasizing the importance of his insights as McDonald’s charts its course for sustained growth. With a focus on driving long-term value for stakeholders, Kempczinski affirmed his commitment to steering McDonald’s towards continued success in the evolving market landscape.

Conclusion

McDonald’s leadership transition signifies a strategic shift aimed at maintaining the company’s trajectory of growth and innovation. As Chris Kempczinski assumes the dual role of CEO and chairman of the board, supported by seasoned leaders like Miles White and Mike Hsu, McDonald’s is poised to navigate the challenges and opportunities of the future with confidence and resilience. With a steadfast commitment to its core values and a focus on delivering value to shareholders and communities worldwide, McDonald’s remains a beacon of success in the global business landscape.

Related: World’s Top 10 Largest Food Services Companies