In September, grocery prices experienced their largest jump since January, with a 0.4% increase driven by price hikes across various staple foods, according to the Bureau of Labor Statistics (BLS). This significant rise, particularly in essential food categories, is a reminder of the challenges in taming food inflation, which remains volatile despite overall economic progress.

Key Drivers of the Price Hike

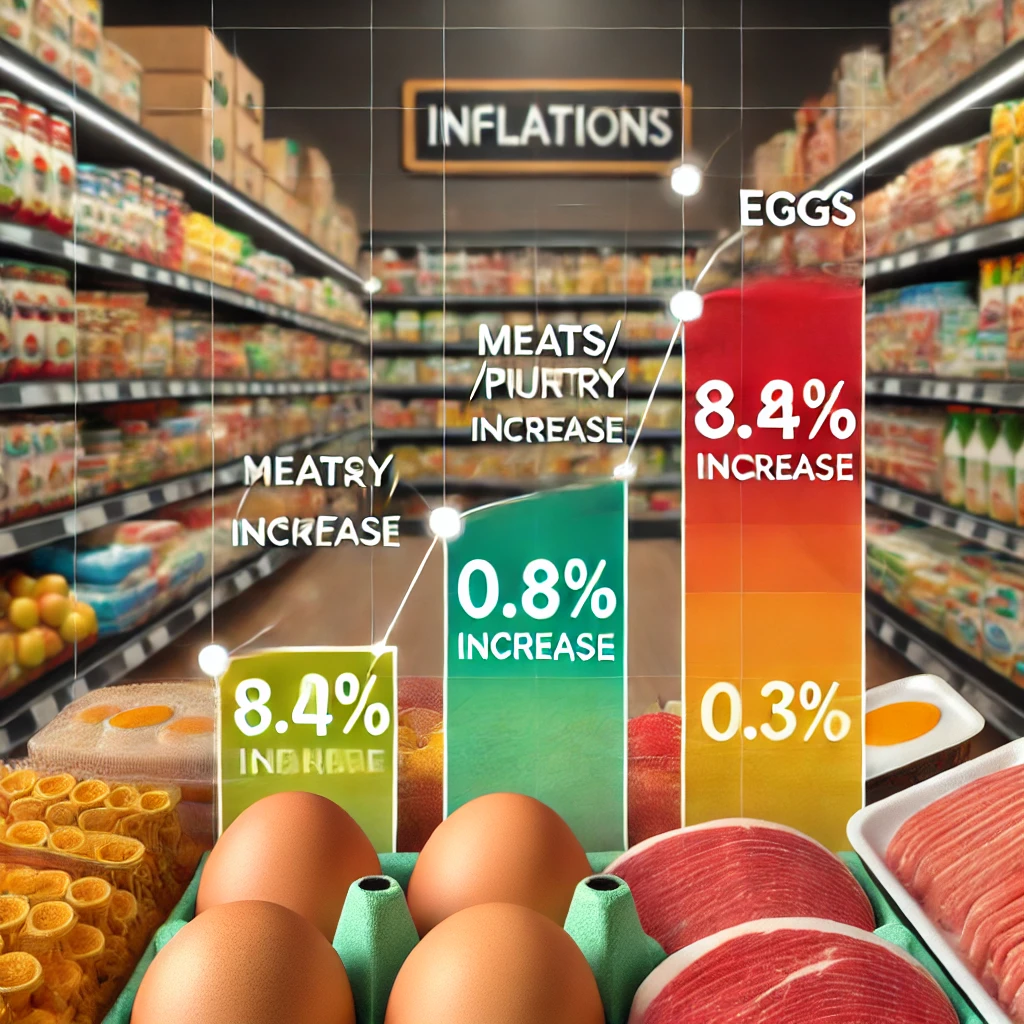

The BLS noted that five out of six major grocery store food groups saw price increases. Notably, the “meats, poultry, fish, and eggs” category surged by 0.8%, with egg prices spiking 8.4% in September alone. This follows a similar increase in January, also 0.4%, indicating recurring inflationary pressure on food staples.

In contrast, August showed only a modest 0.1% increase in grocery prices, following two months of 0.2% hikes. Despite September’s sharp rise, year-over-year data shows food price inflation stabilizing, with food at home (groceries) prices up 1.3% over the last year, while food away from home (restaurant) prices rose 3.9%.

Sector Breakdown: Meat, Dairy, and Grains

Among the key trends, egg prices have soared 39.6% in the past 12 months, driven in part by the ongoing impact of highly pathogenic avian influenza, which has severely affected egg production. Other notable increases include:

- Fats and Oils: Up 1.1%, with butter seeing a 2.8% increase in September (7.8% over the year).

- Bakery Products: Cereal and bakery products rose 0.3%, reflecting steady growth in grain-based items.

While some prices decreased, like pork chops (-1.2%), milk (-0.3%), and ice cream (-0.9%), these declines offer only temporary relief. Over the past year, pork chop prices are still up by 4.2%, highlighting that even products with short-term declines face longer-term inflationary trends.

Inflation Trends and Future Outlook

Although September’s increase was the largest since January, experts remain cautiously optimistic about the overall inflation trajectory. Andy Harig, vice president of FMI-The Food Industry Association, pointed out that year-over-year food-at-home inflation is now at a moderate 1.3%, a significant improvement from the more severe inflation spikes of 2022.

“We remain cautiously optimistic that the worst of food price inflation is behind us,” Harig said. However, he also warned of potential future challenges, such as the impacts of hurricanes like Helene and Milton on the food supply chain.

Broader Economic Context

The overall Consumer Price Index (CPI) rose 0.2% in September, driven by both food price increases and rises in other sectors. Key categories that saw significant price hikes included shelter, motor vehicle insurance, and medical care. On the other hand, the energy index fell by 1.9%, continuing a trend from August.

Interestingly, the all-items index has seen a 2.4% rise over the past year, marking the smallest 12-month increase since February 2021. While this may signal broader progress in controlling inflation, food prices continue to reflect the volatile nature of commodity markets and supply chain disruptions.

Looking Ahead: Stabilizing Food Prices?

With both optimistic and cautious outlooks, the food industry and consumers alike are keeping a close watch on inflation trends. Harig highlighted that recent lessons from the COVID-19 era have strengthened the resilience of the food supply chain, but there are still uncertainties, especially with the looming threat of climate-related disruptions.

For now, while consumers may see some stabilization in grocery prices, the potential for future shocks remains. Factors like climate events, disease outbreaks, and supply chain issues will continue to play a significant role in shaping the cost of essential food items.

Conclusion

The sharp rise in September grocery prices underscores the complexity of managing food inflation in a post-pandemic economy. While year-over-year inflation appears to be slowing, the monthly volatility, especially in key staples like eggs and meats, highlights the ongoing challenges facing consumers and businesses alike. Staying informed and prepared for these fluctuations will be crucial for navigating the unpredictable landscape of food prices in the months ahead.

For more info check out Agri-Pulse

Related: USDA forecasts smaller drop in 2024 farm income